February 17, 2022 by Dick RiceGenerated by expenses involved in the earning of the accounting period’s revenues. An allocation of costs may be required where multiple assets are acquired in a single transaction. Purchase price allocation may be required where assets are acq... Read more

February 17, 2022 by Dick RiceIf our expectation is one thing and result output is other thing then that kind of error we said it as “Logical errors”. Let suppose if we want sum of the 2 numbers but given output is the multiplication of 2. Read more

February 16, 2022 by Dick RiceEssentially, the Form 990 is the IRS’s method of evaluation to make sure your nonprofit is financially honest and legitimate. However, that paperwork, number crunching, and other tedious tasks come with the territory of running an effective non... Read more

February 16, 2022 by Dick RiceMost small business tax deductions are more complicated than this brief overview describes—it is the U.S. Tax Code, after all—but now you have a good introduction to the basics. Examples of tax-deductible startup costs include market research and tra... Read more

February 16, 2022 by Dick RiceBasic economics suggests that as the price of a good goes up, the quantity demand for that good falls . Therefore, a higher interest rate would, all things equal, cause businesses to forego certain investments because it would raise the cost. Read more

February 15, 2022 by Dick RiceA certified public accountant or bookkeeper can help you decide which method is best for your business. Every business has to choose between the cash or accrual accounting method, and once you make that choice, things tend to feel a bit. Read more

February 15, 2022 by Dick RiceCompanies that deliver goods and services and receive payment on different dates may also find that the single-entry system doesn’t suit their needs. The double-entry system is better at matching expenses related to producing a good or service ... Read more

February 15, 2022 by Dick RiceTo summarize, Liquids Inc. has a comfortable liquidity position, but it has a dangerously high degree of leverage. As the quick ratio falls between the current ratio and the cash ratio, the “ideal” result also falls between those two rati... Read more

February 15, 2022 by Dick RiceHe is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. The Principle of Continuity states that asset valuations are based on the assumption the bu... Read more

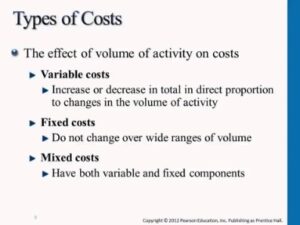

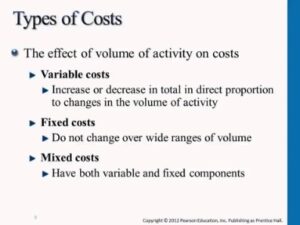

February 15, 2022 by Dick RiceIt looks at a company’s fixed and variable costs and how they affect a business and how these costs can be better managed, according to Accounting Tools. This means that whether an accountant is writing an invoice for your business, testifying. Read more