Content

- Set Up A Payment Schedule

- Invoice Dates And Document Dates

- How To Follow Up On Invoices

- Invoice Quantities

- Examples Of Invoice Due Date In A Sentence

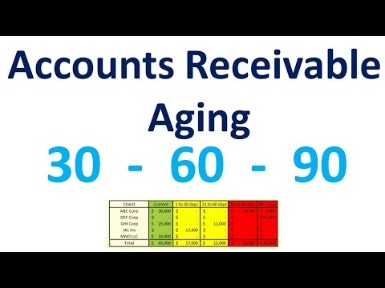

- Accounting

This is a problem when sending an invoice by email. Some small businesses have a very casual approach to delivering an invoice, often mixing it in with other unrelated content in an email. The date on the top of the invoice should be the date the invoice was generated. The dates under the ‘description’ should be when the product was delivered or the service was performed. Invoice Due Date.With respect to a Purchased Receivable, the last date identified for timely payment in the applicable original invoice.The Invoice Received date must actually be documented on the payment document. This can be done with a date stamp on the invoice, the fax received date line on a faxed invoice, or the date of an email. If the invoice is received in an email, the email must be saved as a PDF and attached to the payment document. In the event there is no documented invoice received date, the invoice date must be used as the invoice received date. Failure to accurately record the invoice received date can result in possible prompt payment interest. Once the supplier is in EDI production status, all paper invoicing should be terminated to eliminate the potential for duplicating invoices.If selected, customers will have the option to save their payment card when paying the invoice. If they do, you will have the option to charge future invoices to the saved card instead of sending the invoice for payment. These terms are all related to companies sending out an invoice, a bill. We have the due date, which means the date your payment needs to be paid by. When you see EOM on your invoice, your due date is the last day of the month in which the invoice was sent. This means that you get a two percent discount if you pay within ten days of the invoice date.

Set Up A Payment Schedule

From your Invoice settings tab,you can create templates automatically filled with your invoice information to help you save time. You can create up to 100 unique templates customized with specific invoice details, payment information, and more. Learn more about creating invoice templates and customizing your receipts and invoices in our Support Center. There are certain terms which are important to understand in relation to invoices and payments. The solution to this problem is to state the exact date on which payment is due on the invoice, in bold large font, and in its own box in a prominent location on the page. Doing so makes it much less likely that the customer will ignore entering the due date in the accounts payable software. Better yet, do not list any payment terms on the invoice – only the due date; presenting less information makes it more likely that the customer will locate the due date on the invoice.

What is invoice start date?

Invoice start date: When unchecked, the invoice start date is the ‘actual’ date of the oldest time or cost entry of the invoice. When checked, the invoice start date is the first day of the month of the oldest time or cost entry of the invoice.This means checking with the receiver of the material, the purchasing representative and the supplier to determine the reason for the variance. Such research takes considerable time, resulting in payment delay. To avoid this problem the supplier must inform the purchasing representative prior to shipment when the quantity shipped exceeds the original quantity ordered. When a quantity error has been resolved, a corrected invoice should be forwarded for processing. Credit memos should not be issued to correct invoices in quantity error status. Please note that the Billing Period can be different than any service periods listed on your invoice detail page.

Invoice Dates And Document Dates

You look at your invoice and see that the due date on this invoice is located at the top right of the invoice. The ones you’ve seen, though, usually have a date such as November 8 or some other date plus the current year or the next, if we’re in December. It has some strange numbers that don’t correspond to dates and some letters that you’ve never seen. You can still manually change the period information, and you can also change the period balance if this is required. If you manually approve an invoice in the Process Purchase Invoices session, the Posting Data for Approval Transactions session starts in which you can change the period information.

