Content

- Save Over $10 Dollars An Invoice And $5 A Payment

- Ap Automation That Works With Your Accounting System

- What Are Examples Of Accounts Payable Software?

- Additional Services

- Quickbooks Online

- Ap Automation Faqs

- Save Yourself Time And Stress Were Here To Help You Find The Right Accounts Payable Software Solution For Your Work

- Accounts Payable Software Buyers Guide

- Online Accounts Payable Automation Solutions

Accounts payable, 3-way matching, automated reporting, and analytics – all in one app. Resolve helps B2B companies automate and manage the extension of credit to customers.

Save Over $10 Dollars An Invoice And $5 A Payment

You can also tailor your solution to handle your company’s unique AP workflows and policies. More Control Better visibility into cashflow with customized workflows and approval processes, with special permissions for users by role. Accounts payable and accounts receivable departments were required to quickly migrate to home working environments, in many cases taking their printers and payments processing equipment with them. Other finance professionals continued to work in the office as part of a skeleton crew. Some solutions providers require AP personnel to manually scan their own mailed paper invoices into the AP system for routing. Whereas, other software providers will handle the scanning of mailed invoices for the AP department. Every other department in the company eliminated paper-based processes a long time ago.

Ap Automation That Works With Your Accounting System

Plate IQ is another stand-alone Accounts Payable automation software that helps companies receive, approve, and process transactions more efficiently. Plate IQ is recognized for managing the entire AP life cycle.Keep in mind that most businesses are likely on the medium-low side of the spectrum, with an average cost-per-invoice somewhere between $8 – $20. Whether you’re currently working in accounts payable or just curious about the process, we hope that you found this explanation to be informative. Our onboarding team handles vendor enrollment, so your finance department can focus on more important things. Virtual Cards Virtual cards for AP allow finance departments to turn AP spend into profit via monthly rebates on spend & no transaction fees, earn over 1% cashback.Like its competitor, QuickBooks Online, Xero integrates with Bill.com, an accounts payable add-on lacking some payment features, particularly those needed by global businesses with cross-border transactions. Tipalti provides the world’s only end-to-end payables automation solution, eliminating 80% of the workload spent managing the entire global supplier payment operations. Businesses with an automated accounts payable process save on paper, computing resources, and vendor fees from lost invoices and human error. Furthermore, IT staff and accountants save time when they no longer have to pull data together from fragmented sources. Unleash your team’s efficiency with AvidXchange’s suite of accounts payable solutions and say goodbye to filing cabinets and lost invoices. AP Invoice Automation is the process of converting paper invoices into electronic invoices , automatically entering them into a digital workflow and approval process.

Will accounts payable be automated?

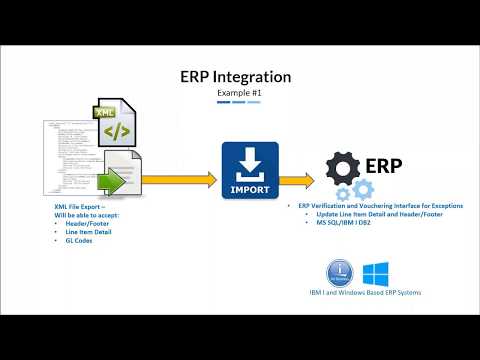

The future of accounts payable is actually happening right now. Firms that embrace AP automation are not only maximizing their efficiency, reducing cost per invoice, and enhancing their vendor relationships; they’re changing how AP is viewed at their organizations.Microsoft Dynamics ERP /CRM software includes accounts payable software solutions for a wide range of industries. Fully integrated app offers up bank synchronization, automated invoices, recurring billing management, reconciliations, and more.

What Are Examples Of Accounts Payable Software?

Plate IQ also helps customers maximize benefits and spot untapped savings. Whether this is in the form of 1% cash back on paid bills or gathering granular data from invoices and vendors, Plate IQ prioritizes cash savings whenever possible. If you’re looking for a stand-alone AP automation tool, MineralTree is one option to consider. Unlike other platforms, MineralTree focuses solely on the Accounts Payable process.To ensure that you choose the right software, consider how it will be configured to support your current workflows. Yooz is a cloud-based service that automates the accounts payable process. It is designed for mid market companies with revenues between $30 million to $500 million and about 100 invoices per month. According to PYMNTS.com, manual and paper-based invoice processing costs businesses an average of $150B annually in the US alone and takes up an average of 19 hours a week. Imagine how much more productive an AP department could be if manual invoice processing was eliminated from daily operations. Spendesk is a different kind of software that offers finance teams ultimate control and oversight into company spending, which includes invoices, credit cards, and any other form of payment. Spendesk’s accounting automation tools are helpful for reducing the time spent at the end of each month on reconciliation and bill pay.We accelerate business growth with the only modern ERP suite and the #1 professional services automation , enabling real-time insights and intelligent decision-making. Learn more about how to see your customers in full color with Salesforce and FinancialForce. Simply migrating away from paper to faster and more secure ePayments immediately reduces the financial impact of paying suppliers.Klippa¿s software helps you to automatically process purchase order invoices. With Klippa you get a clear overview of the status of invoices, you will notice fewer mistakes such a paying the same invoice twice and you are never late with paying approved invoices again.

