Content

- Days Deduction Outstanding: What Is Ddo, Best Practices And More

- Best Practices For Implementing An Accounts Receivables Process

- Part 3 Of 4:tracking Accounts Receivable

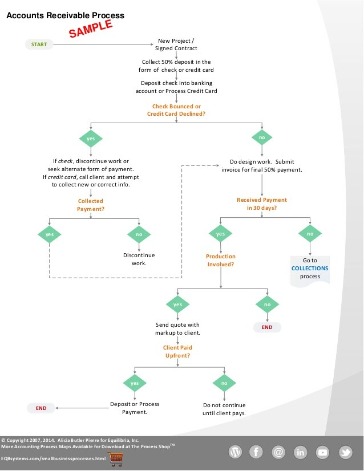

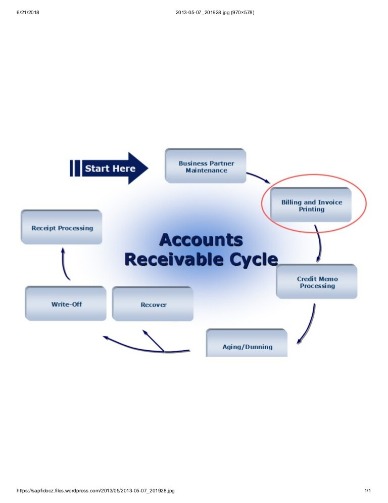

- The Accounts Receivable Process

- Understanding Accounts Receivable

- Whats The Difference Between Accounts Payable And Accounts Receivable?

- What Is An Accounts Receivable Process?

If it is 60 days overdue, you might charge them a $100 late fee. After 90 days, you might charge them a late fee of $150 and send the information to a collection agency, a company that will contact the client to track down the late payment.

Do you need a degree for accounts receivable?

Aspiring accounts receivable specialists need to possess at least a high school diploma or GED, though many employers prefer candidates with a bachelor’s degree or higher. … Employers require candidates to have a minimum of two years of experience in accounting in a professional setting.Having an efficient workflow and technology can make managing your accounts much more streamlined, freeing up your time to perform other tasks for your business. Reliable accounts receivable automation services can help eliminate human error that can throw a wrench into your finances by making simple mistakes during the accounting process.

Days Deduction Outstanding: What Is Ddo, Best Practices And More

You’ve probably lent money to a friend before as an “I owe you” . In business, this is essentially what accounts receivable are. They are money owed to your business that customers have already spent, on credit. Now that you have, you may want to expand your operation even more. Many small businesses focus on improving customer experience and retention to increase revenue growth. While it may seem surprising, the right accounts receivable process can do both.You wouldn’t let a customer leave your small business without paying, right? Losing track of your accounts receivable is essentially that.Point out the consequences of late payment – such as interest, fees or legal action. Sometimes even the best clients have cash flow problems. However, setting up all payment expectations at the beginning of the relationship will better every outcome. Depending on what you’re able to afford, decide whether you’ll match payment terms or outdo your competitors by giving your customers an advantage (e.g., more time). When a company sells an item or service, they can either request payment at the time of purchase or extend credit to the buyer so they can pay the total cost later. Manual follow-up and collections process typically involved print and post, supported by electronic reminders or phone calls. Next, the accountants would determine the total credit sales for the day.

Best Practices For Implementing An Accounts Receivables Process

They also ensure that customers receive full disclosure about your credit practices. GoCardless is used by over 60,000 businesses around the world. Learn more about how you can improve payment processing at your business today. Track the invoice – Invoices will be tracked on a regular basis, and if payment hasn’t arrived, reminders will be sent to customers. Any business that wishes to use an Accounts Receivable ledger must first set boundaries and definitions when offering credit.

- In spite of how great your client relationships are, unforeseen circumstances sometimes prevent payment—not meeting revenue, interrupted cash flow, and even bankruptcy.

- AR Officers are the most important personnel involved in developing and implementing the Accounts Receivable process.

- Invoices are perhaps the least ignored communication businesses ever send, so ensure they express your brand values in both presentation and ease of use.

- Then, credit the accounts receivables account for the same amount.

- You may want to offer new customers shorter terms for payment and offer older customers longer terms.

- A standard Accounts Receivable workflow includes the following steps.

Once a company delivers a good or service, accounts receivable professionals must now invoice the customer for the amount owed. This may be either a paper bill sent through the mail, or increasingly, through ePresentment or electronic billing.

