Content

- Example Of Cash Basis Accounting

- Benefits Of Cash Basis Accounting

- Imagine You Perform The Following Transactions In A Month Of Business:

- Can You Be Cash Basis If You Have Inventory?

- When Are Expenses And Revenues Counted In Accrual Accounting?

- Terms Similar To The Cash Basis Of Accounting

- When Is Accrual Accounting More Useful Than Cash Accounting?

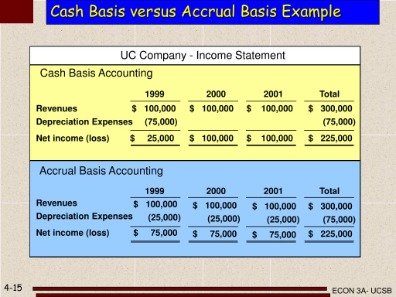

- Accrual Accounting Vs Cash Basis Accounting: What’s The Difference?

- Want A Free Month Of Bookkeeping?

In the meantime, start building your store with a free 14-day trial of Shopify. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Which accounting method is better cash or accrual?

While the accrual basis of accounting provides a better long-term view of your finances, the cash method gives you a better picture of the funds in your bank account. This is because the accrual method accounts for money that’s yet to come in.The reasons for this become apparent when you examine the pros and cons of the method. The cash method may also continue to be appropriate for a small, cash-based business or a small service company.

Example Of Cash Basis Accounting

Lenders do not feel that the cash basis generates overly accurate financial statements, and so may refuse to lend money to a business reporting under the cash basis. However, this may not be the case for a small business that cannot afford the services of a CPA to prepare its books.The primary reason why businesses choose cash basis accounting is due to its simplicity and ease of use. People with little or no financial accounting knowledge can implement the system without the need for a trained accountant. In the accrual method of accounting, account receivable and account payable are used to track amounts due from customers on credit sales and the amount your business owes to the vendor on a credit purchase.If, for example, a store selling sneakers uses cash basis accounting, the storeowner may only account for sales when receiving the cash for any pair of sneakers sold. The owner does not include sales done via credit card or from a credit account, only when the payment hits the account. At the end of an accounting period, the storeowner calculates cash flow from that in the account and from any expenses paid during the time.An accrued expense is recognized on the books before it has been billed or paid. Chizoba Morah is a business owner, accountant, and recruiter, with 10+ years of experience in bookkeeping and tax preparation. Increase the cash account by $500, and post revenue of $500. A customer pays you $500 for an invoice you gave them in February. BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online. Whatever your industry, there are many avenues you can explore for personal advancement. If one of your professional goals is to find out more about business accountancy, this may be a good place to start.

Benefits Of Cash Basis Accounting

That means that the results for the quarter probably won’t be representative of annual results and won’t truly reflect profits. Without more info, investors can’t get a feel for longer-term trends, and therefore can’t extrapolate on future profit or burn rate. The following video summarizes the difference between cash and accrual basis of accounting. The importance of the reporting attributes in GAAP to a special purpose framework such as the cash basis or modified cash basis is a matter of professional judgment. A business can alter its reported results by not cashing received checks or altering the payment timing for its liabilities. This is commonly used to defer the recognition of taxable income to a later reporting period. A person requires a reduced knowledge of accounting to keep records under the cash basis.

What are the pros and cons of cash vs accrual accounting?

The main advantage of the accrual method is that it provides a more accurate picture of how a business is performing over the long-term than the cash method. The main disadvantages are that it is more complex than the cash basis, and that income taxes may be owed on revenue before payment is actually received.With accrual accounting, you recognize the cost of this as soon as you make the agreement with the firm. It doesn’t matter if you’re not actually going to pay them for weeks or even months. You may get a big contract with a multinational to produce training materials. With cash basis accounting, you only recognize the related revenue when you get the cash. As part of the project, though, you’ll have to cover many different costs. With cash basis accounting, there’s no need for complex accountancy systems. There’s certainly no cause to hire accountants to manage the books.But understanding when you’ve truly earned revenue allows you to position yourself for stronger, faster growth. If you know the broader financial situation of your business, you’re able to invest confidently, borrow more, and take smarter risks, all based off of sound financial foundations. A positive bottom line of $29,000 shows the health of your business and opens the door to investing in long-term assets. Of course, you should still be keeping an eye on cash flow to make sure your business stays healthy and solvent.

