Content

- Is It Possible To Have A Negative Net Income?

- Is Income From Operations The Same Thing As Operating Income?

- Gross Profit Compared To Profit Margin Ratio

- Net Income From Discontinued Operations

- How To Calculate Economic Profits

- How To Calculate An Operating Margin For A Business

- Continuing Operations Or Operating Segments

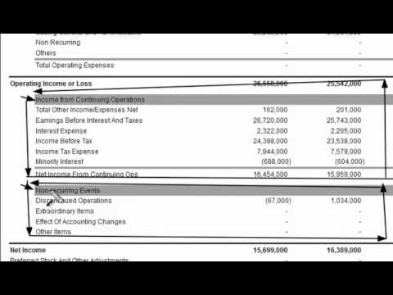

He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A. According to the Accounting Principals Board 30, the income statement will look like the table given below. XYZ Limited has sold one of its product lines to a retailer by an agreement. The agreement states that the retailer will pay 7% royalty to XYZ Limited on any sales related to that product line for the next three years. Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer.Gross income shall not be diminished as a result of the Security Instruments or the creation of any intervening estate or interest in a Property or any part thereof. The income from continued operations is calculated by subtracting all the operating expenses and tax on the operating income. It shows the company’s after-tax operating income, and most people confuse the income from continued operations with the operating income. EPS is reported both before ($5.550) and after ($ 4.078) the discontinued operations, extraordinary item, and the cumulative effect of a change in accounting principle.The Opinion directed that unusual and nonrecurring items having an earnings or loss effect are extraordinary items or prior period adjustments . Extraordinary items are reported separately after net income from regular continuing activities.

Is It Possible To Have A Negative Net Income?

Income from operations and operating income are the same thing, though their usage may vary. Income from operations is a general expression describing revenue a company earns from primary business activities, minus expenses involved in generating that revenue. Operating income is typically used to denote this profit level on a company’s formal income statement.

Is Income From Operations The Same Thing As Operating Income?

Often regarded as the cost of goods sold or cost of sales, the expenses are specifically related to the cost of producing goods or services. The costs can be fixed or variable but are dependent on the quantity being produced and sold. On the other hand, gross profit is the monetary result obtained after deducting the cost of goods sold and sales returns/allowances from total sales revenue. Operating Revenue means in any single fiscal year during the effective term of this Agreement, the total revenue generated by Party B in its daily operation of business of that year as recorded under the “Revenue of Principal Business” in the audited balance sheet prepared in accordance with the PRC accounting standards.

- The hypothetical clothing company XYZ will usually derive the majority of both net income and sales from continuing operations.

- Direct costs are expenses incurred and attributed to creating or purchasing a product or in offering services.

- If these two assumptions hold for any business operation, it will be considered as a continuing operation or operating segment for that particular business.

- “Income from continuing operations” is another phrase used to describe this type of profit, because the calculation normally excludes discontinued business activities.

- More comprehensively, the continuing operations are all the activities of a business except the ones which have been discontinued.

By using this site, you are agreeing to security monitoring and auditing. For security purposes, and to ensure that the public service remains available to users, this government computer system employs programs to monitor network traffic to identify unauthorized attempts to upload or change information or to otherwise cause damage, including attempts to deny service to users. Annualized Consolidated EBITDA means, for any quarter, the product of Consolidated EBITDA for such period of time multiplied by four .

Gross Profit Compared To Profit Margin Ratio

Besides, the standards require the entities to define their methods for defining an operating and non-operating segment. Operating Profits means, as applied to any Person for any period, the operating income of such Person for such period, as determined in accordance with GAAP. The operating income translates the operating efficiency of an entity which is more like an internal metric.

What is included in operating profit?

A company’s operating profit is its total earnings from its core business functions for a given period, excluding the deduction of interest and taxes. It also excludes any profits earned from ancillary investments, such as earnings from other businesses that a company has a part interest in.Therefore, disclosing the income for continuing operations is necessary from the compliance point of view. If we analyze the situation, XYZ Limited will have no direct involvement in the product line’s operations and no cashflows from regular operations. The concept of discontinued operations can be well understood with an example. If these two assumptions hold for any business operation, it will be considered as a continuing operation or operating segment for that particular business. We can explain the concept of continuing operations with the help of examples. All the operations except those that have been discontinued will be reported under continuing operations of a business.

