Content

- What Is Overhead?

- Categorizing Nonprofit Expenses

- Nonprofit Overhead Costs: Breaking The Vicious Cycle

- See Boardable First

- Nonprofit Career Board

- Performance Metric Five: Program Expenses Growth

- Find Your State Association Of Nonprofits

Also included are fundraising expenses, including salaries, professional consultants and special events. All supplies and materials in these administrative areas also count as overhead. Many foundation leaders now understand that overhead is part of the real, necessary costs of delivering quality programs. Funders large and small have shifted grant strategies to fund overhead. Number 15 on the list is California Police Youth Charities which reported spending 90.8% of its funds on overhead costs in 2012. The nonprofit spent 84.6% of its money on fundraising in the year, and 6.1% on management and general costs.The people and communities served by nonprofits don’t need low overhead, they need high performance. I agree that coming up with the fully allocated true cost of a program is a great way to approach fundraising and a recognition that it takes all types of costs (overhead / indirect / direct, whatever) to truly create an impact. Once properly understood, the organization’s “overhead” rate is actually 23%. The IRS does not require that nonprofits spend any specific portion of their income on each category. As to how many non-profit organizations achieve these aims, it’s hard to say. Guidestar’s Nonprofit Compensation Report offers some insights, in the sense that you can get a feel for the non profit pay scale of various well-known charitable organizations. That includes the salary data for top leadership positions such as the CEO and CFO.

What Is Overhead?

Choosing a fixed overhead rate that is low is often just arbitrary and not based on any real costs. The danger there is that squeezing your costs lower and lower can impact your mission in the long run. You might need to invest in training or infrastructure, which you can no longer do because you’ve set your rate way too low. They also believe that nonprofits with low overhead costs do a better job or are more effective. Donors think they know what it takes to financially run a nonprofit, but in reality, most of them are misinformed. By now, though, the myth that all nonprofit overhead is too high is an urban legend. Donors think they’re doing the right thing by attaching stipulations to grants or donations regarding overhead, but sometimes this just hurts the overall cause.

Categorizing Nonprofit Expenses

The BBB Wise Giving Alliance Standards for Charity Accountability were developed to assist donors in making sound giving decisions and to foster public confidence in charitable organizations. The 20 standards cover governance and oversight, measuring effectiveness, finances, fundraising, and informational materials.Instead, the campaign, which continues to build steam, advises donors to pay attention to other factors of a charity’s performance, such as transparency, governance, leadership and results. Historically, charities have been primarily judged on how much of their budget is spent on administrative over head as compared to their program expenses, and the Overhead Myth campaign has sought to change that. Friends of MS Charities makes the list at number 22 with a total overhead percentage of 83.9% in 2012. The nonprofit reported spending 68.1% of its funds on fundraising in the year, and 15.8% on management and general costs.The nonprofit’s goal is “to inform women faced with an unwanted pregnancy that there are choices.” Efrat first began with the goal to increase the Jewish birth rate in Israel. The Maryland-based nonprofit was founded in 1981 with the goal of finding more effective cancer treatments.In short, under-investment in the financial sturdiness of nonprofits. A charity must post a complete copy of its most current, independent audited financial statements on its public website. See the Transparency Benchmark section for more specific information. Helps you to judge the fundraising efficiency of a charity by comparing fundraising expenses with related contributions, not total revenue.

Nonprofit Overhead Costs: Breaking The Vicious Cycle

If a nonprofit spends most of its dollars on a luxurious office far away from the population they serve, it might raise a few eyebrows. However, if a nonprofit frequently reports absent employees because of a recurrent mold problem in their basement office, you’ve also got a problem. Learning to manage your nonprofit budget ensures that your overhead falls exactly where it should. Most nonprofit organizations actually underspend on overhead, but being aware of what it is and how you’re managing it is crucial to your continued success. Calculating overhead, like most things in the nonprofit world, is accompanied by a set of rules. Most nonprofits calculate overhead from information gathered from federal Form 990, submitted each year to the IRS. Form 990 categorizes a nonprofit’s expenses into three categories, which are Program Services, Management and General, and Fundraising.For example, a Cost to Raise $100 of $20 means that the charity spent $20 on fundraising for each $100 of cash donations it received. Cost to Raise $100 reflects how much it cost the charity to bring in each $100 of cash donations from the public in the year analyzed. The Florida-based nonprofit was founded by veterans with the goal of helping other veterans.

