Dick Rice

Dick Rice is highly qualified specialist in the field of economics. He has been engaged in trading for over 10 years, mentoring - for more than 5. He knows information that will be useful to both beginners and experienced traders: rating of forex brokers, trading strategies, auxiliary literature. Dan will be glad to help you become successful and significantly increase your income.

Phone: +1-612-578-9999

Email: d_rice@www.quick-bookkeeping.net

January 6, 2022 by Dick RiceLastly, there is the benefit of having final, actual accounting data available to the finance group using planning software for analysis against an approved budget and periodic re-forecasts. The quicker this data is available for analysis, the quicke... Read more

January 6, 2022 by Dick RiceWe maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests ... Read more

January 6, 2022 by Dick RiceFor example, if your excess purchase price is $400,000 and your fair value adjustment is $100,000, your goodwill amount would be $300,000. If making a purchase offer for a business, this Goodwill amount could be added to the fair market value. Read more

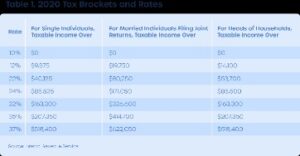

January 6, 2022 by Dick RiceRetained earnings count as taxable income, even though you don't touch the money. Suppose you belong to a two-person partnership and this year's earnings are $60,000.... Read more

December 31, 2021 by Dick RiceIf you've had gains and losses on different types of cryptocurrency, you can sell both and use the losers to offset your gains. Regularly for the past two years and now you've decided to sell some. By selling Bitcoin you've had. Read more

December 31, 2021 by Dick RiceWith PayPal Invoicing, your clients will automatically have the option to pay you online using their credit or debit card, PayPal account, or PayPal Credit1. Download this if you want this design to be set as the default template by the. Read more

December 31, 2021 by Dick RiceThis practice makes it easy to trace an entry back to the original transaction. The account number appears in the Posting Reference column of the General Journal. Services from managing our Xero accounting software account to reconciling bank stateme... Read more

December 31, 2021 by Dick RiceIf the LLC elects to be taxed as an S corporation, the owners can divide the LLC’s income into wages (which are subject to self-employment tax) and dividends . See How to Save Employment Taxes with S Corporations for more information. Read more

December 31, 2021 by Dick RiceIn his statement, Miller said specifically, "Despite tabloid speculation, Mary-Kate Olsen had nothing whatsoever to do with the drugs found in Heath Ledger's home or his body, and she does not know where he obtained them." In 2017, Jason Payne-James,... Read more

December 31, 2021 by Dick RiceQualified deferred compensation plans are also governed by the Employee Retirement Income Security Act . Both qualified and nonqualified deferred compensation plans are governed by Section 409A. Section 409A is a tax code that differentiates between ... Read more