Content

- Why Withholding Makes Sense

- Whats The Difference Between Irs Payroll Tax Vs California Payroll Tax?

- Is Unemployment Taxed? Get Answers To 3 Key Unemployment Income Questions

- Federal Payroll Tax Administration

- Is Unemployment Taxable? Federal And State Tax Considerations

- $10,200 In Unemployment Benefits Won’t Be Taxed, Leading To Confusion Amid Tax

- No Matter How You File, Block Has Your Back

Deposit and return filing deadlines depend on the type of tax. The Employee Development Department is in charge of payroll taxes at the state level. Taxes for the State of California are administered by three separate agencies. The Franchise Tax Board administers the state’s personal income tax and corporate taxes. Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . CAA service not available at all locations.

Is unemployment taxed in California 2020?

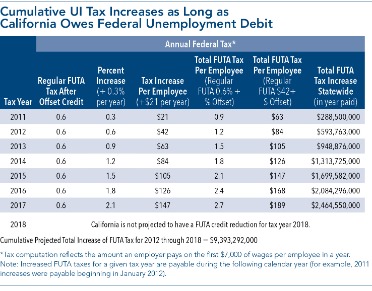

California. State Taxes on Unemployment Benefits: Californians do not have to pay state income taxes on unemployment benefits. … State Income Tax Range: Low: 1% (on up to $17,864 of taxable income for married joint filers and up to $8,932 for those filing individually).These are paid by the employee through wages withheld and through a tax on the employer . The EDD collects state unemployment insurance tax and an employee training tax from the employer as well as collecting disability insurance and state personal income tax from the employee. The disability insurance tax pays for Paid Family Leave. Fees apply if you have us file a corrected or amended return. Eligible individuals receiving unemployment benefits can receive additional unemployment compensation of $300 under the federal government’s CARES Act and American Rescue Plan.

Why Withholding Makes Sense

Maybe you put every penny of your unemployment money toward rent, groceries, utility bills and other necessities. Now you’re looking at a hefty tax bill, with nothing in your bank account to pay it off. Depending on how much unemployment you received in 2020, and how much money you earned overall, tax professionals say you could be in for an unpleasant surprise. Wolters Kluwer is a global provider of professional information, software solutions, and services for clinicians, nurses, accountants, lawyers, and tax, finance, audit, risk, compliance, and regulatory sectors. You must include benefits paid to you from regular union dues in your income. Different rules may apply if you contribute to a special union fund and those contributions are not deductible. In that case, only include as income any amount you get that is more than the contributions you made.

Whats The Difference Between Irs Payroll Tax Vs California Payroll Tax?

It might feel easy to rationalize taking the money now and increasing your deductions when you get back to work. But with these generous unemployment benefits, that mindset could be a substantial liability, he says. With the U.S. experiencing unemployment rates last year that have not been seen since the Great Depression, Congress had to act quickly to mitigate the effects.It looks like we’re having some trouble accessing your Credit Karma account. We’re working hard at getting everything back up and running, so check back soon to access your free credit scores, full credit report and more. Caroline Hart is a writer and producer at KTVU.These taxes were first enacted under the Social Security Act. Freed estimated that, since last week, the small group has heard from several hundred people asking for guidance on their tax returns. The move means that workers who received unemployment benefits last year have some breathing room to figure out what the tax law changes mean for them. Penalty resolution involves paying the full amount of payroll taxes owed plus the penalties levied by the taxing organizations. If you have been charged with evasion, of course, you will also be facing potential jail time.

Is Unemployment Taxed? Get Answers To 3 Key Unemployment Income Questions

If you do not choose to have tax withheld, you may have to make estimated tax payments during the year. We do not handle issues relating to unemployment benefits. Most of the calls we receive are not about one’s eligibility for benefits. They are from desperate people who cannot make it on these benefits alone and are collecting supplemental income under the table. Inevitably, the EDD finds out about these payments from 1099s and other information that are given to the IRS. For tax-rated employers, a percentage of unemployment insurance tax is paid on the first $7,000 in wages paid to every employee in a year. Employers are notified of how much they owe every December.

Federal Payroll Tax Administration

US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions.”I mean, it could be a tipping point. But there are people that need every single dime of that and more.” She said that she intimately understands how precarious finances can compromise one’s mental health.

- The exclusion may affect a taxpayer’s state tax liability.

- You can include your unemployment income in our tax calculator to get an estimate of your tax liability or potential refund.

- The reason the term “trust fund recovery” is used is because these are the amounts that are held “in trust” on behalf of the employee.

- There are limits on the total amount you can transfer and how often you can request transfers.

- Contact the Oregon DOR if you don’t agree with your adjustment or were expecting an adjustment and haven’t received a refund or notice from the state.

- But, the exclusion of some unemployment compensation from federal adjusted gross income for 2020 may qualify taxpayers for increased California tax credits.

Some taxes are withheld from your employee’s wages, some you must pay yourself. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund.

Is Unemployment Taxable? Federal And State Tax Considerations

Available only at participating H&R Block offices. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.If you are still worried about getting it right, do not worry. California offers in-person payroll tax seminars to walk you through the process, and you can find a current schedule here. Exactly how much you pay will depend on how long you have been an employer. For the first two to three years, you will pay 3.4 percent but this rate is subject to change, and will increase over time. You can also pay through a financial institution using an ACH credit payment or through a trusted third party such as an accountant or a payroll service. FICA requires returns to be filed quarterly using Form 941. The deadline is the last day of the first month after the quarter ends.She said that if there is “wiggle room” for workers to save money for taxes right now, since benefits are topped off with the $300 supplement, that would be wise. Benefits won’t be supplemented in April, given the timing of the most recent bill, she noted. Clarence Baldwin Jr., a substitute teacher in San Bernardino, said that he’s still working part-time, but needs unemployment funds to provide for him and his son. Uncertainty about his situation, and how his students are faring financially, looms large in his mind.For example, unemployment is taxed in Michigan, but in California unemployment benefits are exempt from state taxes. What if I receive another tax form after I’ve filed my return? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return.