Content

- Accumulated Depreciation And The Sale Of A Business Asset

- Free Accounting Courses

- Understanding Accumulated Depreciation

- Accumulated Depreciation On The Balance Sheet

- Is Accumulated Depreciation A Current Asset?

- How To Calculate Beginning Year Accumulated Depreciation

- Sum Of The Years Digits Syd Method

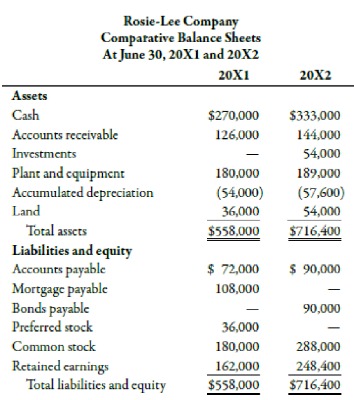

In that case, you will debit the depreciation expense and credit the accumulated depreciation for the same amount to reflect the asset’s net book value on the balance sheet. Subtracting accumulated depreciation from an asset’s cost results in the asset’s book value or carrying value. Hence, the credit balance in the account Accumulated Depreciation cannot exceed the debit balance in the related asset account. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business, over time. The cost for each year you own the asset becomes a business expense for that year. This expense is tax-deductible, so it reduces your business taxable income for the year. Long-term assets are used over several years, so the cost is spread out over those years.Short-term assets are put on your business balance sheet, but they aren’t depreciated. Suppose a company bought $100,000 worth of computers in 1989 and never recorded any depreciation expense. The firm’s balance sheet would still show an asset worth $100,000. Your common sense would tell you that computers that old, which wouldn’t even run modern operating software, are worth nothing remotely close to that amount. At most, you’d be lucky to get a few hundred dollars for scrap parts. This company’s balance sheet does not portray an accurate picture of its financial state. By separately stating accumulated depreciation on the balance sheet, readers of the financial statement know what the asset originally cost and how much has been written off.

Accumulated Depreciation And The Sale Of A Business Asset

Depreciation prevents a significant cost from being recorded–or expensed–in the year the asset was purchased, which, if expensed, would impact net income negatively. To find Year 2, subtract the total depreciation expense from the purchase price ($50,000 – $8,000) and follow the same formula. The accumulated depreciation for an asset or group of assets increases over time as depreciation expenses are credited against the assets.When you record depreciation on a tangible asset, you debit depreciation expense and credit accumulated depreciation for the same amount. This shows the asset’s net book value on the balance sheet and allows you to see how much of an asset has been written off and get an idea of its remaining useful life. At the end of the year your balance sheet shows accumulated depreciation on PP&E of $250,000.Below we see the running total of the accumulated depreciation for the asset. Let’s take a look at the straight-line method in action, shall we? For every asset you have in use, there is an initial cost and value loss over time .

Free Accounting Courses

Many businesses don’t even bother to show you the accumulated depreciation account at all. The $4,500 depreciation expense that shows up on each year’s income statement has to be balanced somewhere, due to the nature of double-entry accounting.

Do you close out accumulated depreciation account?

Accumulated Depreciation is a contra asset account and its balance is not closed at the end of each accounting period. As a result, Accumulated Depreciation is a viewed as a permanent account.When the time came to remove the van from your balance sheet, your assumptions about depreciation turned out to be different from economic reality. This causes net income to be higher than it is in economic reality and the assets on the balance sheet to be overstated, too, which results in inflated book value. To see the specifics of depreciation charges, policies, and practices, you will probably have to delve into theannual reportor10-K. Most businesses list assets, including depreciation, in one line on their balance sheet labeled “Property, Plant, and Equipment—Net.” The amount of accumulated depreciation for an asset will increase over time, as depreciation continues to be charged against the asset. The original cost of the asset is known as its gross cost, while the original cost of the asset less the amount of accumulated depreciation and any impairment is known as its net cost or carrying amount. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts.

