Content

- Mint

- Software Is The Set Of Programs That Enables The Computers Hardware Devices And Application Software To Work Together?

- The Best Tech And Apps For Your Home Office

- On Average, New Budgeters Save $600 In Their First Two Months And More Than $6,000 Their First Year

- How To Build Your Wedding Budget

- Why You Should Be Monitoring Your Checking Account Regularly

- The Best Budgeting App For Most People

- Get The Answers App

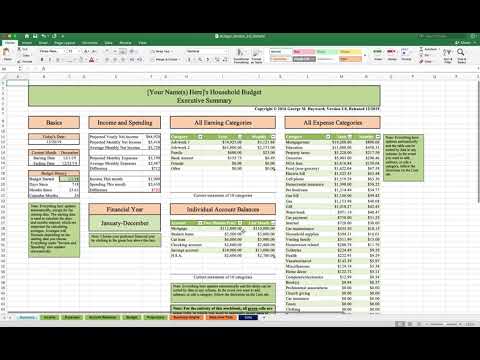

It’s not as easy to set up and use as Simplifi, but if you’re the type to maintain a diet by tracking every calorie, YNAB’s zero-based budgeting approach might strike the right chord for you. The most basic budget apps typically connect with your financial accounts, track spending and categorize expenses so you can see where your money is going. Budgeting apps are downloaded on your mobile phone or tablet to be used on the go, but not all accounting software has this option.

Mint

More popular with Millennials, this app has free and paid versions. You can also individually purchase features from the paid version. One major benefit of Wally is its built-in support for virtually all foreign currencies, which makes it a better option for those who live outside of the United States. You Need A Budget offers a different approach to budgeting by giving every dollar a job. Our editors independently research and recommend the best products and services.

Software Is The Set Of Programs That Enables The Computers Hardware Devices And Application Software To Work Together?

Celes recently shared the latest iteration of her budget template on Reddit, which has an active and growing personal-finance community. The post has over 10,000 upvotes — a sign of approval from fellow Reddit users. See where all your money goes by easily adding your cash, credit cards, investments, and bills. Personal financial management is the software that powers personal finance and many mobile banking apps. Mint.com is an online personal finance tool that allows you to track your spending and helps you make a budget. Both the site and app are intuitive to use, but Simplifi offers a very capable chat function that’s available from 8 a.m. Tap the blue icon with a creepy smile in the bottom right-hand corner of your screen, and you’ll quickly be connected with a customer rep who’s an actual person.With real-time budget matching, you will know whether you can buy that cappuccino or need to wait for your budget to reset next month. If you need help reining in your spending and getting your personal finances under control, a budgeting app may be just what you need.

- The first one million dollars invested is charged a management fee of 0.89%.

- Use the variable and fixed expenses you compiled to help you get a sense of what you’ll spend in the coming months.

- Forget everything you think you know about budgeting and prepare to experience total control.

- Although you can use fancy budgeting software, sometimes a simple sheet of paper or a spreadsheet can be sufficient.

For example, it may be easier to cut spending if you know your short-term goal is to reduce credit card debt. Like many apps and programs, Mint initially requires extra steps signing on and connecting your accounts. Syncing accounts like checking, credit cards, and bills are key because this is how Mint works—by curating your finances and providing an overall picture at a glance.The first one million dollars invested is charged a management fee of 0.89%. However, without paying a cent, you can access Personal Capital’s free money tracking dashboard, which includes some handy budgeting features.

The Best Tech And Apps For Your Home Office

For others, creating a spending plan gives them a feel-good dopamine boost. Wherever you are on that spectrum, a budgeting app can be a great tool to help you achieve your financial goals. Has you connect your financial accounts, then the app tracks and categorizes your transactions. You’ll get alerts when you’re over your budget in a particular category, if it spots a large or suspicious transaction and if you’ve paid ATM fees. Mint also lets you track all your bills in one place and reminds you when upcoming payments are due. All these features are free — including its credit monitoring service. While it isn’t free, Mvelopes offers the ability to connect to unlimited financial accounts and put classic envelope budgeting to use to track your regular spending.A software program may be an integral part of this entire process, aiding with the collection of data, analysis of results, and presentation of financial reporting. Examples of software range from Microsoft Excel on one end to SAP on the other end. In this article, we will examine and compare various types of software for budgeting purposes. You would use ……….software to createspreadsheets, type documents, and edit photos.

On Average, New Budgeters Save $600 In Their First Two Months And More Than $6,000 Their First Year

And while they may never happen, it’s still smart to plan for them . This also includes money you set aside in other savings vehicles, such as a 401 or a 529 plan. Personal Capital offers some transaction tracking tools, but it has limited true budgeting features. With this method of budgeting, you won’t have a clever app to remind you to stay on top of things. If you happen to spend more on dining out than expected, either adjust your behavior or update your budget for the following month. The whole point of this exercise is to gain a better sense of how much money you have coming in and out so you can improve your financial life.

