Dick Rice

Dick Rice is highly qualified specialist in the field of economics. He has been engaged in trading for over 10 years, mentoring - for more than 5. He knows information that will be useful to both beginners and experienced traders: rating of forex brokers, trading strategies, auxiliary literature. Dan will be glad to help you become successful and significantly increase your income.

Phone: +1-612-578-9999

Email: d_rice@www.quick-bookkeeping.net

February 4, 2022 by Dick RiceAs a result, the $200 loss is disallowed as a deduction on your current-year tax return and added to the cost basis of the repurchased stock. That bumps the cost basis of your $600 of replacement stock up to $800, so. Read more

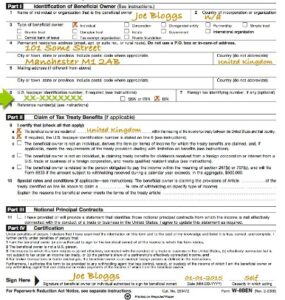

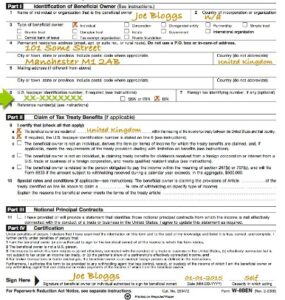

February 4, 2022 by Dick RiceIt also helps categorize foreign vendors doing business with U.S. companies. Sole proprietors and individuals must not fill out the W-8BEN-E form. Instead, they are required to submit the W-8BEN form to receive payment from U.S. companies. Using digi... Read more

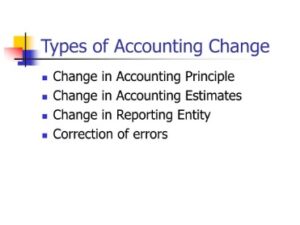

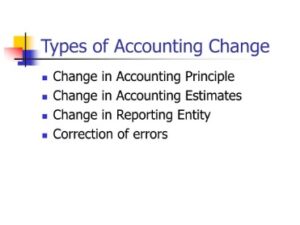

February 4, 2022 by Dick RiceCompanies can generally choose between two accounting principles, such as the last in, first out inventory valuation method versus the first in, first out method. It is imperative for financial markets to have accurate and trustworthy financial repor... Read more

February 3, 2022 by Dick RiceContact the sales tax information center to verify an organization's exempt status. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, inves... Read more

February 3, 2022 by Dick RiceAs your second direct reminder email telling the client his/her payment is overdue, you’ll need to be even firmer and more direct. A clear call to action and asking the client to confirm they received the invoice email will lessen the. Read more

February 3, 2022 by Dick RiceWith Freshbooks, your employees or volunteers can click a timer when they start working on a project and stop it once they’re finished. This gives you an accurate input on the amount of time it takes to complete projects and tracks. Read more

February 3, 2022 by Dick RiceCertain withholding agents, such as farm management companies, can choose to make estimated tax payments on behalf of nonresident taxpayers from sales of agricultural commodities or products. The payments should be made by the last day of the month f... Read more

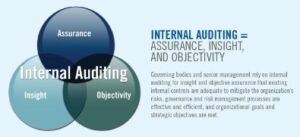

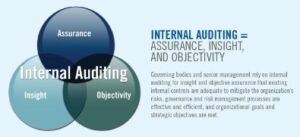

February 3, 2022 by Dick RiceA company's management has the responsibility for preparing the company's financial statements and related disclosures. The company's outside, independent auditor then subjects the financial statements and disclosures to an audit. The procedures the ... Read more

February 3, 2022 by Dick RiceThe company purchases another snowmobile for a price of $75,000. For the sale of one snowmobile, the company will expense the cost of the older snowmobile – $50,000. It stands for “First-In, First-Out” and is used for cost flow assumption... Read more

February 3, 2022 by Dick RiceHowever, this does not influence our evaluations. Here is a list of our partners and here's how we make money. Andrew Khouri covers the housing market for the Los Angeles Times. Before coming to The Times he wrote about commercial real. Read more