Understanding Accumulated Depreciation

It appears on the balance sheet as a reduction from the gross amount of fixed assets reported. The balance sheet would reflect the fixed asset’s original price and the total of accumulated depreciation. Fixed assets are recorded as a debit on the balance sheet while accumulated depreciation is recorded as a credit–offsetting the asset. However, when you eventually sell or retire an asset, you debit the accumulated depreciation account to remove the entry for that asset. If the vehicle is sold, both the vehicle’s cost and its accumulated depreciation at the date of the sale will be removed from the accounts. If the amount received is greater than the book value, a gain will be recorded.No matter which method you use to calculate depreciation, the entry to record accumulated depreciation includes a debit to depreciation expense and a credit to accumulated depreciation. Under MACRS, the IRS assigns a useful life to different types of assets. For example, office furniture is depreciated over seven years, automobiles get depreciated over five years, and commercial real estate is depreciated over 39 years. Most businesses calculate depreciation and record monthly journal entries for depreciation and accumulated depreciation. The actual calculation depends on the depreciation method you use. Two of the most popular depreciation methods are straight-line and MACRS.You can also accelerate depreciation legally, getting more of a tax benefit in the first year you own the property and put it into service . The extra amounts of depreciation include bonus depreciation and Section 179 deductions. If you use an asset, like a car, for both business and personal travel, you can’t depreciate the entire value of the car, but only the percentage of use that’s for business. For example, if you use your car 60% of the time for business and 40% for personal, you can only depreciate 60%. Since land and buildings are bought together, you must separate the cost of the land and the cost of the building to figure depreciation on the building. A contra liability account is a liability account that is debited in order to offset a credit to another liability account.Save money without sacrificing features you need for your business. As an asset drops in value over time, this is marked as depreciation for accounting purposes. Accumulated depreciation refers to cumulative asset depreciation up to a single point during its lifespan. Accumulated depreciation gives an accurate representation of the value of a company’s assets over time. To illustrate, here’s how the asset section of a balance sheet might look for the fictional company, Poochie’s Mobile Pet Grooming.

Accumulated Depreciation On The Balance Sheet

Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. A depreciation schedule is required in financial modeling to link the three financial statements in Excel. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value over time. A capital lease is a contract entitling a renter the temporary use of an asset and, in accounting terms, has asset ownership characteristics.

- Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month.

- To illustrate, here’s how the asset section of a balance sheet might look for the fictional company, Poochie’s Mobile Pet Grooming.

- Accumulated depreciation on the balance sheet serves an important role in capturing the current financial state of a business.

- In other words, it’s a running total of the depreciation expense that has been recorded over the years.

- For example, office furniture is depreciated over seven years, automobiles get depreciated over five years, and commercial real estate is depreciated over 39 years.

Bench assumes no liability for actions taken in reliance upon the information contained herein. Financial modeling is performed in Excel to forecast a company’s financial performance. Overview of what is financial modeling, how & why to build a model. Charlene Rhinehart is an expert in accounting, banking, investing, real estate, and personal finance. She is a CPA, CFE, Chair of the Illinois CPA Society Individual Tax Committee, and was recognized as one of Practice Ignition’s Top 50 women in accounting. Learn more about how you can improve payment processing at your business today.

Is Accumulated Depreciation A Current Asset?

As we’ve touched on above, the accumulated depreciation account is called a long-term contra asset account. To record depreciation using this method, debit the depreciation expense and credit the accumulated depreciation value. Depreciation expenses appear on the income statement during the recording period, while accumulated depreciation shows up on the balance sheet under related capitalised assets.

Tax Calculator For Self

If the amount received is less than the book value, a loss is recorded. Accumulated depreciation is also important because it helps determine capital gains or losses when and if an asset is sold or retired.Tax TipsA Beginner’s Guide to Record-Keeping for Small Businesses Get an overview of all the different records and receipts you have to maintain as a small business owner and how to manage them efficiently. Some companies may list depreciation for plant, machinery, and equipment separately under the value of each item instead of a cumulative figure used in the above example.