Content

- What Is The Breakeven Point Bep?

- Warning: Dont Forget Any Expenses

- Variable Costs Per Unit

- Understanding Contribution Margins

- Relationships Between Fixed Costs, Variable Costs, Price, And Volume

- See How Finding Your Businesss Break

- Start Your 14

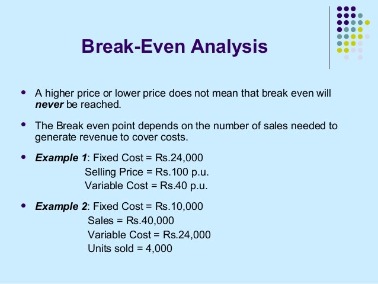

- Example Of Break Even Analysis

For example, if you’ve been selling online and you’re thinking about doing a pop-up shop, you’ll want to make sure you at least break even. Otherwise, the financial strain could put the rest of your business at risk. Some costs can go in either category, depending on your business. But if you pay part-time hourly employees who only work when it’s busy, they will be considered variable costs. First we take the desired dollar amount of profit and divide it by the contribution margin per unit.If you’re already in business, it will help you understand how much money you need to set aside to operate and grow your brand. Fixed costs don’t fluctuate based on the number of units sold.

What Is The Breakeven Point Bep?

So, after deducting $10.00 from $20.00, the contribution margin comes out to $10.00. And just like the output for the goal seek approach in Excel, the implied units needed to be sold for the company to break even comes out to 5k. Or, if using Excel, the break-even point can be calculated using the “Goal Seek” function.

How do you calculate EPS per share?

Determining Market Value Using P/E Multiply the stock’s P/E ratio by its EPS to calculate its actual market value. In the above example, multiply 15 by $2.50 to get a market price of $37.50.Don’t worry if you don’t have a unit selling price set in stone since the break-even analysis will help you with finding the right price. A break-even analysis is a great tool that tells you at what point your total costs meet your total revenues. It can be used to test out business ideas, determine whether or not you should introduce a new product to your business, or show what will happen if you change your pricing strategy. Finding your break-even point is crucial to understand if your fixed and variable costs need to be evaluated, and perhaps reduced. In some cases you can increase your retail prices, but when this is not an option you’ll need to look at your business costs and try to improve them to break even. Your break-even analysis will show you whether your retail product pricing is too low or if your fixed or variable costs are too high.It’s also important to keep in mind that all of these models reflect non-cash expense like depreciation. A more advanced break-even analysis calculator would subtract out non-cash expenses from the fixed costs to compute the break-even point cash flow level. Now Barbara can go back to the board and say that the company must sell at least 2,500 units or the equivalent of $1,250,000 in sales before any profits are realized. Next, Barbara can translate the number of units into total sales dollars by multiplying the 2,500 units by the total sales price for each unit of $500.In most cases, you can list total expenses as monthly amounts, unless you’re considering an event with a shorter time frame, such as a three-day festival. If you’re using the break-even analysis spreadsheet, it will do the math for you automatically. Before we calculate the break-even point, let’s discuss how the break-even analysis formula works. Understanding the framework of the following formula will help determine profitability and future earnings potential. After completing a break-even analysis, you know exactly how much you need to sell to be profitable.

Warning: Dont Forget Any Expenses

Even if your fixed costs, like an office lease, stay the same, you’ll need to work out the variable costs related to your new product and set prices before you start selling. Assume a company has $1 million in fixed costs and a gross margin of 37%. In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs.The break-even point is your total fixed costs divided by the difference between the unit price and variable costs per unit. Keep in mind that fixed costs are the overall costs, and the sales price and variable costs are just per unit. In other words, the breakeven point is equal to the total fixed costs divided by the difference between the unit price and variable costs. Calculating the breakeven point is a key financial analysis tool used by business owners. Small business owners can use the calculation to determine how many product units they need to sell at a given price pointto break even. To stay afloat, at some point businesses must be able to turn a profit.You’ll need to know the sales price per unit, fixed costs, variable costs, revenue and contribution margin calculations. The break-even point formula is calculated by dividing the total fixed costs of production by the price per unit less the variable costs to produce the product.

Variable Costs Per Unit

You run a tight ship and are able to keep your costs fairly low. As a business owner or aspiring entrepreneur, you may be wondering how you can apply this to your current situation. To paint a clearer picture, let’s walk through a real-world example.

