Content

- Amending Your Return

- Can A Form 8888 Allocation Of Refund Including Savings Bond Purchases Be Filed With An Amended Return?

- What Is Happening When My Amended Return’s Status Shows As Completed?

- Where Can I Find More Information About Amending My Return?

- So What Do You Do When You Just Cant Get Your Return Accepted?

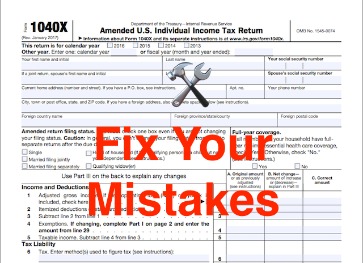

- What To Look For When You File The 1040x Form

Instead, you’ll get a message telling you what the problem was, and how to fix it. You can just correct the problem and refile your return. You can file your amended returnelectronically, or on paper. If you file electronically, follow the instructions for your software provider. 2 years from the payment of an assessment, provided the amended return raises issues relating only to the prior assessment and the refund does not exceed the amount of tax paid on the prior assessment.

Amending Your Return

Is the form you fill out to amend or correct a tax return. On that form, you show the IRS your changes to your tax return and the correct tax amount. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Starting price for simple federal return. Starting price for state returns will vary by state filed and complexity. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice.

- You can also do so with the help of H&R Block, with our various filing options and products.

- CAA service not available at all locations.

- You can file your amended returnelectronically, or on paper.

- It is very important that you submit all schedules and supporting documentation for any changes with your amended return.

If this occurs, the Internal Revenue Service has provided a way for these individuals to redo their taxes by providing an amended return form, Form 1040-X, on the IRS website. The IRS reports changes to federal returns to Virginia Tax. However, this can happen years after you receive your IRS notice, and interest will continue to accrue on any additional balance due starting from the original due date. To avoid additional interest on any tax due, file your amended Virginia return as soon as you are notified of a change to your federal income tax return by the IRS – don’t wait for us to notify you. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return .Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. See your Cardholder Agreement for details on all ATM fees.

Can A Form 8888 Allocation Of Refund Including Savings Bond Purchases Be Filed With An Amended Return?

NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding.This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X. If you owe additional tax, and the due date for filing that tax return hasn’t passed, you can avoid penalties and interest if you file Form 1040-X and pay the tax by the filing due date for that year . If the filing due date falls on a Saturday, Sunday, or legal holiday, your amended return is timely if filed or paid the next business day. If you file after the due date, don’t include any interest or penalties on Form 1040-X; they will be adjusted accordingly. The number of dependents claimed is inaccurate.

What Is Happening When My Amended Return’s Status Shows As Completed?

For paper returns, mark the oval labeled “Amended Return.” Complete the new return using the corrected information, as if it were the original return. Do not make any adjustments to your amended return to show that you received a refund or paid a balance due with your original return.If you need to amend your federal return, you should most likely amend your state return as well. Find out about state tax amendmentsand previous tax year amendments. Keep in mind that if you file an amended tax return on paper rather the e-filing, it can take the IRS eight to 12 weeks to process the amendment. You can check the status of your amended return using the IRS’ Where’s My Amended Return? Wait about three weeks from the date you mailed your return for the information to show up in the IRS system. Changes in filing status, changes in the number of claimed dependents, incorrectly claimed tax credits and deductions, and incorrectly reported income are reasons individual taxpayers file an amended return.Here are some common reasons for filing an amended return and the steps you need to take. If your return is taking a long time to process or you are waiting on your tax refund for more than 21 days, you do not need to, nor should you, file a tax amendment. This will not speed up the process ; a tax amendment is only made to change or correct something on your accepted tax return. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

Where Can I Find More Information About Amending My Return?

She received the personal finance Best in Business award from the Society of American Business Editors and Writers, and she has written three books. This is the time of year when people learn about frequently overlooked tax deductions and credits — and they may also realize that they missed some of these breaks in the past, too.

So What Do You Do When You Just Cant Get Your Return Accepted?

The IRS usually receives copies of these forms, too, and will send you a notice if the information doesn’t match up with your return. “If you find a tax document after you file, you may want to amend,” says Morris Armstrong, a registered investment advisor in Cheshire, Connecticut. “The IRS does use a matching system, and if they find that issuing income document, they will send you a notice with the additional tax, interest and penalties, if any.” Another retroactive change was the itemized deduction for mortgage insurance premiums.

What To Look For When You File The 1040x Form

Mail all the forms and documents to the address provided in the instructions. You realize you claimed an expense, deduction or credit that you weren’t eligible to claim.You can also manage your communication preferences by updating your account at anytime. You will be asked to register or log in. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely.