Content

- Method 1 Of 3:using Straight Line Depreciation

- What Kind Of Assets Can You Depreciate?

- How To Calculate House Payment With Taxes & Pmi

- Using Depreciation To Manage Cash Requirements

- Declining Balance Depreciation

- How To Calculate Straight Line Depreciation

Accountants must adhere to generally accepted accounting principles for depreciation. On the other hand, expenses to maintain the property are only deductible while the property is being rented out – or actively being advertised for rent.

Method 1 Of 3:using Straight Line Depreciation

Choosing the right depreciation method depends on your situation. Regulations may require you to use a particular type of depreciation. If they don’t, you can choose the depreciation method that works best for your circumstances.You will do this calculation yearly until the machine reaches its production capacity of 120,000 whatsits. Many or all of the products featured here are from our partners who compensate us.

- This includes things like routine cleaning and maintenance expenses and repairs that keep the property in usable condition.

- Annual depreciation is separated into fractions using the number of years of the business asset’suseful life.

- Since the asset is depreciated over 10 years, its straight-line depreciation rate is 10%.

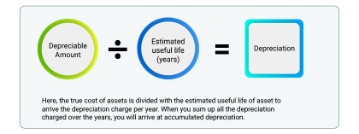

- It is calculated by simply dividing the cost of an asset, less its salvage value, by the useful life of the asset.

- This will reduce your net income by $2,500 each month, and it will also reduce the value of the asset on your balance sheet by $2,500 each month.

Land value is exempt from depreciation, because land never wears out or is used up. In fact, it’s possible for an investor to own a rental property that’s cash-flow positive while paying nothing in taxes. Subtract the salvage value, if any, from the original cost and enter this number in all rows under the Total Depreciable Cost column. In this example, the value is $1,000 purchase price minus $200 salvage value equals $800 depreciable cost. Your fixed asset has a lifespan, after which it will no longer be of use.

What Kind Of Assets Can You Depreciate?

Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. An overview on the benefits and drawbacks of using an LLC with your income properties, along with the cost, ownership structure, asset protection, and financing implications. During a four year holding period, the home appreciated in value to $521,000. The investor decides to sell and the transaction closes on December 31, 2020, just in time for the new year. Property placed into service after 1980 but before 1987 uses the Accelerated Cost Recovery System for depreciation. Investor must be the owner of the rental property and not a tenant.Pre-depreciation profit includes earnings that are calculated prior to non-cash expenses. A fully depreciated asset has already expended its full depreciation allowance where only its salvage value remains. Note how the book value of the machine at the end of year 5 is the same as the salvage value.

What is the simplest depreciation method?

Straight line depreciation is the easiest depreciation method to use, making it ideal for small businesses that need to depreciate fixed assets. Business owners use straight line depreciation to write off the expense of a fixed asset.When your business buys property for long-term use, you can take deductions for the cost of the property by spreading it over several years using a process called depreciation. The Internal Revenue Service calls this type of property capital assets. In regards to depreciation, salvage value is the estimated worth of an asset at the end of its useful life. If the salvage value of an asset is known , the cost of the asset can subtract this value to find the total amount that can be depreciated. Assets with no salvage value will have the same total depreciation as the cost of the asset. Similar to declining balance depreciation, sum of the years’ digits depreciation also results in faster depreciation when the asset is new.

How To Calculate House Payment With Taxes & Pmi

This gives you the amount of depreciation to recognize for each period. Double declining balance depreciation is most often used for vehicles and other assets that lose value quickly. It’s usually the form of depreciation that writes off an asset’s value the quickest. Note that you’re not crediting the actual asset account on the balance sheet, but a separate account called accumulated depreciation. The accumulated depreciation account will have a negative balance, which offsets the value of the asset without changing it on the balance sheet. You will often see these accounts as subaccounts of the fixed asset accounts on the balance sheet. Rental property placed into service after 1986 generally uses the Modified Accelerated Cost Recovery System .As a result, some small businesses use one method for their books and another for taxes, while others choose to keep things simple by using the tax method of depreciation for their books. One way to calculate depreciation is to spread the cost of an asset evenly over its useful life; this is called straight line depreciation. This calculator shows how much an asset will depreciate each year—the yearly depreciation rate—using straight line depreciation.

