Content

- Accounting Periods Say What?!

- Purpose And Perks Of Having 13 Accounting Periods

- How To Make Entries For Accrued Interest In Accounting

- Accounting Information And The Accounting Cycle

- How A Reversing Entry Works

- The Types Of Adjusting Entries

- Last Saturday Of The Month At Fiscal Year End

This practice makes it easy to trace an entry back to the original transaction. The account number appears in the Posting Reference column of the General Journal. Services from managing our Xero accounting software account to reconciling bank statements to doing our tax returns. A good accountant is an impeccable rule-follower — and there are a ton of rules in business finance. Many small business owners who attempt to do their own accounting find it to be tedious, complicated, and time-consuming. The end of the fiscal year would move one day earlier on the calendar each year until it would otherwise reach the date four days before the end of the month . At that point the first Saturday in the following month becomes the date closest to the end of August and it resets to that date and the fiscal year has 53 weeks instead of 52.Closing the expense accounts—transferring the balances in the expense accounts to a clearing account called Income Summary. Closing the revenue accounts —transferring the balances in the revenue accounts to a clearing account called Income Summary. The company may also provide Notes to the Financial Statements, which are disclosures regarding key details about the company’s operations that may not be evident from the financial statements. Information flows from the unadjusted trial balance to the trial balance then to the income statement. Items are entered into the general journal or the special journals via journal entries, also called journalizing. The accounting cycle is performed during the accounting period, to analyze, record, classify, summarize, and report financial information.

Accounting Periods Say What?!

Journal entries are prepared after examining the source document to see if a business transaction has taken place. If a business transaction has taken place, that is a transaction that causes a measurable change in the accounting equation then a journal entry is necessary. Since business transactions always generate documentation, it is the accountant or bookkeeper ‘s job to analyze the source document to determine whether a journal entry is necessary. Source documents are important because they are the ultimate proof of business transactions. Some examples of source documents include bills received from suppliers for goods or services received, bills sent to customers for goods sold or services performed, and cash register tapes. Each source document is analyzed to determine whether the event caused a measurable change in the accounting equation.Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage. This article and related content is provided as a general guidance for informational purposes only. Accordingly, Sage does not provide advice per the information included. This article and related content is not a substitute for the guidance of a lawyer , tax, or compliance professional. When in doubt, please consult your lawyer tax, or compliance professional for counsel.

- For example, a company with a June fiscal year would start its period on June 1 and end it on May 31 of the following year.

- Many business expenses are due monthly, like rent and utilities.

- The account number appears in the Posting Reference column of the General Journal.

- This is the process that businesses use to ensure it gets a positive review.

- Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more.

- If one account is debited for $100, then another account must be credited for the same amount.

Basically, there are 13 four-week periods instead of 12 monthly periods. This makes it easier for certain companies to compare financials during different periods. Technically, an accounting period only applies to the income statement and statement of cash flows, since the balance sheet reports information as of a specific date. Thus, if an entity reports on its results for January, the header of the income statement says “for the month ended January 31,” while the header of the balance sheet states “as of January 31.” Financial statements cover accounting periods, such as the income statement and balance sheet.Accounting practice is the process of recording the day-to-day financial activities of a business entity. Recording the balance of an account incorrectly in the trial balance. Explain the correct procedure for making a journal entry in the General or Special Journal. Source documents are important because they are the ultimate proof a business transaction has occurred. As we walk through the steps of the accounting cycle, consider the following example. After a number of years as a successful CPA at a national firm, you decide to quit the rat race and pursue your true love — yoga. You decide that Atlanta’s Virginia-Highland neighborhood would be the perfect place to open an Ashtanga Yoga studio.

Purpose And Perks Of Having 13 Accounting Periods

The trial balance is a part of the double-entry bookkeeping system and uses the classic ‘T’ account format for presenting values. A trial balance only checks the sum of debits against the sum of credits. If debits do not equal credits then the accountant or bookkeeper must determine why. You can also think of an accounting period as the amount of time it takes to complete oneaccounting cycle.

How long do you have to pay taxes 2021?

The tax deadline in 2021 is May 17. If you need to make an estimated tax payment for the first quarter, that payment was due on April 15, though. What if I can’t get my taxes done by the filing deadline? If you request a tax extension by May 17, you can have until October 15 to file your taxes.The permanent balance sheet accounts will appear on the post-closing trial balance with their balances. When the post-closing trial balance is run, the zero balance temporary accounts will not appear. However, all the other accounts having non-negative balances are listed, including the retained earnings account. As with the trial balance, the purpose of the post-closing trial balance is to ensure that debits equal credits. An adjusting entry is a journal entry made at the end of an accounting period that allocates income and expenditure to the appropriate years. Adjusting entries are generally made in relation to prepaid expenses, prepayments, accruals, estimates and inventory.

