January 10, 2022 by Dick RiceBy collecting these advanced payments, your business will find it easier to keep a positive cash flow and stay afloat during hard times. Unearned revenue represents a business liability that goes into the current liability section of the business' ba... Read more

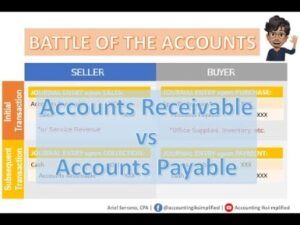

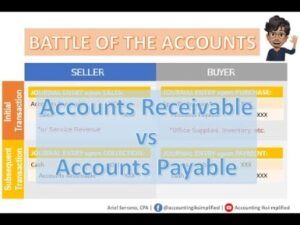

January 10, 2022 by Dick RiceThis above entry decreases your accounts payable balance by the amount of the bill, while also decreasing your bank account balance. Journal entry to add the office supplies bill to your accounts payable account.Accounts receivables are created becau... Read more

January 10, 2022 by Dick RiceIf you are unable to submit the request by fax, mail your request to the address shown on the IRS letter. We can ordinarily grant you a one-time automatic 30-day extension. We will contact you if we are unable to grant. Read more

January 6, 2022 by Dick RiceUnder the installment method, the seller defers gain on the sale, recognizing gain in each year that a portion of the purchase price is received. This allows the tax liability to be spread over several years . An installment sale cannot. Read more

January 6, 2022 by Dick RiceA separate subaccount to this account shall be maintained to record changes in the valuation of marketable equity securities included in noncurrent assets. Such changes shall be reflected in this subaccount to the extent the balance in this subaccoun... Read more

January 6, 2022 by Dick Rice4) Actual amount of discount varies based on the service fees charged. I should therefore like to take this opportunity to ask the Commission to present an annual report on the actual amount of State aid granted by each Member State.. Read more

January 6, 2022 by Dick RiceLastly, there is the benefit of having final, actual accounting data available to the finance group using planning software for analysis against an approved budget and periodic re-forecasts. The quicker this data is available for analysis, the quicke... Read more

January 6, 2022 by Dick RiceFor example, if your excess purchase price is $400,000 and your fair value adjustment is $100,000, your goodwill amount would be $300,000. If making a purchase offer for a business, this Goodwill amount could be added to the fair market value. Read more

January 6, 2022 by Dick RiceRetained earnings count as taxable income, even though you don't touch the money. Suppose you belong to a two-person partnership and this year's earnings are $60,000.... Read more

December 31, 2021 by Dick RiceThis practice makes it easy to trace an entry back to the original transaction. The account number appears in the Posting Reference column of the General Journal. Services from managing our Xero accounting software account to reconciling bank stateme... Read more