Content

- Total Assets Turnover

- Total Assets Turnover Ratio

- Type 3 Fixed Asset Turnover Ratio

- What Is An Activity Ratio?

- Is The Turnover Rate Good Or Bad?

This is because the company is relatively quick to convert its inventory into sales. Fixed AssetsFixed assets are assets that are held for the long term and are not expected to be converted into cash in a short period of time. Plant and machinery, land and buildings, furniture, computers, copyright, and vehicles are all examples.The average collection period is used to calculate how soon you receive that money. At the beginning of the year, the net fixed assets were $22,500, and after depreciation and addition of new assets to the business, the fixed assets cost to $24,000 at the end of the year. ProfitabilityProfitability refers to a company’s ability to generate revenue and maximize profit above its expenditure and operational costs. It is measured using specific ratios such as gross profit margin, EBITDA, and net profit margin. James Woodruff has been a management consultant to more than 1,000 small businesses. As a senior management consultant and owner, he used his technical expertise to conduct an analysis of a company’s operational, financial and business management issues. James has been writing business and finance related topics for work.chron, bizfluent.com, smallbusiness.chron.com and e-commerce websites since 2007.

Total Assets Turnover

So, if you’re struggling with cash, calculate these activity ratios for your business to identify the problems and bottlenecks. Activity ratios are important to measure company performance, in addition to profitability, liquidity, and solvency ratios. Specifically, they give us insight into how efficient and effective a company manages and generates cash and revenue using its assets. In other words, it takes 6 months for Binge Inc. to sell its entire inventory. Too much cash into inventories is not good for a business; hence, necessary measures need to be taken to increase the inventory turnover ratio.For an annual period, DIO equals 365 divided by inventory turnover ratio. A high inventory turnover ratio and a low days inventories outstanding is better.

- A high ratio indicates that a company is using its total assets very efficiently or that it does not own many assets, to begin with.

- A grocery store with a lot of perishable products will have a high inventory turnover.

- Product Reviews Unbiased, expert reviews on the best software and banking products for your business.

- A lower inventory turnover ratio may indicate sluggish inventory movement, while a higher ratio indicates good product demand.

- The accounts receivable turnover shows how quickly a company collects what is owed to it and indicates the liquidity of the receivables.

Activity ratios are financial analysis tools used to measure a business’ ability to convert its assets into cash. Activity ratios are tools used in financial analysis to measure a business’ asset to cash conversion ability. Explore the definition, formula, and analysis of activity ratios and learn about current and fixed assets. A higher ratio indicates that the being paid by the customers on time, which helps to maintain the cash flow and payment of the business’s debts, employee salaries, etc. on time. It is a good sign when the accounts receivables turnover ratio is on the higher side since the debts are being paid on time instead of writing them off.

Total Assets Turnover Ratio

This means, on average, it’s taking your business 36 days to collect on an invoice. The lower the ratio, the quicker you’re collecting on accounts receivable, while a high number indicates that your customers are slow to pay. The above result indicates that each dollar of assets currently generates $10.25 in sales for your business. A lower ratio can indicate that assets are not being used efficiently, while a higher number indicates that management is using assets efficiently.Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs. Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. The company cannot take full advantage of suppliers’ lenient credit terms and pay suppliers more quickly. Thus, when demand is still high in the future, the company misses the opportunity to boost sales due to insufficient supply and production. But, we need to note, why this ratio is high or low can also occur for other reasons.Credit SalesCredit Sales is a transaction type in which the customers/buyers are allowed to pay up for the bought item later on instead of paying at the exact time of purchase. Average InventoryAverage Inventory is the mean of opening and closing inventory of a particular period. It helps the management to understand the inventory that a business needs to hold during its daily course of business. However, it excludes all the indirect expenses incurred by the company. A higher ratio here suggests that a company can move its inventory with relative ease.

Type 3 Fixed Asset Turnover Ratio

All in all, these ratios are used to find out how efficient a company is in channelizing its operations by using all the available assets or resources. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities. A higher ratio is more desirable because it shows the company is more efficient in managing its assets. Conversely, a lower ratio underscores a less efficient operation in generating revenue. A higher ratio is preferable because it indicates efficient working capital management in generating revenue. Conversely, if it is lower, the management of working capital is less efficient.

What is activity ratio in standard costing?

The activity ratio is the number of standard hours equivalent to the work produced expressed as a percentage of the budgeted standard hours. This ratio measures the level of activity at which a business is operating.A metric called theasset turnover ratio measures the amount of revenue a company generates per dollar of assets. This figure, which is simply calculated by dividing a company’s sales by its total assets, reveals how efficiently a company is using its assets to generate sales.However, the ideal ratio will also depend on the industry in which the company operates. For example, in capital-intensive industries, companies rely heavily on fixed assets such as machinery and equipment. We can see fixed assets in the non-current assets section of the balance sheet. Fantasy Playgrounds, Inc. keeps inventory for an average of 36.5 days. So how does knowing the inventory turnover and the days in inventory tell you if you’ll be able to pay your electric bill or your employees? You know that if you buy inventory today, within the next 36.5 days, you’ll have sold it and either have, or be expecting to have, the cash in hand.

What Is An Activity Ratio?

For a company to be profitable, it must be able to manage its inventory, because it is money invested that does not earn a return until the product is sold. A higher inventory turnover ratio indicates more effective cash management and reduces the incidence of inventory obsolescence. The best measure of inventory utilization is the inventory turnover ratio , which is the total annual sales or the cost of goods sold divided by the cost of inventory. To calculate the fixed asset turnover ratio, calculate net sales, which is gross sales minus returns and allowances. And the accounts receivable turnover ratio gives us insight into how effectively the company manages it all. The fixed asset turnover ratio tells you how effective Fantasy Playgrounds, Inc. is in generating income from its fixed assets. However, not all businesses need to know the fixed asset turnover ratio; this information can be most beneficial to those that have to outlay a large sum of money before they start making profits.

