Content

- How To Fill Out Form 2106 For Employee Business Expenses

- What Are Business Expense Categories?

- What Else Can I Deduct As A Business Expense?

- Next Posthow Can A Business Reduce Fixed Costs?

- What Are The Different Types Of Business Expenses?

- What Are Tax

- Overview: What Counts As A Deductible Business Expense?

Examples of miscellaneous expenses are postage, kid’s toys, electronics maintenance, pet care, holiday spending, etc. Food-related expenses constitute a major part of some people’s budget while others spend less by mastering coupons. At this point, you need to think of all the things you do that bring in money. Only guaranteed sources of income should be listed in your budget. For those who are just starting to make budgets, a detailed breakdown of categories is recommended so you would know exactly what you are spending on. Some people are of the opinion that creating master categories save time and simplify their budget.Add to this industry-specific categories, such as R&D costs or spending to seek VC funding. Categorizing expenses isn’t just about prepping for tax season. Proper categorization of your business expenses can prepare you for a future of growth and savvy financial management.

How To Fill Out Form 2106 For Employee Business Expenses

The cost of the first few years of your child’s education may be minimal; however, this depends on the school your child attends. Remember that life is short, so make sure to enjoy it while it lasts. It is completely fine to spend some money on things that give you joy. This category is vital for every family; however, the cost is dependent on the number of persons in the family. Insurance is an essential part of future planning that should be included in your budget. In order to assess your financial situation accurately, it is necessary that you break down this category as much as possible.

- As stated earlier, you’ll want to divide your categories into the most self-explanatory way possible.

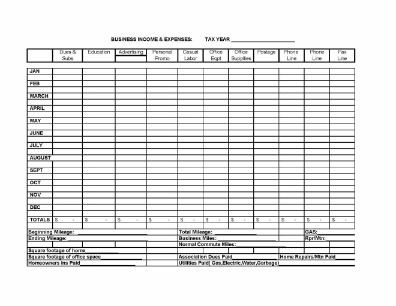

- Today I’m sharing a really easy way to categorize spending with the use of Microsoft Excel Pivot Tables.

- Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities.

- You might also include membership fees for professional associations or publications.

- In this article, we will review the different types of business expenses and how to categorize them.

Consistency is also important, so you’ll want to make sure that you code and record invoices consistently from month to month. If you’re using the cash method of accounting, you cannot deduct that expense for 2019, but it can be deducted in 2020, when you pay the bill. In fact, any expense that is considered ordinary and necessary for your business is likely a deductible expense. Some of the most common expense categories include utilities, travel, salaries and other wages, and rental expense, but there are many more that you should be aware of. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities.

What Are Business Expense Categories?

When it is time to file your taxes or undergo a tax audit, you won’t have to scramble to come up with an accurate total and documentation of your company’s business expenses. You can also use the system you have in place for organizing your business expenses for budgeting your own expenses. With a good, consistent system in place, you’ll have a well-organized and easy-to-access list of small business expenses. The ordinary and necessary cost of insurance can be deducted as a business expense if it is specifically for your business or trade. Examples of tax-deductible insurance expenses include insurance premiums, general and professional liability insurance, commercial property insurance, and data breach insurance. One of the most exhaustive guides to what requirements need to be met for qualifying business expenses is the IRS publication 535. However, if you want a resource that’s easier to wade through, download our free overview guide.A qualified charity is one that the IRS approved as tax-exempt. By setting this up during the vendor setup process, you can eliminate the need to allocate the expense when it’s entered. One handy feature in Zoho Books is the option to record an expense, record mileage, or record bulk expenses. Zoho Books also offers an excellent primer on how to track business expenses.

How do I categorize my business?

You can separate businesses into three basic categories: Service companies, retailers, and manufacturers. Because companies provide many different services and products to their customers, some companies fit more than one of these categories.Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments. If you are applying for financing, a solid roadmap becomes especially important as it is the best way for a lender to get a feel for you and your business. Essence of bookkeeping, and it’s a good habit to review your transactions on a regular basis.And before you doze off or close the page — this will save you some precious time + give you a way to review your spending in detail on a regular basis. You may have charges you’ve been meaning to cancel or inaccurate charges from companies.