How To Build Your Wedding Budget

Both of our picks offer a free trial period, so you should experiment before settling on one option. And if you don’t want to use an app, we have tips on how to make a budget on your own for free. Many or all of the products featured here are from our partners who compensate us.Collect all of your bank and credit card statements over the past year. A year’s worth can give you a good sense of how much you tend to spend over a given period of time. Most institutions let you export your transactions as a CSV file that you can open in Google Sheets, Excel, or Numbers.Mint provides multiple ways for you to create and manage a budget. It’s noted for its simplicity and informative overview of your finances, and it is free to try. If you want to use Mint, you must sync all of your financial accounts, or at least the ones you want to utilize via Mint. Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Kirsten is also the founder and director of Your Best Edit; find her on LinkedIn and Facebook.

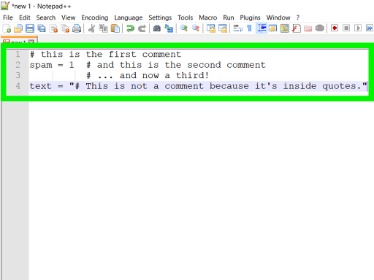

Checking Your Browser Before Accessing Onlinelibrary Wileycom

The cash flow and budgeting tools are not quite as extensive as other apps on this list, but they work just similarly using the same automated tracking of purchases from linked accounts. This is a bit more challenging with credit and debit cards, but Mvelopes makes it easy to follow cash-style budgets in a digital budgeting world. Zero-based budgeting is a budgeting style wherein the sum of your income minus your expenses equals zero. Putting every dollar into a defined category means you’re tracking all of your earnings, which is helpful when you’re trying to stick to a budget. While Mint does have something approximating Simplifi’s spending plan, it’s nowhere near as powerful or elegant.

Why You Should Be Monitoring Your Checking Account Regularly

“And I got to talking to you, I realized that it definitely changed my life, so I don’t know why that wouldn’t extend to other people.” Stay on top of your finances by seeing where your money comes and goes. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. Melanie Pinola is a Wirecutter senior staff writer covering all things home office. She has contributed to print and online publications such as The New York Times, Lifehacker, and PCWorld, specializing in tech, productivity, and lifestyle/family topics. She’s thrilled when those topics intersect—and when she gets to write about them in her PJs.You might choose to break down your expenses even further, between things you need to have and things you want to have. For instance, if you drive to work every day, gasoline probably counts as a need.It lets you sync your bank accounts seamlessly, and it offers a combination of helpful tools and user-friendly design that encourages you to stay within your means. Simplifi isn’t free, but it’s cheaper than competitors with comparable features. Plus, having some skin in the game may compel you to stick with it. Is a budget app that helps you track your spending and plan for purchases. It’s tailored for zero-based budgeting, which is a method where your expenses equal your income.

Get The Answers App

To help you get started, we’ve created a budgeting template you can download. A spokesperson for Mint told us that “Mint only shares data where customers have directed us to do so, or in other cases described in our Privacy Statement. We never sell customer data.” We couldn’t find a way to opt out of advertising or to not consent to the data collection and identification other than closing the account at Mint. Nevertheless, YNAB’s price is worth it if the zero-based budgeting system clicks for you. YNAB offers only email support, but there is a panoply of aids—from help docs to support forums to video courses to 20-minute workshops—to help you get comfortable and confident using the app. You’ll likely find this under your account settings under a security tab. Follow YNAB to get support and lots of great ideas on budgeting.Rebecca is an expert in personal finance, business, and financial markets. Estimate how much you’ll spend in different categories each month over the next year. For instance, maybe your typical $500 grocery bill jumps to $700 in November and December, or you pay your homeowners insurance premium at the beginning of each year.What really makes You Need A Budget different is that we can teach you how to manage your money and get ahead—for good. What if your bills rolled in and instead of piling up, you just paid them? What if you didn’t even realize it was payday because you had money in the bank and weren’t desperate for that check to arrive? Forget everything you think you know about budgeting and prepare to experience total control.An app might claim its data collection is anonymized or impossible to trace back to you, but that’s not entirely true, especially without industry oversight of these apps. This is one of the reasons why we don’t recommend Mint if you have privacy concerns. The good news is, while the person would be able to see a list of your transactions, they wouldn’t be able to move money or log directly into your bank account’s website. Your bank credentials aren’t stored anywhere in the budgeting app where they’re readable. To come up with the lists above, we first reviewed 20 money apps. We examined the purpose of the app as described by its developer, price, budgeting method and types of accounts users could sync.He has been published in The New York Times, Fortune, and Bloomberg, among others. He earned his MA at the Craig Newmark School of Journalism at CUNY, and is currently preparing for the CFP exam at the University of Texas.