Imagine You Perform The Following Transactions In A Month Of Business:

Several accounting software packages are designed for the cash basis of accounting, to make them easier to use. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Understanding the difference between cash and accrual accounting is important, but it’s also necessary to put this into context by looking at the direct effects of each method.These time periods are usually of equal length so that statement users can make valid comparisons of a company’s performance from period to period. The length of the accounting period must be stated in the financial statements. For instance, so far, the income statements in this text were for either one month or one year. Throughout the text we will use the accrual basis of accounting, which matches expenses incurred and revenues earned, because most companies use the accrual basis.

Can You Be Cash Basis If You Have Inventory?

A company or individual using cash basis accounting risks having a misleading account of their business. If the owner pays expenses such as bills and wages while not including all the sales, the balance may look poor in the accounting books. It may appear that the business has a poor or negative cash flow, which may lead to problems with credit facilities. On the other side, the store may look cash rich if there are few expenses in the accounting period. This is particularly dangerous if expenses occur, such as stock purchased on credit, but not accounted for in the store’s accounts. The storeowner may invest elsewhere or take a higher salary, though in fact the business cannot afford it at that time.

- Some construction businesses use the cash method; and there are many other companies that use a modified form of the cash method, which is acceptable under federal income-tax regulations.

- However, this may not be the case for a small business that cannot afford the services of a CPA to prepare its books.

- There are a few caveats, but basically you have to use accrual accounting if your business maintains inventory, is a corporation, or has gross receipts over $25M per year.

- Increase accounts receivable and increase revenue $5,000 for the products shipped to the customer.

- The completed contract method enables a company to postpone recognizing revenue and expenses until a contract is completed.

Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. To enableCBAon the basis of the revenues and expenditures, a document by document split by the split characteristic RE_ACCOUNT is required. The corresponding configuration of the document split takes place automatically in the background when the CL definition is saved. Assume that your startup gets a line of credit from your bank for $50,000.

When Are Expenses And Revenues Counted In Accrual Accounting?

Here are some common reasons why businesses may use cash basis accounting. The cash system of recording transactions is only used by individuals and small businesses that deal exclusively in cash. Cash basis accounting is not acceptable under the generally Acceptable Accounting Principles or the International Financial Reporting Standards . Cash cost is a term used in cash basis accounting that refers to the recognition of costs as they are paid in cash. For example, a company might have sales in the current quarter that wouldn’t be recorded under the cash method because revenue isn’t expected until the following quarter. An investor might conclude the company is unprofitable when, in reality, the company is doing well.

When Is Accrual Accounting More Useful Than Cash Accounting?

Expenses of goods and services are recorded despite no cash being paid out yet for those expenses. Changing accounting methods ends up costing money in accounting services, and it could mean overhauling how your startup processes payments and files taxes. Accrual accounting can be used for every type of business, so it’s flexible no matter what your situation is. If you plan to grow, it’s smart to implement an accounting method that will grow with you. Given the weaknesses of cash basis accounting, many firms go a different way.

Accrual Accounting Vs Cash Basis Accounting: What’s The Difference?

Using cash-basis accounting, the company is only able to recognize the revenue upon project completion, which is when cash is received. However, during the project, it records the project’s expenses as they are being paid. If the project’s time span is greater than one year, the company’s income statements will appear misleading as they show the company incurring large losses one year followed by great gains the next. Accrual accounting allows you to show investors the info they need to evaluate investment risk. Using the accrual method, your firm matches revenue earned with expenses incurred to generate that revenue. The accrual method also provides a balance sheet, which shows future cash collection and debts. This is a more complete picture for investors looking to evaluate your business.

Want A Free Month Of Bookkeeping?

Professionals such as physicians and lawyers and some relatively small businesses may account for their revenues and expenses on a cash basis. The cash basis of accounting recognizes revenues when cash is received and recognizes expenses when cash is paid out. For example, a company could perform work in one year and not receive payment until the following year. Under the cash basis, the revenue would not be reported in the year the work was done but in the following year when the cash is actually received.