Content

- What Is Irs Form 1040

- Irs Free File & How To Get Free Tax Preparation Or Free Tax Help In 2021

- Youre Our First Priority Every Time

- Refund From Amendment

- What To Look For When You File The 1040x Form

- Get The Latest On Monthly Child Tax Credit Payments Here

- When Not To File An Amended Tax Return

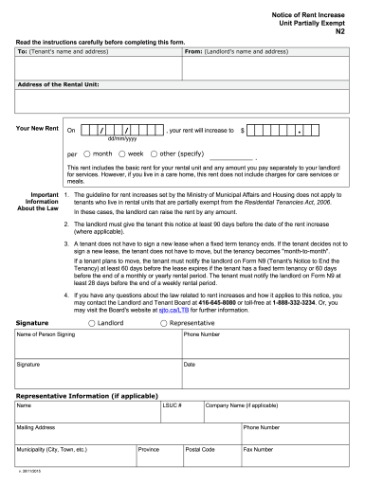

However, do not file your amended return until after you have received the refund. It generally takes the IRS 16 weeks to process an amended return, so you should wait at least 12 weeks before checking on the status of your new amended tax refund. Once your amended return has been processed, you will receive any additional refund you are owed. Amended tax returns need to be filed on paper; they can’t be filed online through e-file. If you need to amend more than one tax return, you should print out and prepare a separate Form 1040X for each tax year.It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details.. That’s why the IRS allows taxpayers to correct their tax returns if they discover an error on a return that’s already been filed.Ultimately, there are numerous reasons why a person may need to file a 1040X, and millions of amended returns are sent each year. If you made a mistake, just use the form and fix it. But make sure to take your time and double check your math, ensuring everything is right this time around. The same goes for any tax credits listed in the Payments section of the document.

What Is Irs Form 1040

Make sure you have access to a printer, scanner, envelope, and postage as well. The Form 1040X can’t be e-filed; it has to be sent through the mail. Plus, you have to send copies of various documents, such as the original return, W-2s and 1099s, so being able to scan them and print more is helpful. Filing an amendment is a pretty straightforward process. To help you get started, here are some Form 1040X instructions. If you cannot access the IA 1040X, you may send an IA 1040 for the year you are amending with the corrections made. Write “AMENDED” clearly on the top of the IA1040 and attach an IA 102 Amended Return Schedule.

Irs Free File & How To Get Free Tax Preparation Or Free Tax Help In 2021

See your Cardholder Agreement for details on all ATM fees. Supporting Identification Documents must be original or copies certified by the issuing agency.

- Second, rest assured that you are not the one and only person to make a mistake.

- You can file Form 1040-X electronically with tax filing software to amend 2019 or later Forms 1040 or 1040-SR.

- If you prepared and e-Filed your 2021 tax return on eFile.com, you can sign-in and prepare your IRS tax amendment right in your account.

- The IRS scrutinizes amended tax returns a little more carefully during processing, so take extra care to make sure your Form 1040-X is as complete and accurate as possible.

- TurboTax will select the right form for you when you prepare your federal amended return and supply instructions for mailing the correct forms to your state’s department of revenue.

This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting.

Youre Our First Priority Every Time

Unless otherwise stated, you still must complete all appropriate lines on Form 1040-X, as discussed under Line Instructions, later.. Are the entries you would have made on your original return had it been done correctly. For the latest information about developments related to Form 1040-X and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form1040X. Line 7—Nonrefundable CreditsCredit for qualifying children and other dependents. Line 2—Itemized Deductions or Standard DeductionItemized deductions. Reducing a casualty loss deduction after receiving disaster-related grant.If you are changing your withholding or excess SS/RRTA, attach to the front of Form 1040-X a copy of all additional or corrected Forms W-2 you received after you filed your original return. Also attach additional or corrected Forms 1099-R that show any federal income tax withheld. If you itemized your deductions, enter in column A the total from your original Schedule A or your deduction as previously adjusted by the IRS. Common mistakes corrected with this form include errors in the taxpayer’s filing status or number of dependents or omissions of credits or deductions. You can mail your amended return to the same IRS Service Center that processed your original tax return if you prefer to send in a paper copy. The IRS also provides a comprehensive list of mailing addresses on its website for various circumstances that require filing an amended return and depending on your state. Form 1040-X is an amended tax return for individuals.

Refund From Amendment

If you filed Formulario 1040-PR, file a Form 1040-X and attach a corrected Anexo H-PR. If you owe tax, pay in full with this return. Generally, you must file an amended return within three years from the original due date of the tax return in order to receive a refund. No penalty for additional tax is due if you voluntarily file an amended return and pay all tax due prior to any contact by the Department. Calculate the tax, penalty, and interest due, and include both your check and the IA 1040XV amended payment voucher with the amended return. You may make your tax payment online through ePay on our website or with a credit or debit card. You do not need to wait to receive your refund before filing an amended return. However, do not file an amended return on the same day that you filed your original return.

What To Look For When You File The 1040x Form

You should generally allow 8 to 12 weeks for Form 1040-X to be processed. However, in some cases, processing could take up to 16 weeks. Go to Where’s My Amended Return on IRS.gov to track the status of your amended return. It can take up to 3 weeks from the date you mail it to show up in our system. You will need to provide the following information. Write or type “Carryback Claim” at the top of page 1 of Form 1040-X. Attach a computation of your NOL using Schedule A and a computation of any NOL carryover using Schedule B .See IRS.gov/Filing/Amended-Return-Frequently-Asked-Questions for more information. IRS Data Retrieval Tool to populate some fields with information from your tax return. This tool will be found on the “Student Financial Information” page of the FAFSA®. Here’s a list of IRS phone numbers) or ask someone at a local IRS office to research your amended return.

Get The Latest On Monthly Child Tax Credit Payments Here

Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns. The IRS usually has three years to assess additional taxes. However, longer periods are allowed for significant underreporting of income and fraud. Column A. This column shows the numbers previously reported on your tax return. Use the copy of your tax return you gathered in Step 1 to complete this column. If you’re outside of that window, you can’t claim a refund by amending your return.Forms 1040 and 1040-SR returns can be amended electronically. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. You would not file the new, revised 1040 with your Form 1040-X, however. Form 1040-X effectively replaces a Form 1040 that contained errors. It allows you to set things right with the IRS, but it doesn’t just include the changed information.