Content

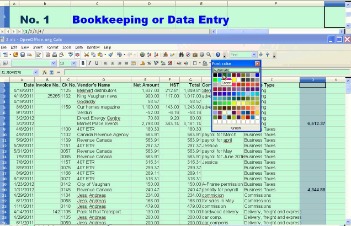

- The Importance Of Accounting For Small Businesses

- Running Your Small Business Just Got Easier

- Compare Specsthe Best Small Business Accounting Software For 2021

- What Is Small Business Accounting?

- More About Xero

- How To Do Accounting For A Small Business

- How Does Accounting Software Work?

- Small Business Accounting 101: How To Set Up And Manage Your Books

GAAP isn’t a law, but it does explain how to measure and present a company’s finances. Start your free 14-day trial of Shopify—no credit card required. In case of an audit, a CPA is the only individual who can legally prepare an audited financial statement. Improving your store’s gross margin is the first step toward earning more income overall. In order to calculate gross margin, you need to know the costs incurred to produce your product. To understand this better, let’s quickly define both cost of goods sold and gross margin. Selling to international customers can be easier than domestic sales.

The Importance Of Accounting For Small Businesses

A certified public accountant or bookkeeper can help you decide which method is best for your business. Every business has to choose between the cash or accrual accounting method, and once you make that choice, things tend to feel a bit clearer.An accounting clerk must have at least a high school diploma and on-the-job training. A CPA must have an accounting degree and additional certifications. A recognized and reliable source where you can look for an accountant is the American Institute of Certified Public Accountants , which has a license verification directory of CPAs. Chartered accountants tend to do commercial work within corporations, rather than doing public practice work for other entities. You can also check out the Accounting & Financial Women’s Alliance if you’d prefer to work with a female accountant. Once you know what you want from your accountant, you can look for candidates. Joshua Dubrow, of the New York State Society of CPAs’ Small Business Outreach Committee, said that many people’s first instinct when looking for an accountant is to turn to the internet.This software has a clean interface and also fully integrates with a third-party payroll service. Businesses can collect payment online from customers through Xero’s integration with Stripe and GoCardless.There’s always a Settings link that takes you to screens where you can specify preferences for the entire site. These include your setup chores and settings you may need to modify at times, such as restricting additional users to specific areas. There are other reports, though, that aren’t so easy to understand. These are considered standard financial reports and they’re the kind of documents you’ll need if you ever want to get a loan from a bank or attract investors.

Running Your Small Business Just Got Easier

You can also browse the Shopify App store for an accounting software that will seamlessly integrate with your ecommerce store. When you first start out you may opt to use a simple spreadsheet to manage your books, but as you grow you’ll want to consider more advanced methods like QuickBooks or Bench. As you keep growing, continually reassess the amount of time you’re spending on your books and how much that time is costing your business. The bookkeeper manages the day-to-day records, regularly reconciling accounts, categorizing expenses, and managing accounts receivable/accounts payable.But he warned against just picking someone you find on Google or an online directory. “Maybe it’s not as complex as a small business that has 10 to 15 employees, but if someone is self-employed, there may be specific advantages and expenses you may be able to take advantage of.” Here are some questions to ask and places to look when choosing a good accountant for your small business. Put together the financial reports you need to get loans and investment.Opening a business bank account is a simple way to keep your business and personal finances separate. Without this separation, it can be difficult to see an overview of your company’s cash flow, figure out where you may be gaining or losing money, and where you can cut costs .

Compare Specsthe Best Small Business Accounting Software For 2021

These statements focus exclusively on liquid assets like cash and cash equivalents — investments that individuals can readily turn into cash. Like revenue, expenses include costs accrued through primary and secondary business activities.Cloud-based accounting software is based in the cloud rather than installed on your desktop or manually maintained in spreadsheets. The software for cloud accounting is hosted on a remote server instead of a server on your business’ premises.

What Is Small Business Accounting?

Thankfully, your receipts also provide a paper trail of your business activities while away. A trial balance is prepared to test if the total debits equal total credits. The accounts are extracted from the ledger and arranged in a report. The balances of the debit and credit columns should be equal. There are many third-party app integrations available, such as Shopify, Gusto, Stripe, G Suite, and more. A unique feature of FreshBooks is that invoices can be highly stylized and customized for a professional look and feel. FreshBooks is a great tool for budgeting out projects, sending estimates or proposals, and collecting customer payments.

Is QuickBooks user friendly?