- The goal of the nonprofit is to enhance public safety and the public’s understanding of “law enforcement safety issues.”

- At Charity Navigator, we recognize that different types of organizations work differently.

- As a nonprofit director or board member, you never want donors to think their money is being wasted.

- Hartsook now use this method with numerous nonprofits througout the country with similar results.

- This nonprofit may well classify both their executive director’s and office manager’s time — 67% of their personnel costs — as “management and general.” Charity raters use this number and will declare this organization to have 67% overhead.

- Indeed, more people are realizing that costs may have nothing to do with how effective a nonprofit is.

- The Farmingdale, NY-based nonprofit was founded in 1991 with the goal of providing financial assistance to those affected by fire or disaster.

Among these charities, the median program expense percentage is lower than the median of all of the charities we rate. These charities serve as fundraising vehicles, and must as a result limit overhead spending. The median program expense percentage for community foundations is higher than the median for all of the charities we rate. One question I am often asked is “ how much should we be spending on operating expenses? Many nonprofits choose to minimize or even eliminate to the degree possible any expenses other than direct program expenses or “support to the cause.” Sometimes this can be achieved without a negative impact on the organization.This isn’t enough, but it’s an important victory for nonprofit advocates. It is also important for nonprofits to know the true costs for delivery of their services – and overhead is part of this cost. This way they can continually remind donors and government officials that impact does not come without a cost. In everyday conversation, nonprofit overhead is a fuzzy term meaning administrative costs such as accounting, insurance, and the salaries of administrators. People understandably don’t want nonprofits to have too many pencil-pushing bureaucrats. Nonprofits that are effective in convincing donors to pay what it takes to do the job, rather than focusing on overhead costs, can find success.

See Boardable First

By requiring charities to post a copy of their complete audited financial statements on their websites as a condition of meeting our transparency benchmark, CharityWatch hopes to encourage more charities to make their audits publicly available. Charities should visit our Charities FAQ for more information about which audit must be posted in cases where a charity or its parent organization, related organizations, or affiliates publish more than one audit.

Nonprofit Career Board

Unfortunately, though, the terms “Management & General” and “Fundraising” are often misinterpreted — sometimes intentionally but more often mistakenly. In a simplified example, imagine an organization with three staff that brings families together who have children with disabilities; their titles are executive director, office manager, and outreach manager. This nonprofit may well classify both their executive director’s and office manager’s time — 67% of their personnel costs — as “management and general.” Charity raters use this number and will declare this organization to have 67% overhead. When they truly unpack the full costs of delivering on mission, they may hesitate to share the information with you for fear of sending you into sticker shock. Give them the opportunity to reset their costs of doing business in the full-cost mindset without losing funding or being perceived as greedy or disingenuous. Provide cover for those nonprofits that are ready to reexamine cost. Publicly announce that your foundation seeks requests that articulate full costs.

What is overhead ratio?

