Content

- Trial Balance And Adjustement Entries

- Accruals

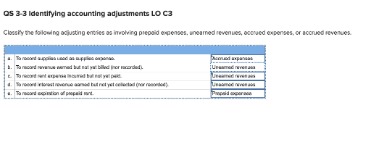

- Adjusting Entries Always Include: A The Cash Account B Only Income Statement Accounts C Only

- Composition Of An Adjusting Entry

- How Adjusting Entries Are Made

- Recording Common Types Of Adjusting Entries

- Learn About The 8 Important Steps In The Accounting Cycle

An adjusting journal entry is an entry in a company’s general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. When a transaction is started in one accounting period and ended in a later period, an adjusting journal entry is required to properly account for the transaction. Let’s pause here for a moment for an explanation of what happened “behind the scenes” when you made your insurance payment on Dec. 17. When you entered the check into your accounting software, you debited Insurance Expense and credited your checking account. However, that debit — or increase to — your Insurance Expense account overstated the actual amount of your insurance premium on an accrual basis by $1,200. So, we make the adjusting entry to reduce your insurance expense by $1,200. And we offset that by creating an increase to an asset account — Prepaid Expenses — for the same amount.

Trial Balance And Adjustement Entries

Real accounts include all accounts in the balance sheet. They are also called permanent accounts or balance sheet accounts. Once you have journalized all of your adjusting entries, the next step is posting the entries to your ledger. Posting adjusting entries is no different than posting the regular daily journal entries. T-accounts will be the visual representation for the Printing Plus general ledger. Accruals are revenues earned or expenses incurred which impact a company’s net income, although cash has not yet exchanged hands. Adjusting journal entries can also refer to financial reporting that corrects a mistake made previously in the accounting period.Other times, the adjustments might have to be calculated for each period, and then your accountant will give you adjusting entries to make after the end of the accounting period. Typically, you — or your bookkeeper — will enter income and expenses as they are recognized in your business. This can be done on either a cash basis or an accrual basis. Even if you are a cash basis taxpayer, keeping your books on an accrual basis is more accurate and will help you make better management decisions. A nominal account is an account whose balance is measured from period to period. Nominal accounts include all accounts in the Income Statement, plus owner’s withdrawal.

Accruals

A worksheet is a mandatory form that must be prepared along with an income statement and balance sheet. If a worksheet is used, financial statements can be prepared before adjusting entries are journalized.Income statement accounts that may need to be adjusted include interest expense, insurance expense, depreciation expense, and revenue. The entries are made in accordance with the matching principle to match expenses to the related revenue in the same accounting period. The adjustments made in journal entries are carried over to the general ledger that flows through to the financial statements. Adjusting journal entries usually involve an entry on each of the two basic financial statements. An example of an adjusting journal entry is adjusting prepaid rent or prepaid insurance to record the expiration of all or part of that asset and reflecting that expiration on the income statement. An example of a reclassification entry is reclassifying the short-term portion of a loan from a long-term liability to a short-term liability.

Adjusting Entries Always Include: A The Cash Account B Only Income Statement Accounts C Only

The adjusting entry records the change in amount that occurred during the period. Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations.

How do you record adjusting entry for interest expense?

Making an Adjusting Entry At the end of each month, make an interest payable journal entry by debiting the monthly interest expense to the interest expense account in an adjusting entry in your records. A debit increases an expense account. This matches this expense to the correct month.Hence the income statement for December should report just one month of insurance cost of $400 ($2,400 divided by 6 months) in the account Insurance Expense. The balance sheet dated December 31 should report the cost of five months of the insurance coverage that has not yet been used up.

Composition Of An Adjusting Entry

Inventory systems used by organizations can be perpetual or periodic. Explore the definition of these inventory systems and understand the differences between perpetual systems and periodic systems. Because you know your inventory amount has decreased by $3,750, you will adjust your actual inventory number instead of posting to the reserve account. Now, when you record your payroll for Jan. 1, your Wages and Salaries expense won’t be overstated. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

- Income statement accounts that may need to be adjusted include interest expense, insurance expense, depreciation expense, and revenue.

- A real account has a balance that is measured cumulatively, rather than from period to period.

- Accrual accounting is based on the revenue recognition principle that seeks to recognize revenue in the period in which it was earned, rather than the period in which cash is received.

- Adjusting journal entries are used to reconcile transactions that have not yet closed, but which straddle accounting periods.

- The left number column is prepared before any adjusting entries are recorded, and the right column includes the effects of adjusting entries.

- This would be posted as unearned revenue in your books.

If so, adjusting journal entries must be made accordingly. If adjusting entries are not prepared, some income, expense, asset, and liability accounts may not reflect their true values when reported in the financial statements. The purpose of adjusting entries is to ensure that your financial statements will reflect accurate data. If adjusting entries are not made, those statements, such as your balance sheet, profit and loss statement, and cash flow statement will not be accurate.

How Adjusting Entries Are Made

The adjusting entry will debit interest expense and credit interest payable for the amount of interest from December 1 to December 31. In such a case, the adjusting journal entries are used to reconcile these differences in the timing of payments as well as expenses. Without adjusting entries to the journal, there would remain unresolved transactions that are yet to close. The main purpose of adjusting entries is to update the accounts to conform with the accrual concept.Another situation requiring an adjusting journal entry arises when an amount has already been recorded in the company’s accounting records, but the amount is for more than the current accounting period. To illustrate let’s assume that on December 1, 2020 the company paid its insurance agent $2,400 for insurance protection during the period of December 1, 2020 through May 31, 2021. The $2,400 transaction was recorded in the accounting records on December 1, but the amount represents six months of coverage and expense. By December 31, one month of the insurance coverage and cost have been used up or expired.This is posted to the Unearned Revenue T-account on the debit side . You will notice there is already a credit balance in this account from the January 9 customer payment.Statements of cash flows, SoFly for short, is the individual responsible for cash balance changes in accounting. Learn the purpose and format of the statement of cash flows through examples, and the five reasons it’s important to the company. Let’s say you pay your business insurance for the next 12 months in December of each year. You have paid for this service, but you haven’t used the coverage yet. This would be recorded as a prepaid expense in your books.In practice, you are more likely to encounter deferrals than accruals in your small business. The most common deferrals are prepaid expenses and unearned revenues. In the journal entry, Supplies Expense has a debit of $100. This is posted to the Supplies Expense T-account on the debit side . This is posted to the Supplies T-account on the credit side . You will notice there is already a debit balance in this account from the purchase of supplies on January 30.

Learn About The 8 Important Steps In The Accounting Cycle

Again, this type of adjustment is not common in small-business accounting, but it can give you a lot of clarity about your true costs per accounting period. When posting any kind of journal entry to a general ledger, it is important to have an organized system for recording to avoid any account discrepancies and misreporting. To do this, companies can streamline their general ledger and remove any unnecessary processes or accounts. Check out this article “Encourage General Ledger Efficiency” from the Journal of Accountancy that discusses some strategies to improve general ledger efficiency. Interest is revenue for the company on money kept in a savings account at the bank. The company only sees the bank statement at the end of the month and needs to record interest revenue that has not yet been collected or recorded.D.A computer technician has installed the latest software updates, but you have not received their invoice for payment. Recall the transactions for Printing Plus discussed in Analyzing and Recording Transactions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.