QuickBooks is one of the most powerful and widely used software solutions for accountants and small businesses. This software is user-friendly and fits the needs of many small business.An accountant who offers audit insurance means they won’t charge any extra for the considerable amount of work they’ll have to carry out during the audit process. However, if you get an accountant to take care of time-consuming tasks like taxes, it’s quite likely they will cost less per hour than you would pay yourself. You’ll not only have extra time to free you up to generate revenue, but you’ll have peace of mind that an expert is taking care of the details. Tech-savvy business owners or those familiar with accounting principles typically use accounting software. Digital bookkeeping offers a much quicker method than manual calculations. Business accounting is the process of gathering and analyzing financial information on business activity, recording transactions, and producing financial statements. Once you have completed an invoice, for example, you have several options.A paid Accounting subscription is required for continued use of your Accounting online account. Key accounting best practices for small businesses include keeping businesses’ finances separate from personal finances, maintaining accurate records, and tracking income and expenses. Small businesses may also want to consider hiring professional accountants or automating their finances with accounting software. Create a payroll file sorted by payroll date and a bank statement file sorted by month. Many accounting software systems let you scan paper receipts and avoid physical files altogether.

More About Xero

This is a necessary chore that helps small business owners track and manage their money effectively – especially during the early stages. Besides keeping you cognizant about your business’ past and present performance, small business accounting also helps in generating invoices and completing payroll. The first plan is $20 per month plus $6 per employee or contractor. In this plan, Wave will process payroll and prepare payroll tax calculations, but the user is responsible for manually completing payroll tax forms and submitting tax payments. The second plan is $35 per month plus $6 per employee or contractor. In this plan, payroll is full-service, which means that all tax filings and payments are completely managed by Wave.You may terminate the plan at any time prior to your renewal date and not be charged for the renewal. Discounted subscription rate is only for the first six months after which the monthly subscription rate will renew at the then-current rate. A valid credit card is required to activate your Accounting subscription.

- Get the business plan template delivered right to your inbox.

- Operating revenue makes up a business’s primary activities, like selling products.

- This accounting software is popular in New Zealand, Australia, and the United Kingdom.

- You can set your own working hours, craft your business strategy, regulate your workload and determine your own finances.

- So, small business accounting sites tell you about them, dividing them into expense types and comparing them with your income using totals and colorful charts.

You can save it as a draft or a final version and either print it or email it. You can create a PDF version of the invoice, copy it, record a payment on it, and set it up to recur on a regular schedule. One of the great things about using a small business accounting website is that it reduces repetitive data entry. Once you fill in the blanks to create a customer record, for example, you never have to look up that ZIP code again.

How To Do Accounting For A Small Business

The more robust plans allow businesses to track inventory, prepare more customized financial reports, run payroll, and choose from more invoicing options. Wave is a web-based accounting solution built for small businesses. With its bank reconciliation feature, you can link your bank accounts, PayPal accounts, and other data sources to see real-time business transactions. You can also generate reports such as accounts receivable, balance sheets, sales tax reports, and accounts payable. We looked at nineteen accounting software companies with specialized products for small businesses before choosing our top five software options. We considered cost, scalability, ease of use, reputation, and accounting features. Scalability was the next most important consideration because as a company grows, its accounting needs grow as well, and transferring financial information to new software can be tedious.

How Does Accounting Software Work?

You have plenty of financial statements to review every week, month, quarter, and so on, but your daily business accounting responsibilities consist of one main task. Assets are anything your company owns that has value, such as bank accounts, accounts receivable, inventory, furniture, equipment, and real estate. While you’re thinking about your money, you might also like to consider our reviews ofonline payroll servicesandtax software. The five services we’ve reviewed offer some combination of the above features and, for the most part, are less expensive than full-featured small business accounting websites .Contact us for a copy of the fund prospectus and recent performance data. Past performance is not necessarily indicative of future results. Pilot also offers a special $200 monthly discount for pre-revenue companies during their first year, bringing the cost to $400 per month for qualifying companies.

Compile A Chart Of Accounts

If vendors offer discounts for early payment, you may want to take advantage. Cash basis accounting is an accounting method in which businesses recognize a sale when a payment is received.The only difference between the two is that the Established plan has additional features like multi-currency, expense management, and project costing. All three plans offer Hubdoc, a bill and receipt capture solution. For businesses looking for a payroll solution, QuickBooks Payroll fully integrates with QuickBooks Online. Intuit’s QuickBooks Online has been the most common accounting software used by small businesses and their bookkeeping and tax professionals. The software is cloud-based and can be accessed through a web browser or through the mobile app. Look for an accountant who has a good understanding of tax laws, accounting software and business management. When interviewing an accountant, pay attention to their communication skills and how they explain information to you.