Content

- Finance Your Business

- Accountedge Pro

- Swedish Bas Chart Of Accounts Layout

- Expense Accounts

- Business Plan

- Overview: What Counts As A Deductible Business Expense?

Because the general ledger account is a chronological listing of every transaction, it would be very difficult to find how much a particular customer owes at any given moment. Modified cash-basis and accrual accounting use the same accounts, which are advanced accounts such as AP and long-term liabilities.The Spanish generally accepted accounting principles chart of accounts layout is used in Spain. The French generally accepted accounting principles chart of accounts layout is used in France, Belgium, Spain and many francophone countries. The use of the French GAAP chart of accounts layout is stated in French law.

- For instance, in December of 2019, you receive a bill from Atlas Roofing for repairs completed earlier in the month.

- This field requires excellent knowledge of the relevant accounting framework, as well as an inquiring personality that can delve into client systems as needed.

- You can also deduct rental payments for a co-working space, as long as you’re not also claiming the home office deduction.

- Ledger accounts that contain transactions related to individuals or other organizations with whom your business has direct transactions are known as personal accounts.

- Businesses can collect payment online from customers through Xero’s integration with Stripe and GoCardless.

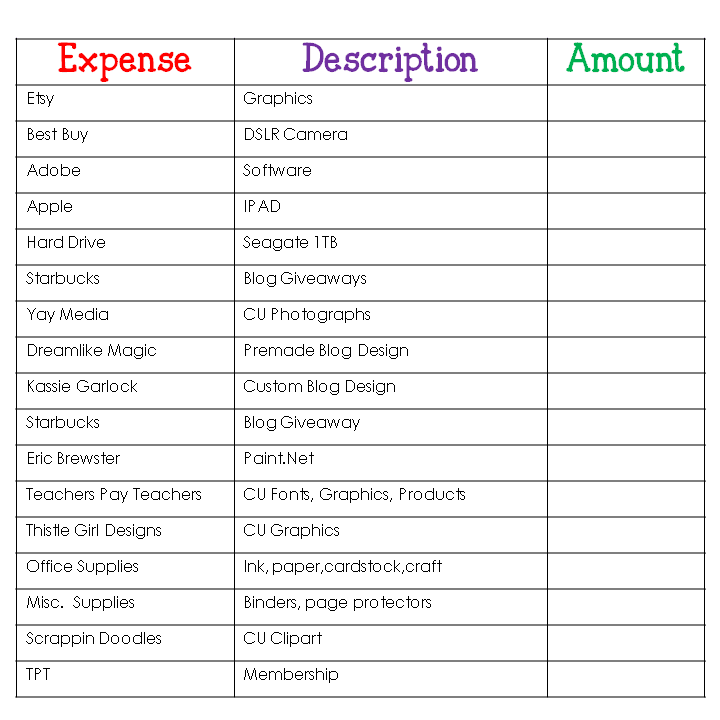

Now that you’ve reviewed the list of budget categories, let’s cover some best practices for categorizing and tracking your expenses. You can deduct the expenses for a vehicle you use in your business. If the car or truck is used only for business, all expenses are deductible.Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Variable expenses are recurring expenses that change depending on how many goods you produce or services you provide to customers.

Finance Your Business

The software is cloud-based and can be accessed through a web browser or through the mobile app. Some of the components of the owner’s equity accounts include common stock, preferred stock, and retained earnings. The numbering system of the owner’s equity account for a large company can continue from the liability accounts and start from 3000 to 3999. The chart of accounts provides the name of each account listed, a brief description, and identification codes that are specific to each account. The balance sheet accounts are listed first, followed by the accounts in the income statement. Fixed expenses are recurring expenses that don’t change from month to month, regardless of sales or production volume. Fixed costs are easiest to budget for because they’re predictable and regular.

What are the 5 main classification of accounts?

The five classifications of account are: Assets, liabilities, equity, revenue, and expenses.If you buy or lease computer hardware or software to use in your business, you may be able to deduct those costs. CookieDurationDescriptionakavpau_ppsdsessionThis cookie is provided by Paypal.

Accountedge Pro

Revenue accounts can include interest, sales or rental income. Again, equity accounts increase through credits and decrease through debits. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management.We considered cost, scalability, ease of use, reputation, and accounting features. Scalability was the next most important consideration because as a company grows, its accounting needs grow as well, and transferring financial information to new software can be tedious.