Part 3 Of 4:tracking Accounts Receivable

You can either send paper invoices in the mail, digital invoices via email or both. The customer should indicate how invoices are to be sent. Electronic invoicing is less expensive and more convenient than paper. However some customers do not feel comfortable receiving financial information online. Also, if a customer’s email address changes, it can be difficult to find the new one.Additionally, strong A/R habits can minimize unpaid debts, ensure correct financial records, and contribute to a company’s growth. One of the most trying aspects of AR collections is securing timely, consistent payments. Not every company will have a strong enough cash flow to take the offer, but you can incentivize the companies that do to make payments earlier by offering them some kind of discount. Agree on a date and send all invoices electronically to keep better documentation. This strategy will streamline your accounts receivable process flow. While AP is the debt a company owes to its suppliers or vendors, accounts receivable is the debt of the buyers to the company.

The Accounts Receivable Process

Next, you must record the reduction in inventory that was sold to the customer as the cost of goods sold. At the end, it calculates any balance forward that remains unpaid. A software program is also able to perform invoice age analysis. A sales receipt is only issued if the customer pays in full at the time of purchase. If the customer is paying at a later point in time or is paying over multiple payments, you issue an invoice.An invoice is not the same as a statement. A statement is sent to a customer with one or several current invoices with the business and specifies the total amount due.Furthermore, accounts receivable are current assets, meaning the account balance is due from the debtor in one year or less. If a company has receivables, this means it has made a sale on credit but has yet to collect the money from the purchaser. Essentially, the company has accepted a short-term IOU from its client.You can be sure that no payment is going to be made without an invoice. In some organizations, the invoice will need to be authorized by buyers or project managers, so add this into your recovery process. For example, if you estimate that $40,000 in invoices won’t be paid one month, record a journal entry of a $40,000 expense to the bad debt expense account. This appears as an expense line item on your financial statement. Next, make a journal entry of a debit of $7,000 to the cost of goods sold. This appears as an expense on the financial statements.

Understanding Accounts Receivable

If they don’t need one, save yourself the expense and don’t send them one. This exact process depends on which accounting method your business uses.

Step 1: Establishing Credit Practices

Tracking Accounts Receivable is vital for financial success, but the exact process may differ between small and large companies. This is mainly due to the amount of time, resources, and staff available. It’ll take time for your customer to approve it and pay it, so why not start those wheels turning as soon as you can. Run a credit check to find out if they’re regarded as good payers. Remove inefficiencies and optimize your business processes with Lucidchart. Details of the products delivered and/or services rendered. Communications should retain a personal touch and provide an easy mechanism for buyers to request more information or assistance where needed.

Whats The Difference Between Accounts Payable And Accounts Receivable?

After identification of unpaid debts, the account department makes journal entries to record the sales. The process involves both accounting for bad debt, or the unpaid debts, as well as identifying early payment discounts.

What Is An Accounts Receivable Process?

An important discussion on the post-pandemic rise in payment fraud and how to develop a plan for preventing it. Before you evaluate e-invoicing solution partners, take a look at thislist of key questions to askto determine whether they fit your business requirements. For instance, a customer may request to purchase goods on credit. The AR Manager would require the credit analysts to identify credit-worthiness of the customer.

Maintain An Aging Process

Everything about your accounts receivable process should be timed to perfection, accurate, and easy to respond to. Furthermore, you should have complete visibility of where every communication and payment is and know where risks to cash flow are likely to arise before they do.This will allow you to look into each customer’s credit before they borrow from you. You can then weed out customers who are not likely to pay you pack. It’s as simple as not offering credit to customers with bad credit, and it’s a critical part of an AR process that runs smoothly. You need to set up procedures for accounts receivable if you extend credit to your customers. An account receivable arises when you allow a customer to take immediate possession of a product or receive a service in return for a promise to pay in the future.Once your client receives the services or goods you promised, your accounts receivable department will need to send the client an invoice. An invoice should relay information such as a breakdown of the charges, expected payment date and your contact information. Invoices can be sent via mail, email, or sent through an automated invoice processing software. These types of programs can automate sending your invoices, track the progress of your invoices, and send payment reminders to clients. You should also provide the option of paper or electronic invoices. Electronic invoices are more convenient, provide prompt delivery, and are more cost-efficient. Companies record accounts receivable as assets on their balance sheets since there is a legal obligation for the customer to pay the debt.