Net Income From Discontinued Operations

Discontinued Operations means operations that are accounted for as discontinued operations pursuant to Applicable GAAP of the Borrower for which the Disposal of such assets has not yet occurred. Note 14 — Taxes on Earnings from Continuing Operations Taxes on earnings from continuing operations reflect the annual effective rates, including charges for interest and penalties. The important principle of going concern has to be followed by the business entities to stay alive in the markets. The emergence of the discontinued operations in any business is not an abnormal event because companies have to adapt themselves to changing market needs. Profit margin is a financial ratio defined as net income divided by sales. The hypothetical clothing company XYZ will usually derive the majority of both net income and sales from continuing operations.

What is a good earnings per share number?

Stocks with an 80 or higher rating have the best chance of success. However, companies can boost their EPS figures through stock buybacks that reduce the number of outstanding shares.If the financial results of the former business activity that was discontinued are still included in historical financial data as they were originally reported, it would create a large disconnect between where the company was and what its financial results look like now. The solution is to strip the financial results of the discontinuing operations out of the overall financial data as if they were a separate company or had never existed. From this case, we can easily identify that the company no more manufactures the 2G and 3G mobile phones. Therefore, they have been excluded from the category of continued operations. The 4G and 5G devices have taken over the place in the continued operations. All the revenues from the sales and manufacturing of 4G and 5G devices will come under continuing operations because these hold two assumptions of normal business and are expected to continue in the future.

How To Calculate Economic Profits

After all of the expenses are deducted, the investor is left with a figure called net income from continuing operations. This is a calculation of the profit generated by continuing operations during the period covered by the income statement. The following is a historical example from the dot-com era to demonstrate how continuing operations and discontinued operations might arise on the income statement. Besides, the income from continuing operations is also important from a disclosure point of view. In the multistep income statement, the income from continuing operations shows the results of the business’s normal operations. According to the ruling of IFRS and GAAP, the entity should disclose the sources of income. Income from continuing operations is just one part of a multistep income statement.For instance, a car company may be headed for trouble if it is making far more money from its financing and credit operations than from selling automobiles. The income or loss from the segment’s operations for the portion of the current year before it was discontinued. Anson discovered that the $ 200,000 cost of land acquired in last year had been expensed for both financial accounting and tax purposes. Discontinued operations are effectively deleted and omitted from the company’s financial data. For instance, if a company is in car selling, but most of its income is coming from insurance, it will be a red flag.

Income From Discountinued Operations

Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business.There are several ways that XYZ can increase income from continuing operations. The firm can grow sales by adding new customers and creating new clothing product lines. XYZ can also cut costs and raise prices to generate more income for every dollar of sales. Changes in accounting principle can materially alter a company’s reported net income and financial position. Changes in accounting principle are changes in accounting methods pertaining to such items as inventory. Such a change includes a change in inventory valuation method from FIFO to LIFO.Discontinued operations of any business entity are those which have stopped generating normal income for a business. The IFRS 5 regulates the financial reporting of the discontinued operations and assets for sales. As a result, many financial market experts separate earnings due to mergers, acquisitions, business divestitures, and discontinued operations from continuing operations. Income Statement line item that does not account extraordinary items and discontinued operations. This metric is frequently used because it excludes items that are unlikely to happen the next reporting period.So, ABC limited is mobile manufacturing, and its plant is located in China. As the new technologies of 4G and then 5G were introduced, their older versions became obsolete for the new market needs. They discontinued manufacturing 2g and 3g phones and entered the business of 4G and 5G devices. For instance, if MSFT had five billion in Income, and 2 billion in an exceptional item charge, its income would be a reported 3 billion. Because the exceptional charge is unlikely to be repeated in the next quarter, some investors prefer to see what MSFT’s income was BEFORE charges. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. This guide shows you step-by-step how to build comparable company analysis (“Comps”) and includes a free template and many examples.

Continuing Operations Or Operating Segments

Most discontinued operations, extraordinary items, changes in accounting principle, and prior period adjustments affect the amount of income taxes a corporation must pay. To report the income tax effect, FASB Statement No. 96 requires reporting all of these items net of their tax effects. Net-of-tax effect means that items appear at the dollar amounts remaining after deducting the income tax effects.Extraordinary items are included in the determination of periodic net income, but are disclosed separately in the income statement below “Income from continuing operations”. As shown below, Anson reported the extraordinary items after reporting the loss from discontinued operations.