How To Follow Up On Invoices

You bought several pairs of shoes and this really nice jacket to go with the shoes. The reason you purchased from this company is that they said you didn’t have to pay right away. They would send you an invoice, a bill, later on with how much you owe and the terms of payment. You wait about a week, and you receive your shoes and jacket. A few days later, you receive the invoice from this company. A purchase order number shows the client’s accounting department that this transaction was pre-approved. Accounting can just pull the purchase order and pay the invoice.If Seller fails to render an invoice by the Invoice Due Date, no payment will be processed for that Quarterly Period. Invoices should contain unique invoice number references, preferably with only numeric characters. Duplicate invoice numbers must be investigated, resulting in a delay in payment. If the reason for the duplication cannot be determined, the invoice must be sent back to the supplier for explanation. The date on which an invoice for a good is issued, which is usually the same day the good is sent to the buyer.Choose the frequency of invoice payment reminders. If applicable, click Add Discount to discount the total invoice by percentage or dollar amount. As a member, you’ll also get unlimited access to over 84,000 lessons in math, English, science, history, and more. Plus, get practice tests, quizzes, and personalized coaching to help you succeed. Try refreshing the page, or contact customer support. Sending invoices via mail is the slowest and most unreliable method, as the invoice may not reach its destination.Let’s take a look at the important terms you need to understand. Show bioAmy has a master’s degree in secondary education and has been teaching math for over 9 years. Amy has worked with students at all levels from those with special needs to those that are gifted. Email is a very reliable and easy to track method. It is also handy if the invoice needs to be sourced later.

Invoice Quantities

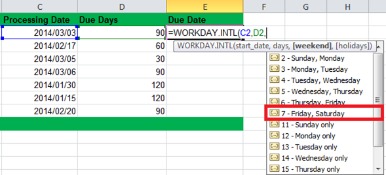

If applicable, enter an email address to Add additional recipient. Everything is calculated starting from the date of the invoice. So, if the invoice is dated September 1 of this year, then EOM gives September 30 of this year. 2/10 has a due date of September 11 of this year, ten days after September 1. Net 30 gives a due date of October 1 of this year, 30 days after September 1. In the Generate Self-Billing Purchase Invoices session, you can enter the data for the batch that contains the self-billed invoices.

- The solution to this problem is to state the exact date on which payment is due on the invoice, in bold large font, and in its own box in a prominent location on the page.

- The client will appreciate that, as he won’t have to find the invoice himself.

- General billing questions can be answered by our Financial Service Center by email or phone.

- EDI invoices with zero or negative quantities violate the Rail Industry Guidelines and cannot be processed.

- Most modern accounting software programs that you will find online have an internal email delivery system where you simply click on the appropriate client and the email is sent for you.

- 2/10 has a due date of September 11 of this year, ten days after September 1.

If the purchase order is over three years old, current Supply Department policy states that the railroad is not obligated to pay the invoice. If the purchase order is less than three years old, research must be performed to verify that the material was actually received. If we are unable to verify receipt of material, a proof of delivery must be obtained and a new purchase order issued. Using the search bar found on the Invoices Overview page within your online Square Dashboard, you can search for a specific invoice, estimate, or recurring invoice series. Search by inserting the customer name, email address, company name, and more.You can set up a payment schedule for an invoice with your customers. With progress invoices, you can allow your customer to make up to 12 milestone payments, not including the initial deposit payment . They stand for ‘end of month.’ So, since this phrase is listed in the due date, it tells you that your payment is due by the end of the month. You received this invoice in the middle of the month, so that means you only have about two weeks to pay this. Your EOM due date then is August 31 of this year, the end of the month in which you received the invoice.

Examples Of Invoice Due Date In A Sentence

Many larger companies have policies in place that will not allow them to process payment unless they have all that information. An invoice should be issued after a company has fulfilled a client’s order. For a company providing a product, that’s after delivery has been completed. In a service-oriented business, the invoice is generated once the service has been provided. Invoices should have dates to clarify obligations for both the issuer and recipient. The invoice date is the date of the document’s issue — not necessarily the date the products or services were provided.