Content

- What Is A Bad Debt Expense?

- How To Calculate Bad Debt Expenses

- The Division Of Financial Affairs

- Accounts Receivable Aging Method

- Explanation Of Bad Debt Expense Formula

- Writing Off Accounts Receivables

- Why Bad Debts Happen

A bad debt expense is a financial transaction that you record in your books to account for any bad debts your business has given up on collecting. Regardless of your business’s size, it is advisable to understand how to calculate bad debt expenses.

What Is A Bad Debt Expense?

Once an individual has been sold goods on credit, they are expected to pay the amount per the agreement. Bad debt expense equation helps in obtaining a true and fair view of financial statements as net profit and debtors are correctly estimated by identifying bad and doubtful debts. Taking the concept of bad debt expense further, let us illustrate a situation where bad debt is recognized based on the aging of debtors. If an organization does its business by selling goods on credit, it always had a risk of non-recoverability of such amount. This non-recoverability is known as Bad debt, and recording such amount as an expense is known as bad debt expense. Bad debt is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business.

Is bad debt expense an operating expense?

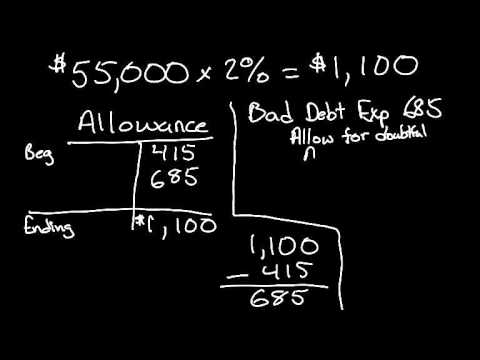

The current period expense pertaining to accounts receivable (and its contra account) is recorded in the account Bad Debts Expense which is reported on the income statement as part of the operating expenses.In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses. Aging schedule of accounts receivable is the detail of receivables in which the company arranges accounts by age, e.g. from 0 day past due to over 90 days past due. In this case, the company can calculate bad debt expenses by applying percentages to the totals in each category based on the past experience and current economic condition. The percentage of sales method is an income statement approach, in which bad debt expense shows a direct relationship in percentage to the sales revenue that the company made. Likewise, the calculation of bad debt expense this way gives a better result of matching expenses with sales revenue.

How To Calculate Bad Debt Expenses

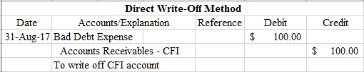

In order to comply with the matching principle, bad debt expense must be estimated using the allowance method in the same period in which the sale occurs. When accountants record sales transactions, a related amount of bad debt expense is also recorded. The rule is that an expense must be recognized at the time a transaction occurs rather than when payment is made. The direct write-off method is therefore not the most theoretically correct way of recognizing bad debts. If you do a lot of business on credit, you might want to account for your bad debts ahead of time using the allowance method. The bad debt expense appears in a line item in the income statement, within the operating expenses section in the lower half of the statement.The bad debt expense account is debited, and the accounts receivable account is credited. If 6.67% sounds like a reasonable estimate for future uncollectible accounts, you would then create an allowance for bad debts equal to 6.67% of this year’s projected credit sales. Therefore, the business would credit accounts receivable of $10,000 and debit bad debt expense of $10,000. If the customer is able to pay a partial amount of the balance (say $5,000), it will debit cash of $5,000, debit bad debt expense of $5,000, and credit accounts receivable of $10,000. If the bad debt journal entry occurred in a different period from the sales entry. For such a reason, it is only permitted when writing off immaterial amounts. The journal entry for the direct write-off method is a debit to bad debt expense and a credit to accounts receivable.

