Dick Rice

Dick Rice is highly qualified specialist in the field of economics. He has been engaged in trading for over 10 years, mentoring - for more than 5. He knows information that will be useful to both beginners and experienced traders: rating of forex brokers, trading strategies, auxiliary literature. Dan will be glad to help you become successful and significantly increase your income.

Phone: +1-612-578-9999

Email: d_rice@www.quick-bookkeeping.net

February 14, 2022 by Dick RiceThat’s because these types of workers pay self-employment tax on their income. On the other hand, if someone is a bona fide employee, you’re required to deduct the necessary taxes. You can submit Form SS-8, Determination of Worker Status ... Read more

February 14, 2022 by Dick RiceThis allows you to see exactly where your money is going and how it fits in your budget. Tracking your spending doesn’t just show you which areas to cut back on spending. It can also highlight the areas that could benefit. Read more

February 14, 2022 by Dick RiceYou also need you also need to select an accounting method. Finally, you digitally sign your return and submit it to the IRS. You have the option of printing off a copy for your records. Filing taxes may be the finish. Read more

February 14, 2022 by Dick RiceThis template is created by another fellow Medium writer, Shawn Forno. It gives you a barebones, but colorful, template that you can use to list out the items that you worked on for the client and the price that needs to. Read more

February 14, 2022 by Dick RiceContact your chosen bank to see what paperwork you’ll need to provide to open your account. This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control. Read more

February 14, 2022 by Dick RiceCommon stock is part of stockholders' equity, which is on the right side of the accounting equation. As a result, it should have a credit balance, and to increase its balance the account needs to be credited. It can take some. Read more

February 14, 2022 by Dick RiceThis use of company automobiles by employees is not a qualified business use. Treat the use of listed property for entertainment, recreation, or amusement purposes as a business use only to the extent you can deduct expenses due to its use. Read more

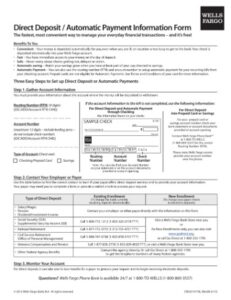

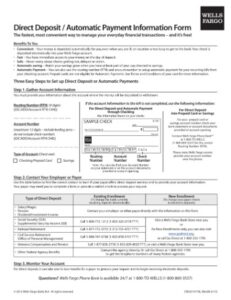

February 11, 2022 by Dick RiceFirst, ask for a copy of a canceled check, so you can verify the account and bank routing numbers manually. Next, do a single test deposit of a penny to ensure the payment goes through correctly. Banks often catch errors and. Read more

February 11, 2022 by Dick RiceAs part of the shift to a new tax regime, U.S. corporations were assessed a one-time tax on foreign profits; the tax can be paid over eight years. Trump’s tax cut bill slashed the corporate tax rate and eliminated and tightened. Read more

February 11, 2022 by Dick RiceAccounts Receivable has a credit of $5,500 (from the Jan. 10 transaction). The record is placed on the credit side of the Accounts Receivable T-account across from the January 10 record. In the last column of the Cash ledger account is. Read more