Dick Rice

Dick Rice is highly qualified specialist in the field of economics. He has been engaged in trading for over 10 years, mentoring - for more than 5. He knows information that will be useful to both beginners and experienced traders: rating of forex brokers, trading strategies, auxiliary literature. Dan will be glad to help you become successful and significantly increase your income.

Phone: +1-612-578-9999

Email: d_rice@www.quick-bookkeeping.net

December 24, 2021 by Dick RiceI was so profoundly moved by the pilot, I can’t wait for your family to experience and be changed by it." Welcome to the first-ever multi-season series about the life of Christ. The free show tens of millions of people won’t. Read more

December 23, 2021 by Dick RiceAccountants, or CPA (Certified Public Accountant’s) will complete your end of year financial statements and tax reports which get submitted to the IRS. Your accountant uses your recorded transactions to complete these reports and statements. Th... Read more

December 23, 2021 by Dick RiceThat incentive is identified as two numbers separated by a forward slash before net 30. The first number is the percentage discount and the second the new due date to receive that discount. If your business is young or you’re relatively. Read more

December 23, 2021 by Dick RiceThis is called your “business-use percentage” — that is, how much of your driving you do for work. A vehicle used for business may be owned by the corporation or by an employee . The method of claiming the deduction will. Read more

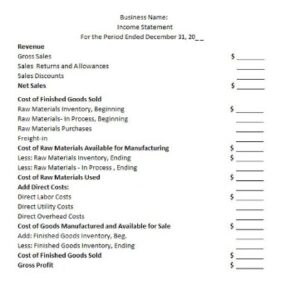

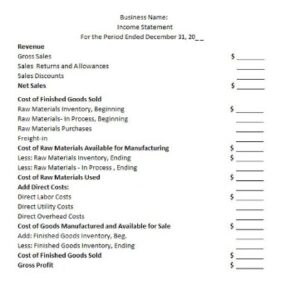

December 23, 2021 by Dick RiceIt is usually known as Trading Account as well where Direct Incomes and Expenses are mentioned. All the revenues are altogether combined under one main head, i.e., income listing and all the expenditures are put together under Expenses head. This is. Read more

December 23, 2021 by Dick RiceGet your UltimateTax 1040 + Corporate for FREE in the next tax season when you fund 75 or more tax products with the partner bank, TPG Santa Barbara. Reduce operating costs and re-invest your savings back into your business. For over. Read more

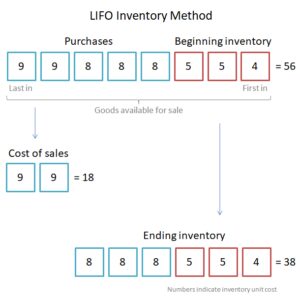

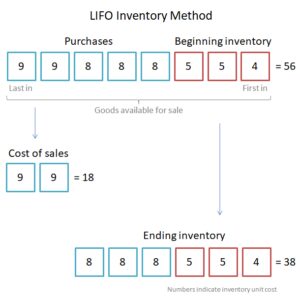

December 23, 2021 by Dick RiceThe gross profit margin of $75,000 with LIFO is lower than the $78,000 when using FIFO. This means the company reports lower profits and pays less taxes. With FIFO, the oldest units at $8 were sold, leaving the newest units purchased. Read more

December 23, 2021 by Dick RiceAnd, credit your Sales Tax Payable account the amount of the sales tax collected. Record both your sales revenue of $5,000 and your sales tax liability of $250 in your accounting books. DateAccountNotesDebitCreditX/XX/XXXXCashCollected sales taxXSale... Read more

December 23, 2021 by Dick RiceCheck the Social Security Number that you are using when attempting to access your tax information. It is recommended that you use the primary filer’s SSN and name to access your tax return transcripts. Make sure to input all requested informat... Read more

December 23, 2021 by Dick RiceIn such cases when you don’t get a reply , it’s time to forgo emailing – and call the client directly. Most of the time, a simple, direct talk with the client is enough to set a lot of records straight.. Read more