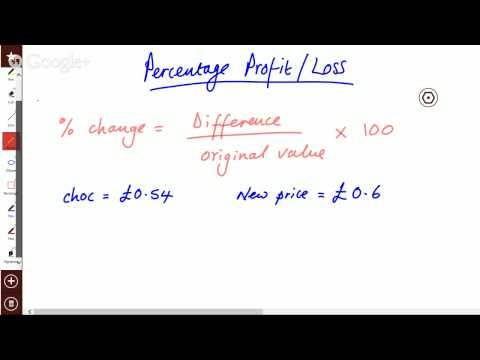

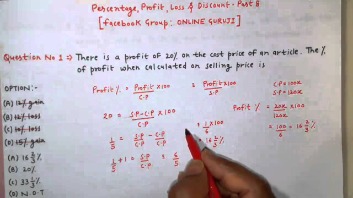

An overhead ratio is a measurement of the operating costs of doing business compared to the company’s income. A low overhead ratio indicates that a company is minimizing business expenses that are not directly related to production.Visit our Links page for a list of resources where copies of charity tax forms may be obtained. Because donations to 5014 organizations are not tax-deductible, such organizations often must spend more on fundraising than 5013 public charities to raise the same level of contributions.In fact, charity rating organizations grade nonprofits partly on how much they spend on overhead. For example, CharityWatch.com reports that it’s reasonable for most charities to spend up to 40% of their budget on operating expenses—in other words, at least 60% should go to programs, and 40% should go to everything else. However, charities that spend less than 40% get higher grades from CharityWatch, with those spending 25% or less on operating expenses receiving the highest “A” grades. Charity Navigator, which employs a sophisticated rating system, gives bonus points to nonprofits with lower operating expenses. The Better Business Bureau says that no more than 35% of a nonprofit’s budget should be spent on operating expenses. Overhead includes a nonprofit’s administrative expenses, which are not directly related to the organization’s programs or services. A nonprofit’s overhead includes the cost of personnel in accounting, management and human resources departments.As a nonprofit director or board member, you never want donors to think their money is being wasted. However, those organizations that shift the narrative away from overhead costs as a sole focus, and on to measures that matter will likely have a much smoother path going forward. Seeks to succinctly convey to donors a charity’s broad mission, and may truncate a charity’s reported mission in cases where it is too lengthy for the format of our report. For a complete description of a charity’s mission and programs, donors may visit the organization’s website or review its IRS Form 990. Please contact the charity directly to request a copy of its tax form, or visit our LINKS page for a list of sources where these may be obtained online. Under Generally Accepted Accounting Principles , an organization is required to issue consolidated audited financial statements that include its multiple, related entities if the reporting entity has sufficient control over the others.In cases where we rate only the larger entity of an organization with multiple, related groups, we make certain adjustments during our analysis so that a charity’s grade is not artificially inflated. Many charities present their fundraising efficiency to donors, using pie charts or other means, by comparing their total revenue to their fundraising expenses. This method often has the effect of making a charity appear to be a more efficient fundraiser than it actually is. Many of the revenues charities report, such as investment income, sales proceeds, program service revenue, etc., are not brought in as a result of fundraising.

Find Your State Association Of Nonprofits

Are single-entity organizations that publish one audit and one tax form. However, other organizations are more complex and publish combined or consolidated audited financial statements that may include a national office, local affiliates, and/or several related organizations. It is generally not enough to analyze and publish a rating based on only one entity of an organization that has multiple, related entities. This is because some charities use one entity primarily to raise funds and pay overhead costs, then grant funds to another, related entity whose activities include primarily programs.CEO Helen Marie Walker received 1.3% of the nonprofit’s funds in 2012. With 95.5% of its funds spent on overhead costs in 2011, Faith’s Hope Foundation is fifth on the list. A total of 94.3% of the nonprofit’s funds went to fundraising in the year, while 1.3% went to management and general costs. The Knoxville-based charity raises funds to provide “education, program services and primarily direct aid to heart patients,” according to Charity Navigator.Allow grantees to tell you what a reasonable indirect cost is for their organizations; don’t prescribe a set percentage. CharityWatch also analyzes a charity’s audited financial statements during our evaluations.The median working capital ratio among these charities is much, much greater than the median reported for among the rest of the charities rated by Charity Navigator. As with food banks, much of the expenses for these charities are in the form of donated food, goods, and supplies, and as a result they need only small amounts of working capital. The median working capital ratio for Development & Relief Services and Humanitarian Relief Supplies charities is lower than the median reported for all of the charities rated by Charity Navigator.