January 11, 2022 by Dick RiceThe IRS allows you to deduct daily travel costs of this long-distance commute. It’s important to note that many companies offer reimbursements to employees directly for mileage expenses; therefore, those employees cannot deduct business mileage... Read more

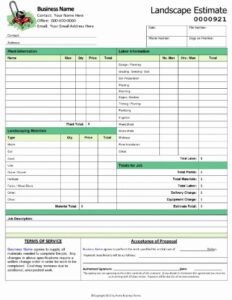

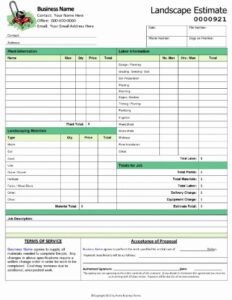

January 11, 2022 by Dick RiceConstruction estimating software creates cost estimates while reducing errors in calculations by automatically fetching the updated prices of materials from your cost database. Check out five reasons you should use construction estimating software. T... Read more

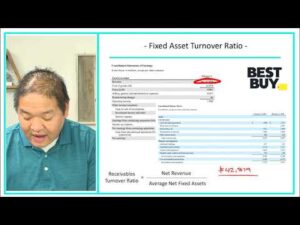

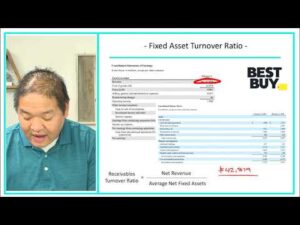

January 11, 2022 by Dick RicePublic companies are required to report these numbers annually as part of their 10-K filings, and they are published online. However, property, plant, and equipment costs are generally reported on financial statements as a net of accumulated deprecia... Read more

January 11, 2022 by Dick RiceFurthermore, if you have a dependent care flexible spending account through your employer, you can't use the money you set aside in that account and the Child and Dependent Care Credit toward the same expenses. But with the high cost of. Read more

January 11, 2022 by Dick RiceShe has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes a... Read more

January 10, 2022 by Dick RiceBy collecting these advanced payments, your business will find it easier to keep a positive cash flow and stay afloat during hard times. Unearned revenue represents a business liability that goes into the current liability section of the business' ba... Read more

January 10, 2022 by Dick RiceAdditionally, your employer also contributes the same amount -- a total of 7.65% of your wages. However, when you're self-employed, you are the employer and the employee. Therefore, you're responsible for paying all of the Social Security and Medicar... Read more

January 10, 2022 by Dick RiceReceiving is required for all purchases in order to make sure that we are paying for what we ordered. For purchases under $10,000, receiving is automatically done in the system by "negative confirmation" -- once PSDS receives an invoice, the departme... Read more

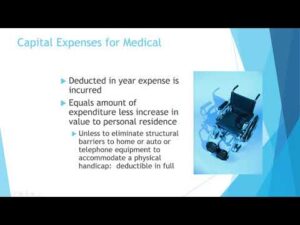

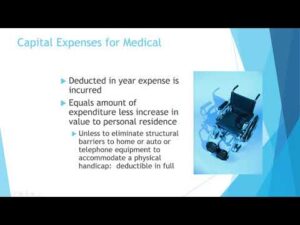

January 10, 2022 by Dick RiceMary would include the amounts she paid during the year on her separate return. If they filed a joint return, the medical expenses both paid during the year would be used to figure their medical expense deduction. You can include medical. Read more

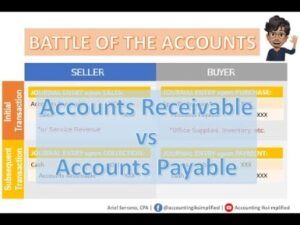

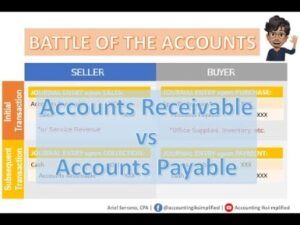

January 10, 2022 by Dick RiceThis above entry decreases your accounts payable balance by the amount of the bill, while also decreasing your bank account balance. Journal entry to add the office supplies bill to your accounts payable account.Accounts receivables are created becau... Read more