January 26, 2022 by Dick RiceImprove the efficiency of collections staff and reduce DSO with a self-service billing and payments community personalized for your customers. Empower them to manage their own accounts online and use built-in social tools for quick and easy communica... Read more

January 26, 2022 by Dick RiceProfessionals know tax secrets and all have insights into how to get the most out of deductions and can see opportunities for more savings that you may miss. Take advantage of their knowledge so that you can take advantage of more. Read more

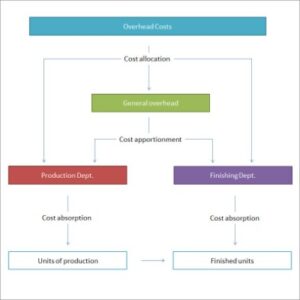

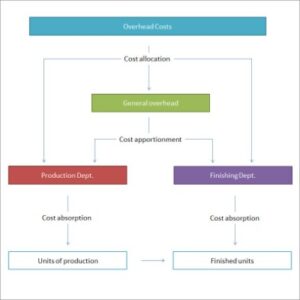

January 26, 2022 by Dick RiceUnlike operating expenses, overheads cannot be traced to a specific cost unit or business activity. Instead, they support the overall revenue-generating activities of the business. Overhead costs are all of the costs on the company’s income sta... Read more

January 26, 2022 by Dick RiceHiring a professional accountant may seem out of reach, but the costs could be worth the return. Gather the preliminary information you need to process payroll.Find your EIN through the IRS.But given all the payroll mistakes you can make , make. Read more

January 26, 2022 by Dick RiceInstead, you will later collect sales tax on those goods from your customers. Out-of-state businesses under the remote seller tax law that went into effect on October 1 are reminded to use business code 605 . The tax applies to remote. Read more

January 26, 2022 by Dick RiceBusiness credit cards can help an organization establish a credit history so it has a better chance at qualifying for financing , including lines of credit and loans, when it needs more capital. Additionally, credit cards offer perks for the business... Read more

January 26, 2022 by Dick RiceFinally, Puerto Rico filed for bankruptcy in 2017, having over $70 billion in bond debt and $49 billion in unfunded pension liabilities. Richard Shapiro, Tax Director and member of EisnerAmper Financial Services Group, has more than 40 years' experie... Read more

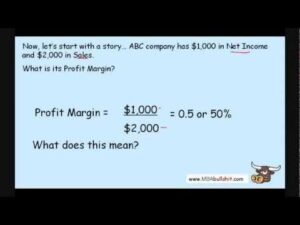

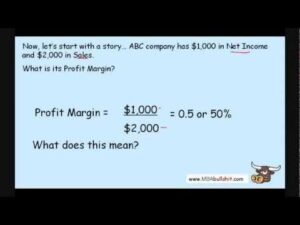

January 26, 2022 by Dick RiceThis gives investors and creditors a clear indication as to whether a company’s core business is profitable or not, before considering non-operating items. Operating income is the amount of revenue left after deducting the operational direct an... Read more

January 26, 2022 by Dick RiceThis is yet another way to help you write invoices that look and feel professional. These are the five steps to writing an invoice effectively and professionally. Include the discount at the bottom of your invoice, under the invoice subtotal. List. Read more

January 25, 2022 by Dick RiceNo credit is allowed for an individual whose federal adjusted gross income exceeds $50,000 ($25,000 for married filing separately). This credit is in addition to the subtraction modification available on the Maryland return for child and dependent ca... Read more