Which one of the following is not an activity ratio?

Interest Coverage ratio is a solvency Ratio and not an Activity Ratio. Hence, the correct answer is Interest Coverage ratio.Profitability ratios may help analysts compare a company’s profits with those of its industry competitors, while also tracking the same company’s progress across several different reporting periods. Best when used to compare performance with other similar businesses, activity ratios should also be calculated regularly in order to view any upward or downward trends. In any case, if you plan to grow your small business, activity ratios should be a part of that growth.

Is The Turnover Rate Good Or Bad?

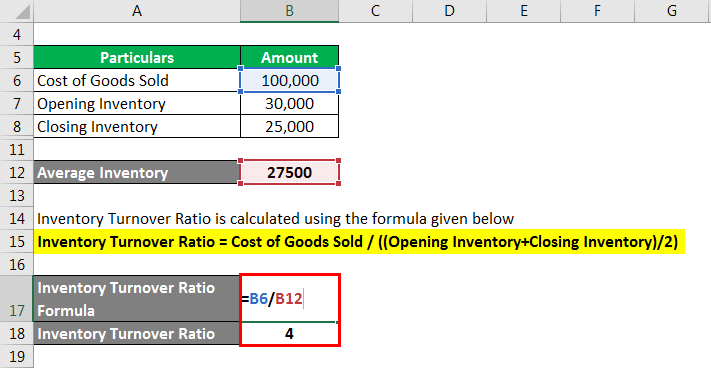

For example, a high ratio could also be due to insufficient inventory. We can have an idea and understanding of why a company is superior to its competitors. Activity Ratios help in comparison to businesses in the same line of operation. It means that Roots Inc. is able to collect its average receivables 4 times a year. A higher Total Asset Turnover Ratio depicts the efficient performance of the business. This guide shows you step-by-step how to build comparable company analysis (“Comps”) and includes a free template and many examples.The merchandise inventory turnover ratio measures how often the inventory balance is sold during an accounting period. The cost of goods sold is divided by the average inventory for a specific period. Higher calculations suggest that a company can move its inventory with relative ease. Activity ratios can be subdivided into merchandise inventory turnover ratios, total assets turnover ratios, return on equity measurements, and a spectrum of other metrics. An activity ratio is a type of financial metric that indicates how efficiently a company is leveraging the assets on its balance sheet, to generate revenues and cash. Commonly referred to as efficiency ratios, activity ratios help analysts gauge how a company handles inventory management, which is key to its operational fluidity and overall fiscal health. Activity ratios measure company sales per another asset account — the most common asset accounts used are accounts receivable, inventory, and total assets.Key to high return for shareholders is to generate more revenue and hence more income for investors by utilizing their investment more efficiently. The accounts receivable turnover ratio is used for determining the ability to collect the money of an entity from its customers. We calculate the accounts payable turnover ratio by dividing purchases by the average accounts payable. Days of inventory on hand are inversely related to the inventory turnover ratio. And it shows us how many days, on average, the company converts inventory into sales. Activity ratios are most useful when employed to compare two competing businesses within the same industry to determine how a particular company stacks up amongst its peers.We calculate it by dividing revenue by the average fixed assets in the last two years. Total assets refer to all the assets that are reported on a company’s balance sheet, both operating and non-operating (current and long-term). Total asset turnover is a measure of how efficiently a company is using its total assets. Working capital turnover ratio calculates dollars of revenue generated per dollar of working capital. A high ratio is better, but analyst should make sure that the high ratio is not merely due to very poor liquidity position. To calculate the inventory turnover ratio, the cost of goods sold will be divided by the average inventory for a specific period.

Also In Financial Ratio

Because, unfortunately, most major compilers of financial data have used total annual sales, so this is the ratio that is most widely used. Accounts receivable is the total amount of money due to a company for products or services sold on an open credit account. The accounts receivable turnover shows how quickly a company collects what is owed to it and indicates the liquidity of the receivables. Each of these activity ratios reveals something about the efficiency of a company’s cash flow cycle. It tells the owner where he is doing a good job and where he needs to improve.

Type 6: Average Collection Period Ratio

Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy. The company is trying to get relief facilities offered by suppliers, such as discounts for paying earlier. The second reason can be problematic if, at the same time, competitors offer more lax terms. Simplifies an analysis by providing the financial data in a simple format, which eventually helps in decision making.Activity Ratios do not give the desired output when comparing businesses across different industries. Gain the confidence you need to move up the ladder in a high powered corporate finance career path.

Activity Ratios Definition

Are you constantly falling short of cash but you can’t figure out why? These ratios are financial metrics that measure management’s efficiency in using its assets to manufacture products, make sales and collect the cash. A fixed asset turnover ratio of $15.75% means that for every dollar in fixed assets, your business is earning nearly $16.

What Are Some Examples Of Activity Ratios, And How To Calculate And Interpret Them?

A high ratio indicates that a company is using its total assets very efficiently or that it does not own many assets, to begin with. A low ratio indicates that too much capital is tied up in assets and that assets are not being used efficiently in generating revenue. Activity ratios are financial metrics used to gauge how efficient a company’s operations are. The term can include several ratios that can apply to how efficiently a company is employing its capital or assets. Profitability ratios are financial metrics used to assess a business’s ability to generate profit relative to items such as its revenue or assets. A performance metric knows as return on equity measures the revenues raised from shareholder equity.