Additional Services

To meet these needs, FinancialForce works with a thriving ecosystem of partners that complement our solutions. Grow your company alongside the only modern ERP suite and the #1 professional services automation . Whether you deal in time and materials (T&M), subscription-based contracts, fixed-fee services, or a blend of these, you’re free to develop pricing and billing models tailored to your customers’ needs. If your organization is paying the majority of its suppliers via paper checks, we can help. Examples of customized workflows could be a different routing tree for large invoice amounts or flagging an invoice if the vendor ID or email address is not recognized. A more elaborate version of customized workflows could be sending separate approval requests to members of the AP team for individual line items. It’s worth noting that invoice automation eliminates over 85% of the items outlined above.

Quickbooks Online

Billy the Bot checks from the time an invoice is uploaded, to when it’s registered, and even when communicating with integrated systems. When there is a duplicate or potential duplicate invoice, Stampli will present a warning message at the top of the invoice.

- It also helps you stay secure thanks to features such as payment fraud detection and payment risk management.

- Percentage of early payment discounts versus the percentage of discounts offered.

- Get your suppliers paid faster with flexible, managed payment options like Mastercard, AvidPay Direct or check.

- Today’s accounts payable solutions are designed to take advantage of artificial intelligence and machine learning, which yield significant benefits.

- In these instances, you may need to check for integrations that offer the option to connect the Accounts Payable software to an accounting or bookkeeping software of choice.

- Of course we’re happy to hear from you via phone or email as well.

An example of control for the invoice approval process—is by setting approval limits for a specific or all users. Or requiring an additional approver when a limit is reached or invoice amount is changed by AP. Reporting functionality tools also provide full control and visibility into suspicious activity by AP staff or management.Most of the time, you won’t even have any control over these factors, but the thing AP software can control on your behalf is technology risk. Increased efficiency.Outsourcing is all about performing nonstrategic activities instead of managing low-value tasks on the dot, and that’s what makes companies successful even with fewer resources. By purchasing an outsourcing system, you’re offloading transaction functions to a non-human factor and you get to focus on activities that are more valuable and analytically sharp. As you can probably conclude, AP software is often the key to efficient cost structures and economies of scale, especially when working in a low-margin and industry. Stampli AP Automation offers API integrations to connect directly with a company’s accounting, financial, or ERP system.AP Automation securely stores all invoice-related documents electronically within the system for up to 7 years. Documents for AP Automation often include vendor files and contracts, W-9s, and invoice history. With AP Automation from Stampli, the invoice itself becomes a communications channel and historical record where all comments, questions, answers, and invoice inputs are documented in a central and searchable location. Anyone can be invited to the conversation including vendors where they have limited access to what they can see if invited. Get started with AP Automation in days — not months — as our Customer Success team guides you through a fast and easy setup process. Effortlessly transition from paper to virtual trays using the Stampli AP Automation dashboard familiar to any AP processor.

Accounts Payable Software Buyers Guide

Capterra has helped thousands of businesses find the best A/P software. Compare product reviews and features, and learn from our Finance Software Research. FinancialForce customers come in all sizes, from mid-size services firms to global titans. But they all share a clear focus on their customer’s success and a commitment to business agility. Whether it’s funding new investments, gaining a competitive advantage, or attracting and serving customers, growth is essential to success in the technology industry.Best of breed AP Automation systems are rare and they provide end-to-end AP Automation with the ability to pay inside the system or outside the AP Automation system. All the while offering a variety of payment methods which don’t push fees on vendors and they make payment reconciliation easy.On the off-chance the vendor still prefers to be paid via paper check, the check will print locally with signatures and other information prefilled. Checks can also be printed via an off-site check printing partner – a nice solution to have in the event you can’t print checks from home or make it into the office. Much like consumer credit, the faster and more reliable businesses are when it comes to paying their suppliers, the more likely those suppliers are to permit larger orders and provide early payment discounts.The right reporting tools can improve your payables efficiency. For example, aging reports can allow users to report on past due payment records by the number of days they are outstanding, allowing the team to prioritize payments. Strong automation software improves the efficiency of your AP teams by reducing the time needed to issue checks and prepare month/year-end reports. AP automation eliminates vendor late fees and reduces common errors such as duplicate payments. Fewer opportunities for human errors upfront means less time spent making corrections as AP teams process invoices or balance the books. Accounts payable software automates management of money owed to other parties, and helps accountants manage expenditures and invoices.Does the vendor have a growing customer base, and are they regularly updating the platform? Mergers and acquisitions are also very common in the enterprise software world.