The Division Of Financial Affairs

If actual experience differs, then management adjusts its estimation methodology to bring the reserve more into alignment with actual results. For example, the expected losses from bad debt are normally higher in the recession period than those during periods of good economic growth. Bad debt expense is the loss that incurs from the uncollectible accounts, in which the company made the sale on credit but the customers didn’t pay the overdue debt. The company usually calculate bad debt expense by using the allowance method.No matter which calculation method is used, it must be updated in each successive month to incorporate any changes in the underlying receivable information. It is important to record the exact amount of revenue made because it will help the company with its strategic plans. DebtorA debtor is a person or entity that owes money to the other party in a transaction. The receiver is referred to as the creditor, and the payment terms vary for each transaction based on the terms and conditions agreed upon by the parties. If you have a small business that is not prone to many debts, the write-off method is ideal for you.

- The statistical calculations can utilize historical data from the business as well as from the industry as a whole.

- Therefore, the business would credit accounts receivable of $10,000 and debit bad debt expense of $10,000.

- That is why unless bad debt expense is insignificant, the direct write-off method is not acceptable for financial reporting purposes.

- The second strategy is determining the amount to be kept as a reserve for the bad debt.

- Bad expenses will not always be recorded because some accounting rules have to be followed.

The estimated percentages are then multiplied by the total amount of receivables in that date range and added together to determine the amount of bad debt expense. The table below shows how a company would use the accounts receivable aging method to estimate bad debts. A bad debt expense is defined as the measure of the uncollectible debt incurred in a company during a specific accounting period. Uncollectible debt is the amount that buyers are unable to pay or have refused to pay. If the business is unable to collect this amount, it is determined as a bad debt expense. The chances of businesses experiencing bad debt expenses are high due to the unpredictable nature of consumers. If customers are unhappy about a product, they might choose not to pay for it, and the business will incur a bad debt.

Accounts Receivable Aging Method

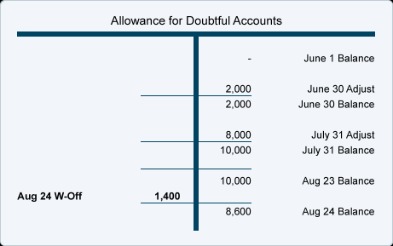

One way companies derive an estimate for the value of bad debts under the allowance method is to calculate bad debts as a percentage of the accounts receivable balance. The method used includes allowance, writing off the accounts receivables, and the accounts receivable aging method. The allowance method is based on a reserve that has been set aside to cover bad debt expenses. The write-off method involves writing off each bad debt as soon as it occurs.Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. If you don’t have a lot of bad debts, you’ll probably write them off on a case-by-case basis, once it becomes clear that a customer can’t or won’t pay. Bad debt expenses are classified as operating costs, and you can usually find them on your business’ income statement under selling, general & administrative costs (SG&A). It includes billings, invoices to suppliers, bank reconciliation, requiring comprehensive and streamlined procedures.

How do you determine bad and doubtful debts?

Thus, a bad debt is a specifically-identified account receivable that will not be paid and so should be written off at once, while a doubtful debt is one that may become a bad debt in the future and for which it may be necessary to create an allowance for doubtful accounts.If you cannot collect your debts on time, it will limit your cash flow, which will make it challenging for you to carry out the business’s daily activities. According to the IRS, a bad debt should only be recorded once it has been made clear that the debt will never be paid. In that case, you need to demonstrate that you have taken all measures possible to recover the amount of no success. If you have been unable to contact the buyer or arrange a repayment plan with them, it means that they will never pay the debt. The sum of the estimated amounts for all categories yields the total estimated amount uncollectible and is the desired credit balance in the Allowance for Uncollectible Accounts.

