Content

- Inventory Valuation

- What Are The Advantages And Disadvantages Of Lifo Method?

- Alternatives To Fifo For Determining Cost Of Goods Sold

- Fifo Inventory Method And Your Business

- How To Calculate Cost Of Goods Sold Using The Fifo Method

- Why Does Apple Use Fifo?

- Calculating Inventory Using Fifo

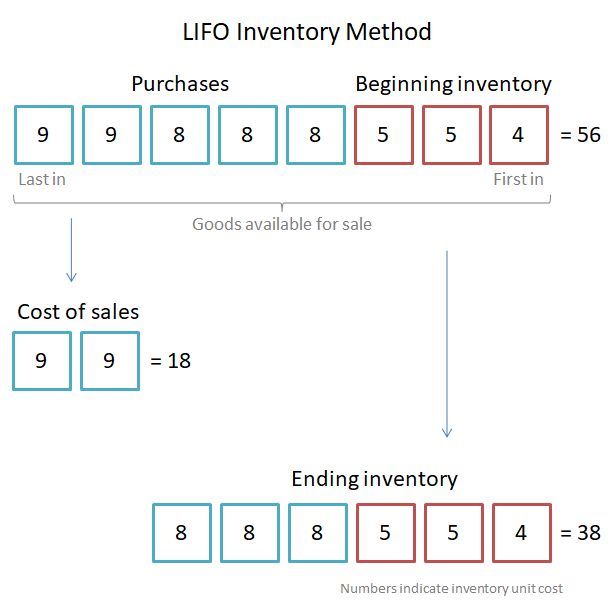

The gross profit margin of $75,000 with LIFO is lower than the $78,000 when using FIFO. This means the company reports lower profits and pays less taxes. With FIFO, the oldest units at $8 were sold, leaving the newest units purchased at $11 remaining in inventory. Under LIFO, the last units purchased are sold first; this leaves the oldest units at $8 still in inventory. The method you use to value the ending inventory determines the cost of goods sold.This video will provide a demonstration of cost assignment under the FIFO method. We provide third-party links as a convenience and for informational purposes only.

Inventory Valuation

If you want to use LIFO, you must meet some specific requirements and file an application using IRS Form 970. Specific identification is used when specific items can be identified. For example, the cost of antiques or collectibles, fine jewelry, or furs can be determined individually, usually through appraisals. The method is easy to understand, universally accepted and trusted. The FIFO method is considered to me a more trusted method than the LIFO (“Last-In, First-Out”) method.

What is the basic formula for the gross profit method?

Gross profit equals net sales minus the cost of goods sold.To determine the cost of units sold, under FIFO accounting, you start with the assumption that you have sold the oldest (first-in) produced items first. FIFO is one of several ways to calculate the cost of inventory in a business.

What Are The Advantages And Disadvantages Of Lifo Method?

Under LIFO, companies can save on taxes along with a better match their revenue corresponding to their latest costs when prices are rising. In simple words, this method assumes that the most recent goods added to an inventory are sold first. You can try our most efficient and reliable lifo calculator to manage the inventory goods that were added to your inventory concerning lifo method.

- Note that the $42,000 cost of goods sold and $36,000 ending inventory equals the $78,000 combined total of beginning inventory and purchases during the month.

- With the ACM calculation, we’ll use the same bookstore example.

- Calculating your inventory lets you keep an eye on your business’ performance and its overall assets.

- Additionally, you people can try fifo method calculator uses fifo method to find the ending inventory in the balance order same as that in which it was added to the company’s stock.

- FIFO & LIFO are two different but common ways of valuing inventory that affects how COGS, sales and profits are accounted for.

- You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

It considers the cost of goods sold, relative to its average inventory for a year or in any a set period of time. For example, consider a company with a beginning inventory of two snowmobiles at a unit cost of $50,000. The company purchases another snowmobile for a price of $75,000. For the sale of one snowmobile, the company will expense the cost of the older snowmobile – $50,000. We now have a much clearer picture of what happened during the month of January. When using FIFO, we pick the units that were acquired first and use the cost of those units first. We keep picking units until we have accounted for the cost of all the units sold, in this case 245 units.

Alternatives To Fifo For Determining Cost Of Goods Sold

In the United States, a business has a choice of using either the FIFO (“First-In, First Out”) method or LIFO (“Last-In, First-Out”) method when calculating its cost of goods sold. Both are legal although the LIFO method is often frowned upon because bookkeeping is far more complex and the method is easy to manipulate. To calculate COGS using the FIFO method, determine the cost of your oldest inventory. With FIFO, you can figure out how to build marketing strategies based on the data as well, such as running a promotion on a popular item. You will also get a real-time look at the inventory flow so you can improve your margins and buying costs, thereby affecting your bottom line. FIFO calculates COGS at a much more precise level than ACM because it accounts for each item whereas ACM only uses the average of similar products. Calculating your inventory lets you keep an eye on your business’ performance and its overall assets.