What Else Can I Deduct As A Business Expense?

T&E expense category will be dependent on the standard mileage rate for computing reimbursements and mileage deductions. Some business expenses you can deduct fully and some only partially.Let’s say you buy new furniture for the waiting room in your auto shop. Limitations on what you can categorize as a business expense. Partners Merchant accounts without all the smoke and mirrors. Earn your share while providing your clients with a solid service. Financial Institutions Integrate our services with yours to solidify your place as a trusted advisor for your commercial banking customers.

Next Posthow Can A Business Reduce Fixed Costs?

This review will help you understand what the software does and whether it’s right for you. Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. You can categorize the premiums you pay for general liability, professional indemnity, and other types of insurance here. Use this category for making payments into a business retirement plan, like a 401.

What Are The Different Types Of Business Expenses?

In this type of system, money goes towards monthly bills before anything else. If there is not enough to cover the expenses, the next influx of income goes towards the loss. Start by identifying the expense categories your business uses the most—that financial statement will help here—and ones that you’ll need to grow. Those “ordinary and necessary” expenses must be incurred in an organization motivated by profit.It may seem like a nuisance, but taking the time to set up categories for your business expenses now can save you a major headache down the road. It can also help you pay less in taxes when you look at deductible expenses. And finally, categorizing business expenses lets you see the big picture in terms of where your company is spending money.Looking to grow your business?

What is expense analysis?

December 22th, 2020. Expenditure analysis involves processing a small amount of relevant procurement data in order to learn from it and thereby improve operations. It should be carried out in the context of a clear, shared procurement strategy.Events like going to the movies or attending games are included. The food portion of your budget regards the things you eat or drink. Buying groceries, dining out, and your morning coffee fall under the food bracket.QuickBooks Online is the browser-based version of the popular desktop accounting application. It has extensive reporting functions, multi-user plans and an intuitive interface.

What Are Tax

Plus you have the security of having adequate backup and a solid audit trail in place, should you ever be audited. In conclusion, organizing and tracking expenses for small business can be a tedious job at first.Insurance payments can fall under the vehicle expense category if it’s vehicle insurance, and the salaries and compensation category if you are offering insurance policies to employees. Remember to keep records of business expenses and other business paperwork even after you file your taxes.Speaking of, it’s worth spending time with a financial adviser to understand the types of expenses you can and can’t include in a specific category. IRS allows businesses to deduct costs incurred throughout the year which are ordinary and necessary to the business. As you can imagine, your small business expenses are largely ordinary and necessary for your industry, so the amount of your deductible expenses is quite high. It can be helpful to ensure the business expenses are deductible before recording them in the appropriate category. Creating and communicating a procedure to your team can help you achieve this.In this article, we’ll describe how to categorize personal expenses, regardless of your initial budget. Moreover, we’ll list three budgeting options so you can pick the one that’s right for you. Any spending considered a personal expense can’t be written off. In addition, you can’t deduct expenses related to client entertainment, with the exception of meals; fines or penalties for violating a law; country club dues; and illegal payments. For example, a greeting card business may have dedicated categories for shipping and storage rental, whereas software-as-a-service companies may have categories for digital services. By developing expense categories that fit your business and recording and organizing expenditures as you go, you’ll find it easier to get all the deductions you’re due. Your company’s meal and entertainment expenses are the most likely to be abused and least likely to be reported correctly.

Company

While accounting software won’t be much help if bills aren’t posted to the correct expense account, it can go a long way in helping you categorize and track your expenses throughout the year. You’ll also want to check out IRS Publication 535; Business Expenses, for a more complete explanation of business expenses and exactly what you can deduct. Decide on the right categories for your specific business expenses. How to use Microsoft Excel Pivot Tables to easily categorize spending. Review for accuracy and find recurring expenses that need to be canceled. Tracking business expenses also helps you budget effectively and find external funding if required. Business-related tax expenses like state and local sales tax, state and local income tax, personal property tax, and excise tax may be deductible.