Content

- What To Know About Student Loan Forgiveness For Nurses

- You Are Leaving H&r Block® And Going To Another Website

- How To Get Away With Tax Fraud

- Your Charitable Contributions Are Disproportionately High Compared To Your Income

- Subscribe To Kiplinger’s Personal Finance

- Research All Possible Tax Deductions You May Qualify For

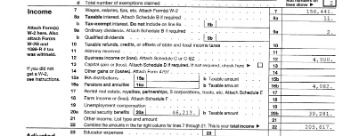

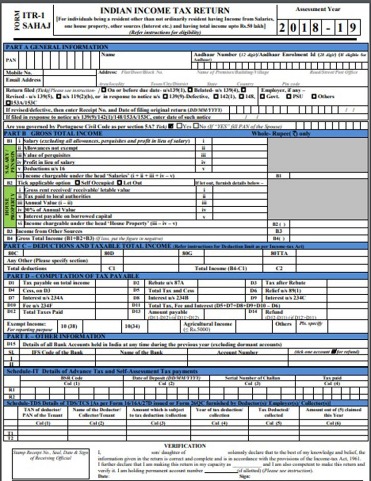

Unemployment, or a new job, now is a good time to adjust the amount of taxes withheld from your paycheck by adjusting your withholding on your W-4 and refiling the form with your employer. There are a handful of tax deductions that are recognized the year in which you pay them. If you’re really bad at math, consider hiring a tax preparation service to do your return. Pros know the ins and outs of tax law. And even though, they’re not free, one may be worth your while if you suck at math.

Can I still get a refund for 2014 taxes?

The IRS may hold the 2014 refunds of taxpayers who have not filed tax returns for 2015 and 2016. The unclaimed money will be applied to any amounts still owed to the IRS or a state tax agency. The money may also be used to offset unpaid child support or past due federal debts, such as student loans.Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

What To Know About Student Loan Forgiveness For Nurses

Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . CAA service not available at all locations. Available only at participating H&R Block offices. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only.Choosing to not file a return because your income for 2018 doesn’t require it doesn’t mean you’re not due a refund. And if you’re eligible for a refund, you have to file a return to get it. In 2018, the IRS reported it had $1.1 billion of unclaimed refunds from an estimated 1 million taxpayers who didn’t file in 2014 alone. Simply put, many Americans with little or no income don’t file tax returns because they think they have no federal income tax liability and aren’t required to file a tax return. Conversely, if you earn a lot of money you’ll also fall on the IRS’ radar.If you plan to use direct deposit to receive your refund, double check the bank account information you provide. If you enter the wrong account information, you won’t receive your refund as you planned. And getting things straightened out can be a pain. One question to ask, though, is whether you really want a refund at all. If you’ve had too much withheld from your paychecks in your past, ask your employer for a copy of Form W-4, which you can use to recalculate how much money is taken out of your pay for taxes.The one not-so-pleasant—and even somewhat stinky—part of spring is that your taxes are due. That, of course, could be pleasant if you’re getting a refund. Fortunately, there are ways to maximize your return and avoid the most common mistakes people make to ensure the biggest part of your return is your own and not Uncle Sam’s. Failing to maximize your return and making mistakes can mean paying more taxes than you have to or, even worse, underreporting your income and setting yourself up for interest and penalties later. Here are 11 ways to get the most out of your tax return. With tax season in full swing, you may be wishing for just a few more tax breaks to boost your 2014 refund. And while there isn’t too much you can do right now , there are a few ways you can still boost your tax return and get a head start on your 2015 tax planning at the same time.

Can I still file my 2014 taxes in 2019?

You can still file 2019 tax returns File your 2014, 2015, 2016, 2017, 2018, 2019, and 2020 tax returns.Plus, your refund money could be used to pay debts owed to the IRS or state tax agency, such as unpaid child support or student loans. If you have not filed tax returns for 2015 or 2016, your refund for 2014 may be held by the IRS.

You Are Leaving H&r Block® And Going To Another Website

CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return . It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation.

How To Get Away With Tax Fraud

Examples of those investigations can be found for fiscal years2014 and 2015. Your refund should never be deposited directly into a preparer’s bank account. Preparing your taxes isn’t a lot of fun – according to the Pew Research Center, 72% of Americans believe the federal tax code is too complex. For instance, the Tax Foundation found that the U.S. tax code is approaching 10.1 million words in length, not counting the lengthy court documents that help describe some of the tax laws on the books.Their calls were recorded and used to snare the two – because, well, why not? Jackson thanked the agent profusely, telling her that she was “so happy” after being informed that she would receive her refund – yes, the one for $94 million – in “7-10 business days.”Sometimes Married Filing Separately can reduce each partners’ adjusted gross income and result in a higher refund. Some professional tax services, even offer to do that dual calculation for you. Dig into all deductions available to you. Some of the more common deductions include charitable donations, medical costs, prepaid interest on a mortgage and education expenses. Deductions are subtracted from your adjusted gross income, which lowers your actual taxable income. Your taxable income is the amount you pay taxes on.

Your Charitable Contributions Are Disproportionately High Compared To Your Income

The IRS stated that the median potential unclaimed refund from 2014 is $847, so this isn’t an insignificant amount of money. So, since 2014’s tax return was due in April 2015, this year’s tax deadline will represent the three-year mark. Any 2014 tax refunds not claimed by the April 17, 2018, Tax Day officially become the property of the U.S. American taxpayers could be entitled to about $1.1 billion in unclaimed tax refunds from the 2014 tax year, according to a recent IRS newsletter. The agency estimates that 1 million taxpayers could potentially have a claim to some of this money, with a median unclaimed refund amount of nearly $850. But for some American taxpayers, it’s not the preparation process that’s a headache – it’s the potential of being audited by the IRS.As one extra note, make sure you have documentation for every charitable contribution you make in case the IRS comes calling. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. Additional training or testing may be required in CA, MD, OR, and other states.

Subscribe To Kiplinger’s Personal Finance

H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice.

- Year-round access may require an Emerald Savings®account.

- Farms include plantations, ranches, ranges and orchards.

- If you are married but don’t file jointly or if you are claimed on someone else’s return, you will likely not qualify for this deduction.

- To find out if you are eligible to receive the EITC, refer to the chart above and additional info at IRS.gov, or use the online EITC Assistant to estimate the amount of credit you are entitled to claim.

- Any extra will then be passed to the next tax year.

Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Small Business Small business tax prep File yourself or with a small business certified tax professional. Farm income averaging.You may be able to average some or all of the current year’s farm income by spreading it out over the past three years. This may lower your taxes if your farm income is high in the current year and low in one or more of the past three years. Deductible farm expenses.Farmers can deduct ordinary and necessary expenses they paid for their business. An ordinary expense is a common and accepted cost for that type of business.You might want to do this if you’d pay less tax overall between your federal and state taxes. This can happen if you itemize on your federal and state returns and get a larger tax benefit than you would if you claimed the standard deduction on your federal and state returns. Note that some states don’t allow itemized deductions, such as Michigan or Massachusetts.

American Opportunity Tax Credit

The same mistake goes for your tax preparer. If someone else is preparing your taxes, double check that he or she has signed it. And make sure you sign it as well. Know that these forms will come directly from the bank or financial institution where you earn the interest.You may get a refund of part or all of the income tax you paid in prior years. You may also be able to lower your tax in future years. Be realistic about your dependents.