Swedish Bas Chart Of Accounts Layout

The good news is that the vast majority of your business expenses are deductible. Just be sure you’re tracking them properly in order to take advantage of them, and if you have any questions about what is and isn’t deductible, it’s always best to refer them to your accountant or CPA.If your trip combines business and personal travel, you must allocate the expenses between business and personal days. For example, suppose you fly to New York City for a five-day business conference and tack two extra days on the end of your trip for sightseeing. In that case, your transportation costs to and from New York are fully deductible. However, you can deduct hotel charges only for the days you’re attending the conference. The costs you can deduct include airfare, baggage charges, lodging expenses, car rentals, ridesharing service and taxi fares, public transportation, parking fees, and tolls. If you own or rent an office for your business, any expenses related to maintaining the office are deductible.Say you have a checking account, a savings account, and acertificate of deposit at the same bank. When you log in to your account online, you’ll typically go to an overview page that shows the balance in each account. Similarly, if you use an online program that helps you manage all your accounts in one place, like Mint orPersonal Capital, what you’re looking at is basically the same thing as a company’s COA. You can see all your assets and liabilities, all on one page.This field is concerned with the examination of a company’s systems and transactions to spot control weaknesses, fraud, waste, and mismanagement, and the reporting of these findings to management. The career track progresses from various internal auditor positions to the manager of internal audit. There are specialties available, such as the information systems auditor and the environmental auditor. This field uses a unique accounting framework to create and manage funds, from which cash is disbursed to pay for a number of expenditures related to the provision of services by a government entity. Government accounting requires such a different skill set that accountants tend to specialize within this area for their entire careers.The only difference between the two is that the Established plan has additional features like multi-currency, expense management, and project costing. All three plans offer Hubdoc, a bill and receipt capture solution. Nineteen accounting software companies were researched and compared before selecting our top five best suited for small businesses. When evaluating companies, we considered cost, ease of use, features, integrations, and scalability. There are many different types of accounting software available for small businesses, with varying capabilities and price tags.

Expense Accounts

These are the costs of creating your product or service, running your business, and generating sales. Reviewing financial accounts is a good habit that will encourage you to stay on top of your expenditures. Reconciling bank statements can be easily done using accounting software. If you find you’re having challenges, a business-only credit card is a top expense management best practice.

What is BRS in simple words?

For reconciling the balances as shown in the Cash Book and passbook a reconciliation statement is prepared known as Bank Reconciliation Statement or BRS. In other words, BRS is a statement that is prepared for reconciling the difference between balances as per the cash book’s bank column and passbook on a given date.This is unique to Wave, as the majority of accounting software does not charge a fee for ACH payment processing. Xero is the best in our review for micro-businesses that are looking for very simple accounting software. This software has a clean interface and also fully integrates with a third-party payroll service. Businesses can collect payment online from customers through Xero’s integration with Stripe and GoCardless. The main components of the income statement accounts include the revenue accounts and expense accounts. Liability accounts also follow the traditional balance sheet format by starting with the current liabilities, followed by long-term liabilities. The number system for each liability account can start from 2000 and use a sequence that is easy to follow and compare in different accounting periods.

Business Plan

Each asset account can be numbered in a sequence such as 1000, 1020, 1040, 1060, etc. The numbering follows the traditional format of the balance sheet by starting with the current assets, followed by the fixed assets. Companies often use the chart of accounts to organize their records by providing a complete list of all the accounts in the general ledger of the business.Current liabilities include accounts payable and other payables like income tax, payroll taxes, and sales tax, as well as accruals such as wages payable. These current liabilities are those debts that must be paid within one ear or within the normal operating cycle of the business.

Accounting Categories And Their Role

Plus you have the security of having adequate backup and a solid audit trail in place, should you ever be audited. In this article, we’ll explain what type of expenses are deductible as well as provide you with a list of the most commonly used business expense categories. Educating yourself about the common small business expense categories will make it much easier to determine what is and isn’t deductible at tax time. QuickBooks Self-Employed will total up all business transactions automatically. Intuit’s QuickBooks Online has been the most common accounting software used by small businesses and their bookkeeping and tax professionals.

Overview: What Counts As A Deductible Business Expense?

The cookie is used in context with transactions on the website.x-cdnThis cookie is set by PayPal. Regulation S-X, Regulation S-K and Proxy statement In the U.S. the Securities and Exchange Commission prescribes and requires numerous quarterly and annual financial statement disclosures. A large portion of the required disclosures are numeric and must be supported by the Chart of accounts. The charts of accounts can be picked from a standard chart of accounts, like the BAS in Sweden. In some countries, charts of accounts are defined by the accountant from a standard general layouts or as regulated by law. However, in most countries it is entirely up to each accountant to design the chart of accounts.Daniel is an expert in corporate finance and equity investing as well as podcast and video production. Another unique account is Accumulated Depreciation—a contra-account. Accumulated Depreciation is used to offset the Asset account for the item. Depreciation can be very complicated, so we recommend seeing your Accountant for help with the depreciation of Assets.

What Small Business Expenses Cant You Write Off?

FreshBooks is a great tool for budgeting out projects, sending estimates or proposals, and collecting customer payments. Founded in 2003 in Toronto, FreshBooks started as just an invoicing software. Over time, more features have been added and FreshBooks now has over 500 employees. Current liabilities are a company’s debts or obligations that are due to be paid to creditors within one year.