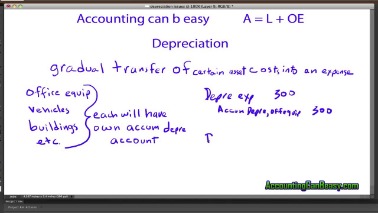

What is the formula for depreciation?

How it works: You divide the cost of an asset, minus its salvage value, over its useful life. That determines how much depreciation you deduct each year. Example: Your party business buys a bouncy castle for $10,000.The asset must have a useful life that can be determined and it must be expected to last for more than a year. Straight line basis is the simplest method of calculating depreciation and amortization, the process of expensing an asset over a specific period. Companies have several different options for depreciating the value of an asset over time, in accordance with GAAP. Most companies use a standard depreciation methodology for all of the company’s assets. Thus, depreciation methodologies are typically industry-specific. In between the time you take ownership of a rental property and the time you start renting it out, you may make upgrades. Some of them can be added to the depreciable value of the property.

Using Depreciation To Manage Cash Requirements

But while income and equity can increase a tax burden, depreciation expense helps to decrease or even eliminate taxes owed on the income a rental property generates. Calculate the number of months during the tax year that the property was available for rent or rented.An intangible asset can’t be touched—but it can still be bought or sold. Examples include a patent, copyright, or other intellectual property. The IRS also refers to assets as “property.” It can be either tangible or intangible. You will continue with these calculations until you reach the scrap value of the asset.

Declining Balance Depreciation

Some companies may also use the double-declining balance method, which is an even more aggressive depreciation method for early expense management. There are four methods for depreciation allowable under GAAP, including straight line, declining balance, sum-of-the-years’ digits, and units of production. So, if you use an accelerated depreciation method, then sell the property at a profit, the IRS makes an adjustment. They take the amount you’ve written off using the accelerated depreciation method, compare it to the straight-line method, and treat the difference as taxable income. In other words, it may increase your tax bill in the year of sale. The straight-line depreciation method is the easiest to understand and implement.

How To Depreciate Rental Of A Principal Residence

Depreciation is a non-cash expense rental property owners take to reduce the amount of taxable net income. For the third year, the depreciable cost becomes $360 with a depreciation of $144, and so on. Divide 100% by the number of years in the asset life and then multiply by 2 to find the depreciation rate. For example, if you bought factory equipment for $1,000, then that’s the amount that you’ll use as the purchase price.

Asset’s Useful Life

This includes things like routine cleaning and maintenance expenses and repairs that keep the property in usable condition. It’s a good idea to consult with your accountant before you decide which fees to lump in with the cost of your property. If you paid $120,000 for the property, then 75% of $120,000 is $90,000. For the sake of this example, the number of hours used each year under the units of production is randomized. Play around with this SYD calculator to get a better sense of how it works. Its salvage value is $500, and the asset has a useful life of 10 years.To get a better sense of how this type of depreciation works, you can play around with this double-declining calculator. Self-employment taxes can take a big bite out of your income—but you can take steps to minimize the impact. As a business owner in a state that imposes sales taxes, you have an obligation to collect and report sales tax. Small businesses with an e-commerce presence may be responsible for collecting and remitting sales tax to several states. An asset’s salvage value is its estimated value when it reaches the end of its useful life. Units of production depreciation is most often used in manufacturing for equipment that is expected to produce a certain number of items before it’s no longer useful.Since the asset is depreciated over 10 years, its straight-line depreciation rate is 10%. An asset’s useful life is the length of time the item can function before it is no longer useable. However, accounting standards or IRS rules generally require you to set an asset’s useful life at a standard length based on its classification. Here are some examples using classes from the IRS’s general depreciation system. NerdWallet strives to keep its information accurate and up to date.Depreciation methodically accounts for decreases in the value of a company’s assets over time. In the United States, accountants must adhere togenerally accepted accounting principles in calculating and reportingdepreciationon financial statements. GAAP is a set of rules that includes the details, complexities, and legalities of business and corporate accounting. GAAP guidelines highlight several separate allowable methods of depreciation that accounting professionals may use. The following calculator is for depreciation calculation in accounting.