Content

- Accounting

- Second Payment Reminder Email: On The Day The Payment Is Due

- Business Operations

- Latest On Entrepreneur

- The Best Bank Accounts For New Business Owners

- What Kinds Of Supplier Behaviour Can Exacerbate Matters With Customers?

- What Reasons Cause Customers To Be Late In Making Payments?

If you have a contract, and you really should, review it carefully. The only way to resolve the nonpayment is by going through an arbitration board. Get in touch with the arbitration board to find out what you need to do to file a case.All companies should have a schedule of procedures in place to stay on top of overdue invoices and minimize efforts spent on client follow-up. If communication by internal employees is non-effective, a business may need to employ legal action or a collections agency. We contacted you on regarding your overdue invoice and still have not received payment.

Accounting

I love working with you and have always taken our relationship as more than just client/supplier. But if I can’t rely on you paying promptly or it takes several attempts and reminders to get my money, that’s not good business. To reduce your chance of getting caught with an unpaid invoice in the future, consider doing credit checks on prospective customers before agreeing to work with them.I’ve also attached a copy of the invoice to this email, in case the original was lost or deleted. This is an aggressive move and some customers will take offense. Free business credit scores to determine what type of financing you can obtain today. Outstanding invoices are tracked and reviewed by the finance department.

Second Payment Reminder Email: On The Day The Payment Is Due

Contact someone else at the office, such as the accounting manager. Only do this after you’ve made several fruitless attempts at contacting with your contact. Could you reply to this message and let me know you’ve received it? I’m sure you’re busy, but I’d appreciate if you could take a moment and look over the invoice when you get a chance.Also, make the payment process as convenient as possible, set-up recurring invoices, and work on establishing strong client relationships. It’s not worth the time, energy and money to hunt down a $300 invoice. Maintain that attitude even when you need take a firmer approach toward reclaiming your compensation. If you still haven’t received payment after a full month, it’s time to step out from behind the email curtain and call your client directly. First of all, it’s possible that your client changed email addresses, or accidentally provided you with an incorrect email address. Or, if you’re working with a larger institution, you may be sending your invoice requests to the wrong person or department.

Business Operations

This manner of funding can be either long- or short-term and is intended to finance working capital. A cash flow loan can open the door to lending for a business without a great credit score or a lengthy financial history. Since a cash flow loan is secured, interest rates are a bit lower than more traditional loans.

What is the meaning outstanding payment?

2 adj Money that is outstanding has not yet been paid and is still owed to someone. You have to pay your outstanding bill before joining the scheme.Delaying payments for this reason is also a way of retaining cash resources, even when there is not necessarily a need to do so. Cash flow problemscan have an extremely wide range of causes related to management problems or market conditions, for example.

Latest On Entrepreneur

Here are a few tips to handle past-due invoices and help you avoid getting late payments. Lack of communication between customer and supplier is the root cause of tension surrounding payments and unpaid invoices. In the vast majority of cases, late payment of an invoice is the result of a customer’s cash flow problems. However, customers will typically adopt an insular stance as they feel something akin to shame. They don’t want their cash flow problems to become common knowledge, so they “play dead” and don’t answer calls or reminders from suppliers.

- Try creating instant invoices by downloading our word invoice templates and send all the invoices absolutely free.

- Contact someone else at the office, such as the accounting manager.

- For example, if it is mentioned net-30 in payment terms, that means the client or the customer has 30 days to pay the invoice.

- And, this is why you need to track your invoices to balance your cash flow.

- I have always been there at the drop of a hat to sort out any problems you might have.

- In fact, it’s a good idea to open a card in your business’ name and use it responsibly whether or not you actually need it to build credit.

Learn about bad debt, including its causes and available remedies, how to collect them, and how to prevent them in the future. Check out our tips to perform credit checks on existing and potential customers, in order to assess credit risk. If the amount you’re owed exceeds the small claims court maximum limit, you’ll have to go to a regular court to file a lawsuit. You can represent yourself, but it’s not advised in this situation. If your client is local, you can use a business mediation service. This process involved a trained, neutral mediator you works with both parties to resolve the dispute.

The Best Bank Accounts For New Business Owners

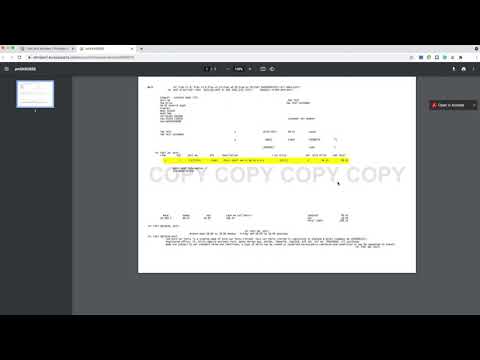

With invoice factoring, you basically receive a cash advance amount of 80 percent of the total receivable. As the borrower, you’ll be responsible for the interest and fees on the advance. If you’ve met your client through an online ad or freelance website, contact the customer service department of the site to report the problem. If there are too many complaints, they’ll stop running the ads for that person. Our records show that we haven’t yet received payment of $5,400 for Invoice #10237, which is overdue by one week. The best practice, of course, is for your customers to send payment immediately after receiving your invoice. The invoice due date is a specific date set by the company or the vendor as the due date for making the payment at the latest.undefinedThe specific legal action will depend on the type of organization you’re dealing with. It’s different for sole proprietors, partnerships and companies. In other words, it can get complex – so use a specialist lawyer. Your debt collector might have inhouse legal expertise, or they may introduce you to a lawyer. Debt collectors have a skill for getting overdue invoices paid.

What Kinds Of Supplier Behaviour Can Exacerbate Matters With Customers?

At this point, you should consider whether the cost of litigation is worth it to settle the overdue invoice. In accounting, the accounts payable department tracks all outstanding invoices and schedules them for payment. Accounting clerks in this department receive the invoices, review them for accuracy, seek approval from managers and record them into the accounting system. The clerks often require a schedule to track each outstanding invoice to ensure proper and timely payment to vendors.The intermediary has no emotional attachments, and demonstrates openness, listening to the customer to then find an amicable solution. Out-of-court negotiation is preferable, in order to both facilitate unpaid invoices recovery and maintain a commercial relationship. Customers won’t make the same promises to an intermediary as they do to a supplier they know. Once dialogue starts, they usually understand and appreciate the approach. If you want to prevent the hassle of unpaid invoices in the first place, make sure that you research new clients to make sure that they’re legit and don’t have any prior complaints. After that make sure that you have a signed contract, keep detailed records, and ask for a payment upfront.