Content

- Accounting Accrual Vs Cash Basis

- Why Accounting Skills Are Indispensable For Entrepreneurs

- Accounting Strategies For Growing A Business

- Take On Your Business’s Financial Responsibilities Yourself And Save Money By Mastering These Accounting Skills

- Track Your Assets, Liabilities, And Equity Balance Sheet

- Components Of An Organizational Annual Operating Budget

- File Your Income Taxes

You can choose between an Excel document, a Google sheet, Quickbooks, or another tool, depending on the complexity of your business transactions. You also need to choose if you want to do this yourself, outsource the work, or if you want to hire someone else. Entrepreneurs can use the balance sheet to help keep the business in check. While sales may be increasing exponentially, keeping an eye on the liabilities side of the balance sheet is important to the long-term success of the business. Even though investors care about growth potential, they also care about how much the company owns versus how much it owes. The balance sheet gives investors, and potential buyers, a solid understanding of where the company currently stands.Much the same thinking applies to the financial life of your business. While it is optimal to employ a CPA to help with taxes, payroll, and other financial matters, they also are expensive.

Why accounting is needed in business?

Why Is Accounting Important? Accounting plays a vital role in running a business because it helps you track income and expenditures, ensure statutory compliance, and provide investors, management, and government with quantitative financial information which can be used in making business decisions.Thus, you and other entrepreneurs might overlook things like accounting. In the midst of formulating your business plan you surely went over some numbers but might not have done a full accounting. If you have a business, you will want to create separate accounts for banking, credit cards, and similar needs. Keep these things separate to organize your accounting and protect yourself. You will want to start keeping records immediately after starting a business. Don’t wait, because you will regret it when you eventually need these records, and you are forced to find records and information that is no longer easy to get, Christenson said. Then you can consider hiring an accountant, either to manage all your accounting needs or maybe just to look at your records periodically to see if anything looks off.If she uses all of her cash assets to purchase the laptop, the accounting equation will record this as shown in Figure 9.8. To learn more, check out Maryville University’s online Bachelor of Science in Accounting degree program and see how your online degree can jumpstart your career. At Discover Accounting we try to give our readers all the information they need to start a successful career in the field of accounting. We have career guides, licensing guides, education guides and much more. After your business has been in operation for a while, you will be able to predict your numbers with greater and greater accuracy.

Accounting Accrual Vs Cash Basis

The laptop still costs $1,000, but the business has only $100 in cash assets. Shanti purchases the laptop with a credit card, and the clerk finalizes the sale. Figure 9.10 shows the impact of the sale on the accounting equation. When the cash is spent, reducing the assets column to zero, a new asset account for the computer is created to record the dollar amount paid for the laptop. Again, because Shanti doesn’t owe another party at the end of the transaction (because she didn’t make any additional contribution), the balance of the owner’s equity account remains the same. The equation shows that Shanti still owns 100 percent of the assets. Your income statement is an aggregate of all your profits and losses over a period of time.We offer self-paced programs on the HBS Online course platform. Without accurate predictions, it’s all too possible to grow either too fast or not fast enough—both of which can be detrimental to the success of your business. Academic SolutionsIntegrate HBS Online courses into your curriculum to support programs and create unique educational opportunities. Attend this free webinar and learn how to streamline processes, maximize efficiency, and increase profit.

What is entrepreneur essay?

Thus a simple definition of entrepreneurship is doing new things or doing things which are already being done in a new way. According to Dr. J.E. Stepenek, “Entrepreneurship” is the capacity to take risk; ability to organise and desire to diversify and make innovations in the enterprise.Entrepreneurs may need to provide banks, lenders or investors with a financial forecast relating to the new small business venture. This information is essential for obtaining outside financing for business startup costs. Entrepreneurs usually write a business plan, which includes an economic forecast, expected startup and monthly expenditures, and pro forma financial statements. This accounting information is heavily relied upon by lenders or investors to ensure the entrepreneur has an accurate and reliable picture of financial expectations. Doing this helps business owners find problems, fix them, and take advantage of legal loopholes that save money.As startup businesses evolve, your role as an accountant may need to evolve with it. Because of this, accountants with a strong small business background have a choice about how they enter the startup business world. With your accounting degree, you can seek employment at accounting firms that have a range of clients.

Why Accounting Skills Are Indispensable For Entrepreneurs

You also will have a hard time getting bank loans and investors, because they often require detailed financial information. With an immersive but fully online program, you may be drawn to the entrepreneurial opportunities within accounting itself. Bureau of Labor Statistics, 7% of accounting professionals are self-employed. Even those who don’t want to launch businesses of their own can use their abilities to enter the startup scene. Regardless of whether your startup investment came from bootstrapping tactics or venture capitalists, you can’t afford to blow your budget or rack up debts your business may not be capable of repaying. At the same time, you can’t afford to turn a blind eye to your sales and profits if you want your business to thrive.