How To Make Entries For Accrued Interest In Accounting

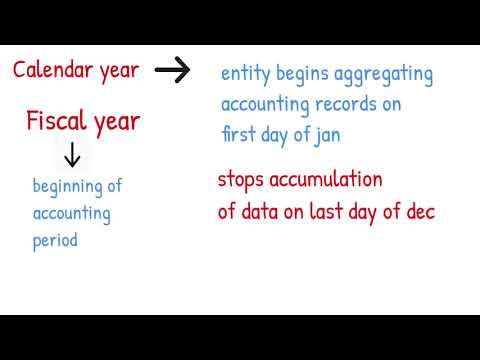

This indicates the accounting period is the month , although the entity may also wish to aggregate accounting data by quarter , half , and an entire calendar year. An accounting period is an established range of time during which accounting functions are performed, aggregated, and analyzed including a calendar year or fiscal year. The accounting period is useful in investing because potential shareholders analyze a company’s performance through its financial statements that are based on a fixed accounting period. The Income Summary account is a clearing account only used at the end of an accounting period to summarize revenues and expenses for the period. After transferring all revenue and expense account balances to Income Summary, the balance in the Income Summary account represents the net income or net loss for the period.

Accounting Information And The Accounting Cycle

The purpose of setting this standard is to give a framework for financial statements. Shareholders and investors can analyse the company’s performance from one accounting period to the next. An accounting period, in bookkeeping, is the period with reference to which management accounts and financial statements are prepared. The accounting period can be considered as the time taken to complete an accounting cycle of the business. Since the accounting cycle records transactions over a period of time and reports them in the form of financials, one accounting cycle equals one accounting period.For example, a business might look at an accounting time period for the current month, but also aggregate data for the quarter and fiscal year. In some of the ERP tools there are more than 12 accounting periods in a financial year. Older systems sometimes called these periods “Month 0” and “Month 13”. If a set of financial statements cover the results of an entire year, then the accounting period is one year. If the accounting period is for a twelve month period ending on a date other than December 31, then the accounting period is called a fiscal year, as opposed to a calendar year.

How A Reversing Entry Works

However, the financial statements for the monthly accounting periods are likely to be used only by the companies’ managements. An accounting period is the span of time covered by a set of financial statements. This period defines the time range over which business transactions are accumulated into financial statements. It is needed by investors so that they can compare the results of successive time periods. For internal financial reporting, an accounting period is generally considered to be one month.A post-closing trial balance checks the accuracy of the closing process. Since accountants and bookkeepers often need to trace the origin of a ledger entry, they use cross-indexing. In cross-indexing a notation is made for each entry that indicates which general or special journal account the general ledger entry came from.For example, one entity may follow the calendar year, January to December, while another may follow April to March as the accounting period. In management accounting the accounting period varies widely and is determined by management.

The Types Of Adjusting Entries

Businesses who wish to display consistency and stability in their growth over the long term can verify this with a consistent accounting period. Calendar year in which accountants perform functions such as gathering and aggregating data and creating financial statements. The financial statements made during these periods are very important for attracting potential investors or procuring loans from banks. The fiscal year refers to an annual period that does not end on December 31. The International Financial Reporting Standards allows 52 weeks as an accounting period.Along with the expense, any resulting revenue that occurred as a direct result of the expense should also be reported in the same period. For example, you would enter the cost of goods sold in the same accounting period as the revenue received from the sale of these goods. An accounting period is used for recording and analysis purposes. It’s an established timeframe during which accounting functions are measured.

Accounting Cycle Fundamentals

While the resulting income statement will only represent the February accounting period, the month of February will also be represented on the quarterly financial statements for Q1. The accounting requirement that each transaction be recorded by an entry that has equal debits and credits is called double-entry procedure. This double-entry procedure keeps the accounting equation in balance. For each business transaction recorded, the total dollar amount of debits must equal the total dollar amount of credits. If one account is debited for $100, then another account must be credited for the same amount. With 13 accounting periods, each accounting cycle is typically four weeks long instead of 12 calendar months.This is used to create financial statements at the close of the accounting period. Yet another variation on the accounting period is when a business has just been started, so that its first accounting period may only span a few days. For example, if a business begins on January 17, its first monthly accounting period will only cover the period from January 17 to January 31.Using this concept, the business’ ongoing and complex undertakings are divided into short time periods and reported in monthly, quarterly and annual financial statements. For each time period, the business prepares and publishes financial statements. The time period of the financial statement is shown in its heading.However, the start and end dates are flexible; for example, a business’s fiscal year could start on July 1st and conclude on June 30th. The IRS allows businesses to choose which year to use, but the choice is hard to reverse. Switching from calendar to fiscal or vice versa would require special permission given only if certain circumstances are met. Internally, the accounting period is considered to be a month or a quarter while externally it is for a period of twelve months.