- Once you have your break-even point in units, you’ll be making a profit on every product you sell beyond this point.

- Finding your break-even point is crucial to understand if your fixed and variable costs need to be evaluated, and perhaps reduced.

- If you already have a business up and running, then you already know what you’re currently selling products and services for.

- As a business owner or aspiring entrepreneur, you may be wondering how you can apply this to your current situation.

- These opinions, findings, or experiences may not be representative of what all customers may achieve.

- A firm can analyze ideal output levels to be knowledgeable on the amount of sales and revenue that would meet and surpass the break-even point.

- When your company reaches a break-even point, your total sales equal your total expenses.

For example, if you know you need to sell 200 pairs of jeans per month to break even, you can plan to buy and sell more so you will not only break even but also make money. But if you buy 250–300 pairs of jeans, you’ll need to devise a strategy to sell the units in one month. Many small and medium-sized businesses never carry out financial analysis.

Understanding Contribution Margins

Or any of its affiliates are not liable for decisions made or actions taken in reliance on any of the testimonial information provided. Find and apply for the Ink business credit card best suited for your business. Find a variety of financing options including SBA loans, commercial financing and a business line of credit to invest in the future of your business. Chase offers a wide variety of business checking accounts for small, mid-sized and large businesses.

Relationships Between Fixed Costs, Variable Costs, Price, And Volume

Turning a profit is the goal of every business, but it doesn’t happen overnight. Calculating the break-event point is a useful tool to determine when your product will become profitable. The BEP is the point at which your total costs and total revenue are equal. If you’re thinking about changing your business model, for example, switching from dropshipping products to carrying inventory, you should do a break-even analysis. Your startup costs could change significantly, and this will help you figure out if your prices need to change too.The next step is to divide your costs into fixed costs, and variable costs. To find your break-even point, divide your fixed costs by your contribution margin ratio.

How do you calculate break even volume?

Divide the start-up costs by the profit per unit. This is the break even volume. In the example, $100,000/$1 means you have to sell 100,000 units to break even.The break-even quantity at each selling price can be read off the horizontal axis and the break-even price at each selling price can be read off the vertical axis. The total cost, total revenue, and fixed cost curves can each be constructed with simple formula.

See How Finding Your Businesss Break

Your revenue is also used to calculate your business’s profit. Profit is simply your total revenues minus your total costs. The break-even point is when a company’s total costs meet its total revenues. Put simply, it’s the turning point for when a company is able to make a profit. Knowing how many units you need to make and then sell to customers will help you determine what your startup costs will be.That means the investor has the right to buy 100 shares of Apple at $170 per share at any time before the options expire. The breakeven point for the call option is the $170 strike price plus the $5 call premium, or $175. If the stock is trading below this, the benefit of the option has not exceeded its cost.Fixed costs are expenses that remain the same, regardless of how many sales you make. These are the expenses you pay to run your business, such as rent and insurance. First we need to calculate the break-even point per unit, so we will divide the $500,000 of fixed costs by the $200 contribution margin per unit ($500 – $300). When the number of units exceeds 10,000, the company would be making a profit on the units sold.Running a business requires you to spend money upfront on a range of fixed costs necessary for doing business. You also need to pay out money for every unit or service you produce. If turning a profit seems almost impossible, then you may want to reconsider the idea or adjust your current business model to cut costs and bring in more revenue.The more units or services you sell, the more money you’ll need to pay. The time frame will be dependent on the period you use to calculate fixed costs . For this, you’ll need to rely on good cash flow management, and possibly a solid sales forecast.For example, a business that sells tables needs to make annual sales of 200 tables to break-even. At present the company is selling fewer than 200 tables and is therefore operating at a loss. As a business, they must consider increasing the number of tables they sell annually in order to make enough money to pay fixed and variable costs. The break-even value is not a generic value as such and will vary dependent on the individual business. Some businesses may have a higher or lower break-even point. However, it is important that each business develop a break-even point calculation, as this will enable them to see the number of units they need to sell to cover their variable costs.What this answer means is that XYZ Corporation has to produce and sell 50,000 widgets in order to cover their total expenses, fixed and variable. At this level of sales, they will make no profit but will just break even. The main purpose of break-even analysis is to determine the minimum output that must be exceeded for a business to profit. It also is a rough indicator of the earnings impact of a marketing activity. A firm can analyze ideal output levels to be knowledgeable on the amount of sales and revenue that would meet and surpass the break-even point.