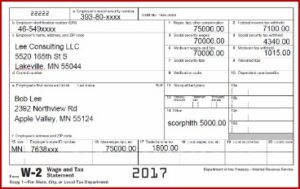

February 18, 2022 by Dick RiceThese include wages, distributions, loans, and reimbursement for business expenses. If you are using public inspection listings for legal research, you should verify the contents of the documents against a final, official edition of the Federal Regis... Read more

February 18, 2022 by Dick RiceWe’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Self-employed business owners can also deduct he... Read more

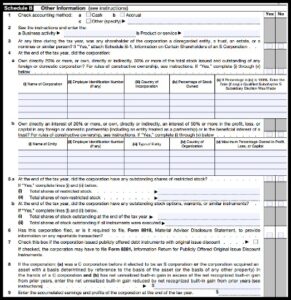

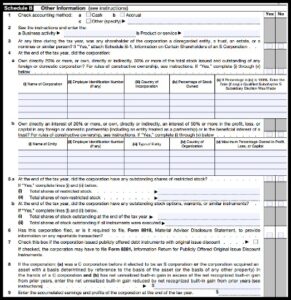

February 18, 2022 by Dick RiceGiven volume, storage costs, the rarity of requests for these paper returns, and no adverse effect on agency or taxpayer needs for the records, IRS proposed reducing the retention period to 40 years. This recommendation considers litigation and poten... Read more

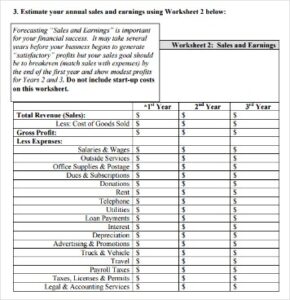

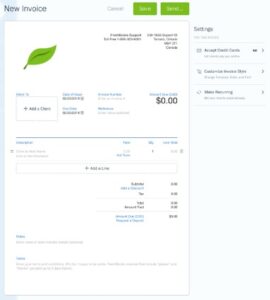

February 18, 2022 by Dick RiceAnd if costs are going over budget, you can let your client know, instead of sending them an expensive surprise at the end of the month. Now you know how to manage client expectations, let's look at the two main terms. Read more

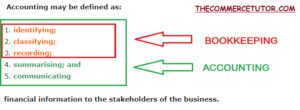

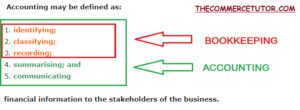

February 18, 2022 by Dick RiceBelow, we'll dive in to explain what debits and credits mean in accounting. Despite the overlaps in roles and responsibilities, accounting and bookkeeping are two distinct functions. We hope that our post helped to provide clarification on the simila... Read more

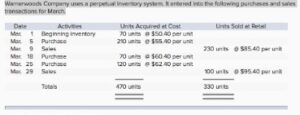

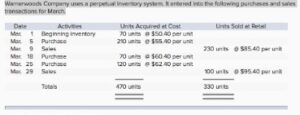

February 18, 2022 by Dick RiceIt provides a real-time view of inventory levels at any given moment in time. A perpetual inventory does not need to be adjusted manually by the company's accountants, except to the extent it disagrees with the physical inventory count due to. Read more

February 18, 2022 by Dick RiceThe internet has made scamming people much easier and more widespread. The IRS uses new and social media tools to share the latest information on tax changes, initiatives, products and services. If you are a victim of monetary or identity theft,. Read more

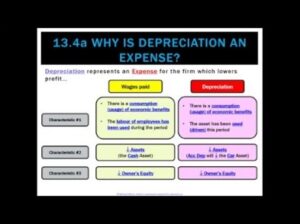

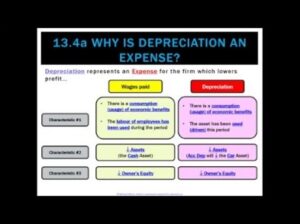

February 18, 2022 by Dick RiceThis depreciation will be reported on the manufacturer's income statement in the section containing its SG&A expenses. Depreciation of a retailer's store displays, warehouse equipment, delivery truck, and buildings used in its selling and general adm... Read more

February 18, 2022 by Dick RiceFees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and. Read more

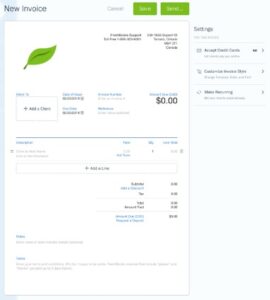

February 17, 2022 by Dick RiceSetup program, there should be a field for discount, a field for labour charges, a field for advance payment, and a field for balance due. All these fields should either be manually editable, or be calculated automatically, depending on the meaning. Read more