Accounting Strategies For Growing A Business

Although many entrepreneurs may be fearful of dredging through endless stacks of financial documents, accounting often provides entrepreneurs with the clearest picture of their business’ success. Entrepreneurs must also keep copious amounts of records regarding the small business startup for tax and legal purposes. One of the key skills you’ll need as an entrepreneur is record keeping. You need to set protocols in place for storing every receipt, recording every transaction, and noting every time you bring in or ship out inventory. You might consider using tools such as a computer tablet where you can record notes on a text tool or numbers in a spreadsheet.Contemporary software packages and a strong set of business practices and protocols will ensure that your pride and joy grows and develops to suit your long-term vision. This is especially important when working with multiple invoices, purchase orders, vendors, and tax accounts. To develop accounting skills and competencies, consider earning an online Bachelor of Science in Accounting degree from UAB’s Collat School of Business.

Take On Your Business’s Financial Responsibilities Yourself And Save Money By Mastering These Accounting Skills

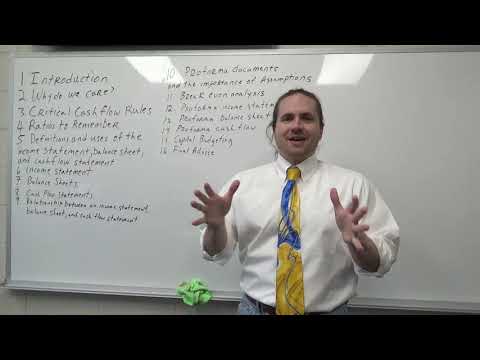

Learn essential accounting concepts and operating characteristics of accounting systems in this introductory course. Focus will be on both financial and managerial accounting with emphasis on the basics of financial statements, how to interpret these statements, and how to make good decisions based on them. Use accounting information to identify and analyze alternative decisions that will help you take the course of action yielding the greatest benefit to your company. This course is designed for a user of accounting information, not as an introduction to a professional accounting career. In both examples, Shanti reports the computer as an asset of the business that is valued at its $1,000 cost.

- I’m thinking about hiring business legal services for when I start my own retail company someday.

- In most circles, you’ll hear plenty of people recommendinggeneric skills like “communication” and “leadership,” which are certainly important.

- This is a very important tip that might seem like it’s common sense.

- In addition to helping you manage your business, a budget and forecast can help you get funding.

- But, as your business grows, these basic accounting functions take on a complexity of their own.

For accounting purposes, we want to be able to see what the business owns compared with what it owes . For example, if Shanti does not have sufficient cash to pay for the laptop, she may have the electronics store charge her credit card for the purchase. In that case, the credit card company pays the store, and Shanti’s business now owes the credit card company for the amount of purchase . As an accountant aiming to work with entrepreneurs, you may consider furthering your education with a bachelor’s in accounting degree. This educational pursuit will help you navigate the business world — whether you want to join an accounting firm, help a new startup, or launch your own startup business. While helping a small business prepare for financial success, you should also keep in mind what your future role with that company is and align it with yourcareer path goals.You may also find them helpful because they provide a snapshot of your business at any point in time. “It will give you a good sense for where your business is as a whole,” Christenson said. When keeping records, make sure to store your original receipts. If you get audited by the IRS, they will want to see receipts, not your Excel file. Christenson recommended that businesses keep their receipts until the statute of limitations on your tax return has expired, then it’s probably safe to toss them for tax purposes. With that, let’s dive into the seven things you must know about accounting when starting a business. We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf.

Track Your Assets, Liabilities, And Equity Balance Sheet

Starting a business often requires entrepreneurs to understand and complete a variety of business functions. An important business function when starting a small business is accounting.

More Posts On Accounting

Maybe I should give accounting school a try first before starting my own business. My parents and I want to start a business and we are looking for advice to know more about accounting services and be able to hire the right bookkeeper.

The Right Education Can Make A Difference

After all, a business without a bottom line is merely a great idea or an expensive hobby. When a business is launched — when an idea or passion becomes a commercially viable product or service — money inevitably changes hands. As an entrepreneur, whenever it passes through your hands, you’ll need to be accountable. In this easy-to-read ebook, we explain the basics, such as key accounting terms you need to know and accounting concepts you should understand. We also talk about when is the right time to work with an accountant, what an accountant can do for your business (and what they can’t), and tips on how to find and work with the right accountant.