March 1, 2022 by Dick RiceAll three of the deductions are considered contra accounts, which means that they have a natural debit balance ; they are designed to offset the sales account. But they’re not the only sales metrics you should analyze and monitor regularly. You... Read more

February 28, 2022 by Dick RiceIt's much simpler to stick to expense so you only have to make one entry. In casual conversation, raw materials and supplies for your company can mean the same thing.But things can get tricky when dealing with office supplies, office expenses,. Read more

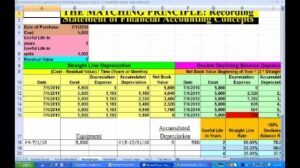

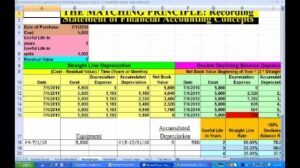

February 28, 2022 by Dick RiceFixed assets refers to the assets, whose benefit is enjoyed for more than one accounting period. Fixed assets can be tangible fixed assets or intangible fixed assets. As per matching concept, the portion of asset employed for creating revenue, needs ... Read more

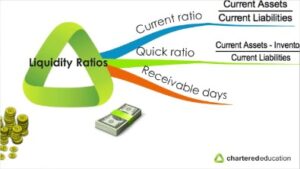

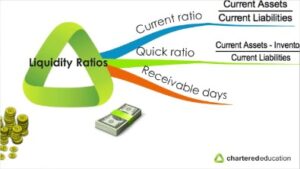

February 28, 2022 by Dick RiceThe ratio is an indication of a firm’s market liquidity and ability to meet creditor’s demands. In many cases, a creditor would consider a high current ratio to be better than a low current ratio, because a high current ratio indicates. Read more

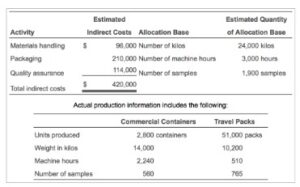

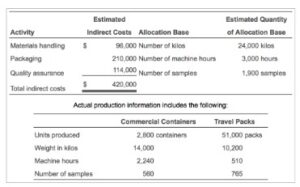

February 28, 2022 by Dick RiceStandard Costs — To assist in monitoring productive efficiency and cost control, managerial accountants may develop standards. These standards represent benchmarks against which actual productive activity is compared. Importantly, standards can be de... Read more

February 25, 2022 by Dick RiceHowever, there are situations when the accumulated depreciation account is debited or eliminated. For example, let’s say an asset has been used for 5 years and has an accumulated depreciation of $100,000 in total. A lot of people confusedepreci... Read more

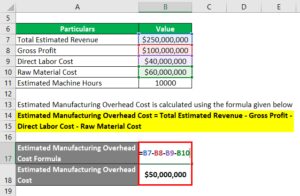

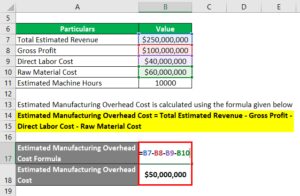

February 25, 2022 by Dick RiceIf that is the case, simply substitute your per-unit numbers in the billable hours equation. All of this tracking should be relatively easy to do with proper accounting software. But exactly how you categorize overhead costs will differ from business... Read more

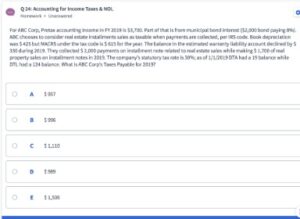

February 25, 2022 by Dick RiceIf a return with NOL carryovers has not yet been filed, go to theLOSSscreen and uncheck the boxProcess NOL carryforward using "taxable income without NOL carryforward" figure. Under a long-standing provision, IRC §172, a corporation can elect to waiv... Read more

February 25, 2022 by Dick RiceYou can calculate your available credit by subtracting your current account balance from your total credit limit and factoring in any outstanding charges that are not yet visible on your balance. There are situations when the bank account balance is ... Read more

February 25, 2022 by Dick RiceThis assumption of a causal relationship is increasingly less realistic as production processes become more complex. The predetermined overhead rate is set at the beginning of the year and is calculated as the estimated overhead costs for the year di... Read more