Why FIFO method is used?

The FIFO method can help lower taxes (compared to LIFO) when prices are falling. … If the older inventory items were purchased when prices were higher, using the FIFO method would benefit the company since the higher expense total for the cost of goods sold would reduce net income and taxable income.Inventory on the balance sheet will be higher than when using other inventory methods, assuming costs are rising. You have to remember that if the paid-price for the inventory fluctuates during the specific time period you are calculating Cost of Goods Sold, then that should be taken into account too. Furthermore, you can use an online fifo lifo calculator that uses both fifo and lifo valuations to provides you the fifo lifo inventory table. Remember that ending inventory is a crucial component in the calculation of the cost of goods sold.

Fifo Inventory Method And Your Business

Unsold inventory is considered an asset, and when it’s sitting there, you need to know exactly how it affects your bottom line as well as how it relates to taxes. Magento Bring Erply inventory management power to your web store with our Magento module. Prestashop Bring Erply inventory management power to your web store with our PrestaShop module.The FIFO method assumes the first products a company acquires are also the first products it sells. The company will report the oldest costs on its income statement, whereas its current inventory will reflect the most recent costs. FIFO is a good method for calculating COGS in a business with fluctuating inventory costs. No doubt, the decision to use LIFO vs. FIFO is complicated, and even each business situation is varying. You should have to conform to IRS regulations and U.S. and international accounting standards.

How To Calculate Cost Of Goods Sold Using The Fifo Method

During the period of inflation, the use of fifo will outcome in the lowest estimate of COGS among the three approaches, and even the highest net income. FIFO is the easiest method to use, regardless of industry, and this inventory valuation method complies with GAAP and IFRS. To calculate the cost of goods sold, start with the oldest units. In this case, the store sells 100 of the $50 units and 20 of the $54 units, and the cost of goods sold totals $6,080. Let’s assume that a sporting goods store begins the month of April with 50 baseball gloves in inventory and purchases an additional 200 gloves. Goods available for sale totals 250 gloves, and the gloves are either sold or remain in ending inventory.Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. On 31st December 2016, 600 units are on hand according to physical count.If you want to read about its use in aperpetual inventory system, read “first-in, first-out method in perpetual inventory system” article. Last in, first out is another inventory costing method a company can use to value the cost of goods sold. Instead of selling its oldest inventory first, companies that use the LIFO method sell its newest inventory first. LIFO costing (“last-in, first-out”) considers the last produced products as being those sold first.

How Do You Calculate Fifo And Lifo?

For example, those companies that sell goods that frequently increase in price might use LIFO to achieve a reduction in taxes owed. You assume that all 2,000 of the Batch 1 items worth $4 each were sold first. LIFO, short for last-in-first-out, means the last items bought are the first ones sold. Cost of sales is determined by the cost of items purchased the most recently.Because this method assumes that the most recently purchased items are sold, the value of the ending inventory is based on the cost of the oldest items. The remaining 25 items must be assigned to the higher price, the $15.00. The FIFO inventory method can also be the mandated method by the IRS depending on your business and how it operates so knowing the difference between FIFO and ACM is important. You can also use FIFO value calculation as a way to predict your cash flow, especially as your previous FIFO inventory calculations can create a benchmark and you’re getting real-time data. When your inventory can’t be sold or is out of date, then it becomes obsolete, but the FIFO inventory method helps you reduce the risk of having high amounts of obsolete inventory. Following FIFO, a company assumes that their oldest items will sell first, even if they haven’t actually sold first. The FIFO inventory method is popular with grocery stores and other stores that sell perishables, but it has plenty of applications for other retailers as well.When it comes to periods of inflation, the use of last-in-first-out will outcome in the highest estimate of COGS among the three approaches, and the lowest net income. Additionally, you people can try fifo method calculator uses fifo method to find the ending inventory in the balance order same as that in which it was added to the company’s stock. Whereas, try lifo method calculator that uses the lifo method while performing ending inventory calculations on the most recent goods.

Why Does Apple Use Fifo?

All costs are posted to the cost of goods sold account, and ending inventory has a zero balance. It no longer matters when a particular item is posted to the cost of goods sold account since all of the items are sold.The IFRS prohibits LIFO inventory method because of the potential distortions it may have on a firm’s profitability and financial statements. For instance, LIFO valuation method can understate a firm’s earnings for the purposes of keeping taxable income low. Also, this approach result in inventory valuations that is outdated and obsolete. Under this inventory valuation method, both inventory and COGS are depends upon the average of all units bought during the period.On the other hand, manufacturers create products and must account for the material, labor, and overhead costs incurred to produce the units and store them in inventory for resale. The LIFO method requires advanced accounting software and is more difficult to track. You’ll spend less time on inventory accounting, and your financial statements will be easier to produce and understand. Using FIFO simplifies the accounting process because the oldest items in inventory are assumed to be sold first. When Sterling uses FIFO, all of the $50 units are sold first, followed by the items at $54.