Content

- Everything You Need To Know About Accounts Payable

- Want More Helpful Articles About Running A Business?

- Thought On accounts Receivable Vs Accounts Payable

- What Is Accounts Payable?

- The Top 25 Tax Deductions Your Business Can Take

- Additional Services

- What Kind Of Account Is Accounts Payable?

- Accountability

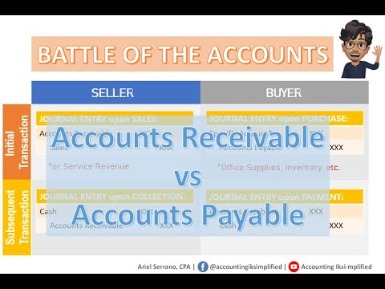

This above entry decreases your accounts payable balance by the amount of the bill, while also decreasing your bank account balance. Journal entry to add the office supplies bill to your accounts payable account.Accounts receivables are created because of the selling of goods and services, while accounts payables are created because of purchasing material on credit. Many payables are required in order to create products for sale, which may then result in receivables.

Everything You Need To Know About Accounts Payable

We’ll show you how to create an invoice, make recurring invoices, send reminders, and more. QuickBooks Online is the browser-based version of the popular desktop accounting application. It has extensive reporting functions, multi-user plans and an intuitive interface.Current liabilities are a company’s debts or obligations that are due to be paid to creditors within one year. A voucher is a document recording a liability or allowing for the payment of a liability, or debt, held by the entity that will receive that payment.

- According toBacs, almost half of the UK’s small to medium sized businessesare being paid late, with the average company waiting for £32,185 in overdue payments.

- Account balances due from the debtor are usually due in a year or less, depending on the agreed-upon timeframe.

- Asset turnover measures the value of revenue generated by a business relative to its average total assets for a given fiscal year.

- When the amount of the credit sale is remitted, they will debit the liability in the AP ledger and will credit cash.

- The money that a company would receive from its debtors in the future is accounts receivable.

Management can use AP to manipulate the company’s cash flow to a certain extent. For example, if management wants to increase cash reserves for a certain period, they can extend the time the business takes to pay all outstanding accounts in AP. However, this flexibility to pay later must be weighed against the ongoing relationships the company has with its vendors. Accounts payable and accounts receivable play important roles in the accounting cycle. Both accounts payable and accounts receivable are reflected on your balance sheet, with their respective balances directly affecting cash flow and net income.

Want More Helpful Articles About Running A Business?

Be sure to use an invoice template to ensure you’re including all the relevant information. You should also issue the invoice as soon as work is completed to make sure you get paid faster. Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team.

Thought On accounts Receivable Vs Accounts Payable

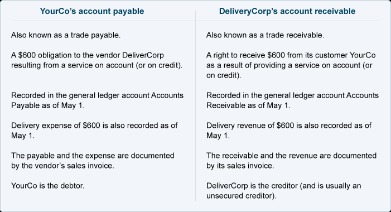

These accounts are created when a company purchases something on credit. The simplest way to think about accounts payable is money that needs to be paid. How a company chooses to pay their outstanding bills affects their overall cash flow. If you’ve only recently stepped foot into the accounting and bookkeeping arena, you may still find yourself confused about accounts payable and accounts receivable.

What Is Accounts Payable?

Sometimes a borrower becomes insolvent or has a lack of cash flow and can’t pay their current debts. If it is clear that the account will not be paid at all, a debt can be written off and then later become a tax deduction. Creditors can also note the debt as an allowance, which allows them to account for the debt in the short-term while waiting for repayment for the debtor. Accounts payable vs. accounts receivable are opposites, where accounts payable is money a business owes its suppliers and accounts receivable is money owed to the business .A wide gap between receivable and payable is not a good sign for the company in the long run. Take for instance, if the customers of the company are not making timely payment but the company has to pay to its suppliers.

The Top 25 Tax Deductions Your Business Can Take

Current Asset Of The Balance SheetCurrent assets refer to those short-term assets which can be efficiently utilized for business operations, sold for immediate cash or liquidated within a year. It comprises inventory, cash, cash equivalents, marketable securities, accounts receivable, etc. Receivables represent funds owed to the firm for services rendered and are booked as an asset. Accounts payable, on the other hand, represent funds that the firm owes to others.It also means securing good credit and maintaining strong relationships with vendors. You can then leverage this trust should you need to work out an alternate payment arrangement in the future. This is especially the case if you are just starting out and doing a lot of transactions with credit (i.e. “on account”).Essentially, accounts receivable refers to outstanding invoices that are owed to your company by customers. It represents a line of credit that has been extended from the client to the customer. Accounts payable refers to the amount of money that a company owes to its suppliers. Usually, companies may categorize AP into multiple accounts such as interest, income taxes, or raw materials.Even if it does create such provision, this would be against the business ethics and affect the goodwill of the company as well. Examine whether your budget allows for cash negotiations or payment terms extended by a supplier. Longer payment terms shorten the operating cycle because your organization can delay paying out cash.

Additional Services

Although some people use the phrases “accounts payable” and “trade payables” interchangeably, the phrases refer to similar but slightly different situations. Trade payables constitute the money a company owes its vendors for inventory-related goods, such as business supplies or materials that are part of the inventory. Accounts payable include all of the company’s short-term debts or obligations.

What Kind Of Account Is Accounts Payable?

You must be able to identify both processes to reduce stress in the long run. Whether it’s a small business or corporate finance, AP and AR function the same way and both are required for a full transaction. Track – Invoices are tracked on a regular basis through a trial balance. When payment is not received, reminders are sent out and additional action may be taken (i.e. phone calls or collections). Approval – The invoice must go through a set of controls and an approval process to ensure the payment is warranted and accepted as a debt.Accounts payable, on the other hand, can be of various types such as sales tax payable account, interest payable, income tax payable and so on. Accounts Receivable and Accounts Payable are business terms that are primarily used in accounting. The real difference between Accounts Receivable vs Accounts Payable is clear from the names itself. When as a business you buy any product and don’t pay for it up front, then the amount that you owe is accounts payable.By optimizing your accounts receivable process, you can ensure that your business is able to maintain a healthy cash flow. This means that you’ll have more than enough cash coming through to cover your business’s expenses. Plus, you won’t have to struggle to survive from day to day but can take a long-term approach to growth. The turnover ratio of the accounts receivable can determine the strength of a company’s AR. The word “receivable” is used here because the business has a right to “receive”; it has fulfilled its obligation of delivering a product or a service.In certain situations where the business is working under longer credit terms, accounts receivable may qualify as long-term assets instead of current ones. Net working capital is the difference between current assets and current liabilities.Accounts receivable exist because the company sells goods and services on credit. Accounts payable are there because a company buys products or raw materials on credit.The difference between a Trades Receivable Account and accounts and notes receivable is that it is a direct result of company sales. When a customer buys a good or service and is extended short-term credit in which to repay the loan, this is listed as a trades receivable entry in the current trades receivable account. Accounts payable is considered a liability account as it keeps track of all funds a business owner is liable for when transacting with a third party.