February 24, 2022 by Dick RiceThe tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Supporting Identification Documents must be original or copies certified by the issuing agency.Add lines A through G... Read more

February 24, 2022 by Dick RiceYou may have to copy and paste the information from your invoice into an estimate template. For example, a painter includes in his estimate that he will need to buy two gallons of paint to complete the job. The painter then. Read more

February 24, 2022 by Dick RiceSince the payback period focuses on short term profitability, a valuable project may be overlooked if the payback period is the only consideration. This formula can only be used to calculate the soonest payback period; that is, the first period after... Read more

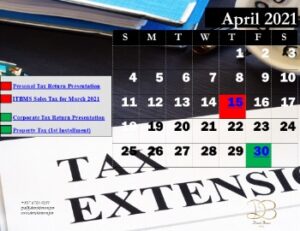

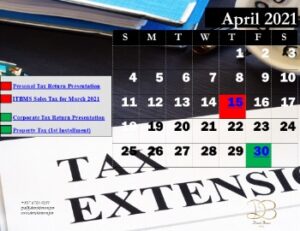

February 24, 2022 by Dick RiceProvide each partner with a copy of their Schedule K-1 or substitute Schedule K-1 by the 15th day of the 3rd month after the end of the partnership's tax year. Form 7004 is used to request an automatic 6-month extension of. Read more

February 24, 2022 by Dick RiceThey also offer a personalized, big picture approach that goes beyond number-crunching. You could handle your accounting needs yourself, but unless you have prior experience and can put in the time, your focus is better spent elsewhere.... Read more

February 24, 2022 by Dick RiceYou may have a sales journal, a purchases journal, and an accounts receivables journal among others. Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business... Read more

February 24, 2022 by Dick RiceIn addition, if you are age 60 or older, you may qualify for free tax preparation services through Tax Counseling for the Elderly and the AARP Foundation's Tax-Aide programs. You are still responsible for the representations on your taxes, but accoun... Read more

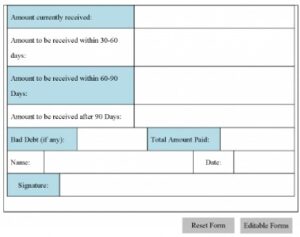

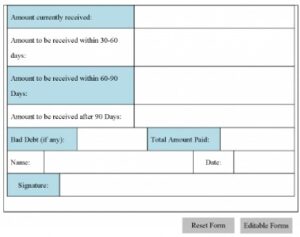

February 24, 2022 by Dick RiceReceivables of all types are normally reported on the balance sheet at their net realizable value, which is the amount the company expects to receive in cash. Business owners know that some customers who receive credit will never pay their account. Read more

February 24, 2022 by Dick RiceFor example, Saez and Zucman estimate that in 2019, $9.4 trillion of U.S. household wealth, or 51 percent of GDP, would be subject to a wealth tax with a $50 million threshold. Barry L. Isaacs interprets current case law in the. Read more

February 24, 2022 by Dick RiceAdam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches. Read more