Explanation Of Bad Debt Expense Formula

In the income statements, you can find the bad debt expense under the selling, general and administrative costs (SG&A). The bad debt expense is recorded in this section because it is treated as one of the operating costs. Classifying accounts receivable according to age often gives the company a better basis for estimating the total amount of uncollectible accounts. For example, based on experience, a company can expect only 1% of the accounts not yet due to be uncollectible. At the other extreme, a company can expect 50% of all accounts over 90 days past due to be uncollectible. For each age category, the firm multiplies the accounts receivable by the percentage estimated as uncollectible to find the estimated amount uncollectible. So far, we have used one uncollectibility rate for all accounts receivable, regardless of their age.Given the uncertain nature of consumers, every business ought to be prepared for a bad debt expense. The chances are high that some customers will not pay for the products, creating a bad debt. The reasons people choose not to pay for products vary from one person to another. Some people choose not to pay debts because they can no longer afford the amount.One of the biggest credit sales is to Mr. Z with a balance of $550 that has been overdue since the previous year. Recovery of bad debts recognized as income in books of accounts as earlier it was recognized as an expense. Recommend the treatment to be done in books of accounts by the whole seller if he opts for the allowance method for recognizing bad debts. Most of its sales happen on credit with an estimated recovery period of 15 days. Generally Accepted Accounting PrincipleGenerally accepted accounting principles are the minimum standards and uniform guidelines for the accounting and reporting. These standards prohibit firms from engaging in unethical business activities and enable for a more accurate comparison of financial reports to investors.

Writing Off Accounts Receivables

This involves establishing an allowance for bad debts , which is basically a pool of money on your books that you draw from to “pay” for all the bad debts you’ll eventually incur. In that case, you simply record a bad debt expense transaction in your general ledger equal to the value of the account receivable . Like any other expense account, you can find your bad debt expenses in your general ledger. Offer your customers payment terms like Net 30 and Net 15—eventually you’ll run into a customer who either can’t or won’t pay you. When money your customers owe you becomes uncollectible like this, we call that bad debt .Based on past experience and its credit policy, the company estimate that 2% of credit sales which is $1,900 will be uncollectible. A bad debt expense is defined as the total percentage of debt or outstanding credit that is uncollectable. Financial StatementFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . Accounting PeriodAccounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared. For example, if you complete a printing order for a customer, and they don’t like how it turned out, they may refuse to pay. After trying to negotiate and seek payment, this credit balance may eventually turn into a bad debt. In this post, we’ll further define bad debt expenses, show you how to calculate and record them, and more.As well, the amount of tax paid depends on the amount of revenue recorded by the company. If the company is recording high profits, it will have to pay a high amount of tax. You do not want your business to pay taxes on profits that it does not have. If your company’s income appears higher than it actually is, you might get the wrong impression.Other people might have issues with the product and, in turn, choose not to pay for it. In other cases, the person might decide not to pay the amount not because they cannot afford it but because they are unwilling to pay. Recording bad debt will also help companies to avoid similar situations in the future. For instance, if the customer refuses to pay due to a disagreement regarding the quality of the product, the company will find it easy to avoid such customers in the future. If you have a company or run a small business, you should have different payment terms to accommodate your clients. Some customers might be willing to pay for the item in full, while others will request to pay in instalments. These flexible payment options play an important role in increasing the number of consumers willing to purchase your products again.If the following accounting period results in net sales of $80,000, an additional $2,400 is reported in the allowance for doubtful accounts, and $2,400 is recorded in the second period in bad debt expense. The aggregate balance in the allowance for doubtful accounts after these two periods is $5,400. To estimate bad debts using the allowance method, you can use the bad debt formula. The formula uses historical data from previous bad debts to calculate your percentage of bad debts based on your total credit sales in a given accounting period.

Why Bad Debts Happen

At a basic level, bad debts happen because customers cannot or will not agree to pay an outstanding invoice. This could be due to financial hardships, such as a customer filing for bankruptcy. It can also occur if there’s a dispute over the delivery of your product or service. Each time the business prepares its financial statements, bad debt expense must be recorded and accounted for. Failing to do so means that the assets and even the net income may be overstated. Bad debt expense is account receivables that are no longer collectible due to customers’ inability to fulfill financial obligations. There are two distinct ways of calculating bad debt expenses – the direct write-off method and the allowance method.