December 27, 2021 by Dick RiceFeaturing the most up-to-date and critical information delivered in an easy-to-find format. You will not receive KPMG subscription messages until you agree to the new policy. Since the last time you logged in our privacy statement has been updated. W... Read more

December 24, 2021 by Dick RiceFor example, the fixed assets account would have its own ledger account with only transaction involving fixed assets. One is to teach accounting, since it presents a clear representation of the flow of transactions through the accounts in which trans... Read more

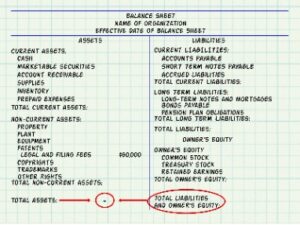

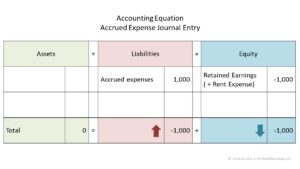

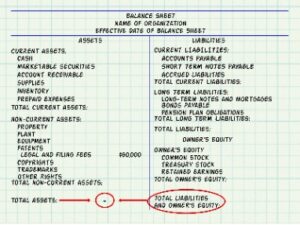

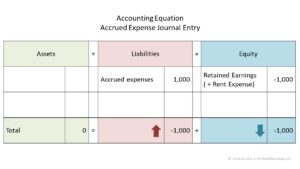

December 24, 2021 by Dick RiceThese are the financial obligations a company owes to outside parties. Cash, the most fundamental of current assets, also includes non-restricted bank accounts and checks. Cash equivalents are very safe assets that can be readily converted into cash;... Read more

December 24, 2021 by Dick RiceUse the bank deposit feature to combine transactions within your undeposited funds account. In the video above, we used a QuickBooks Online sandbox account to recreate common transactions that would use undeposited funds. In this guide, we will walk ... Read more

December 23, 2021 by Dick RiceAccountants, or CPA (Certified Public Accountant’s) will complete your end of year financial statements and tax reports which get submitted to the IRS. Your accountant uses your recorded transactions to complete these reports and statements. Th... Read more

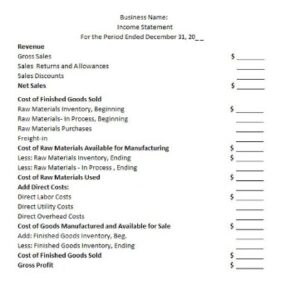

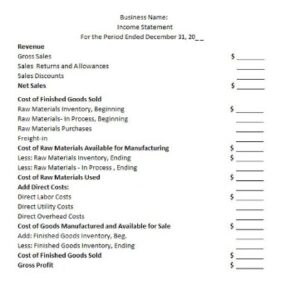

December 23, 2021 by Dick RiceIt is usually known as Trading Account as well where Direct Incomes and Expenses are mentioned. All the revenues are altogether combined under one main head, i.e., income listing and all the expenditures are put together under Expenses head. This is. Read more

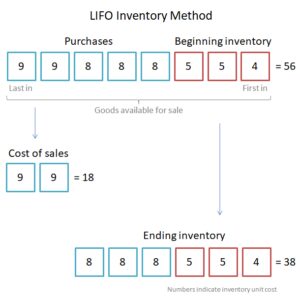

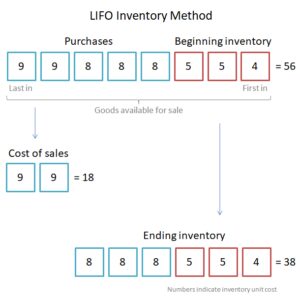

December 23, 2021 by Dick RiceThe gross profit margin of $75,000 with LIFO is lower than the $78,000 when using FIFO. This means the company reports lower profits and pays less taxes. With FIFO, the oldest units at $8 were sold, leaving the newest units purchased. Read more

December 23, 2021 by Dick RiceAnd, credit your Sales Tax Payable account the amount of the sales tax collected. Record both your sales revenue of $5,000 and your sales tax liability of $250 in your accounting books. DateAccountNotesDebitCreditX/XX/XXXXCashCollected sales taxXSale... Read more

December 23, 2021 by Dick RiceIf it is 60 days overdue, you might charge them a $100 late fee. After 90 days, you might charge them a late fee of $150 and send the information to a collection agency, a company that will contact the client. Read more

December 22, 2021 by Dick RiceYou can also check your state's guidelines to verify they follow the legal minimum. While most employers offer an overtime rate of time and a half, others offer double time or other pay. Your employer may have to follow certain additional. Read more