Content

- Small Business Tax Obligations: Payroll Taxes

- Payroll Deductions Calculator

- File

- The Pandemic Impact On Social Security And Medicare

- How Is Social Security Tax Calculated?

- How To Figure Out The Percentage Of Taxes Taken Out Of Paychecks

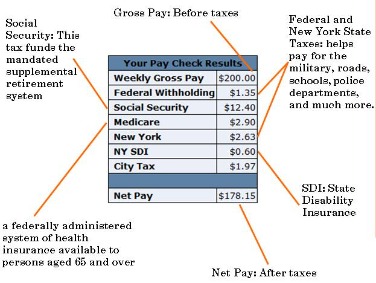

If the amount you owe ends up being less than what was withheld, you’ll be due a refund. Your goal in this process is to get from the gross pay amount to net pay (the amount of the employee’s paycheck).To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. If your state has an income tax, you will probably have state income taxes withheld from your paycheck. Your employer will use information provided on the state version of Form W-4 and your income to determine how much to withhold. Your employer sends the federal income tax withholding to the IRS on your behalf. Your goal is to have at least enough FITW during the year to cover your expected federal income tax liability. Employee paychecks start out as gross pay.

Small Business Tax Obligations: Payroll Taxes

You do not need to withhold state taxes in jurisdictions that do not impose state taxes on income, such as Alaska, Florida, Texas, Wyoming, and Washington. The wage bracket tables are segregated for five different payroll periods (daily, weekly, bi-weekly, semi-monthly, and monthly). To determine withholding amounts, employers pick the applicable pay period and wage bracket for employees, then read across the table to the column that shows the filing status.

Payroll Deductions Calculator

Add the taxes assessed to determine the total amount of tax to withhold from an employee’s check. Divide the result by gross pay to establish the percentage of the paycheck dedicated to taxes. To establish the total percentage of taxes withheld for all employees, add the taxes taken out of each individual employee’s check and total the result.If you receive pension income, you can use the results from the estimator to complete a Form W-4P and give it to your payer. Gather information for other sources of income you may have. Gather the most recent pay statements for yourself, and if you are married, for your spouse too.

What percentage of withheld is federal income tax?

The federal withholding tax has seven rates for 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether you’re filing as single, married jointly or married separately, or head of household.Businesses that offer health insurance, dental insurance, retirement savings plansand other benefits often share the cost with their employees and withhold it from their pay. Depending on the type of benefit and the regulations that apply to it, the deduction may be pretax or post-tax. Pretax is more advantageous to employees because it lowers the individual’s taxable income. Since the W-4 is a planning tool, you can change the following entries in order to increase your paycheck IRS withholding amount.

File

This test looks at the degree of control an employer has over the financial aspects of the job. In some professions, having significant control over supplies used for work supports a worker’s status as an independent contractor. Ashley Adams-Mott has 12 years of small business management experience and has covered personal finance, career and small business topics since 2009.

- Be careful not to deduct too much Social Security tax from high-income employees, since Social Security is capped each year, with the maximum amount being set by the Social Security Administration.

- It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation.

- Here are the key factors, and why your tax withholding is important to monitor.

- This is true even if you have nothing withheld for federal, state, and local income taxes.

- You should know that we do not endorse or guarantee any products or services you may view on other sites.

- You will also need to consider the additional Medicare tax deduction due by higher-income employees, which begins when the employee reaches a $200,000 in earnings for the year.

The $534 is her gross pay for the pay period. The IRS requires that all workers in the U.S. sign IRS FormW-4 at hire. This form includes important information you will need to pay the employee and to make sure withholding and deductions are correctly calculated on the employee’s pay. Previously claimed federal deductions that were impacted by federal tax law changes, such as the employee business expense deduction. Payroll taxes, including FICA tax or withholding tax, are what your employer deducts from your pay and sends to the IRS, state or other tax authority on your behalf.

The Pandemic Impact On Social Security And Medicare

And $137,700 for 2020.Your employer must pay 6.2% for you that doesn’t come out of your pay. Note that allowances won’t be used to calculate paycheck withholding on Form W-4 starting in 2020. The total FITW for the year will be reported on your Form W-2 in box 2.

How Is Social Security Tax Calculated?

This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Payroll is the compensation a business must pay to its employees for a set period or on a given date.

What percentage of my paycheck is withheld for federal tax 2021?

The following are aspects of federal income tax withholding that are unchanged in 2021: No withholding allowances on 2020 and later Forms W-4. Supplemental tax rate: 22% Backup withholding rate: 24%Your paycheck stub might also show year-to-date totals. This is good to know if you want to estimate if you’ll have a refund or balance due at the end of the year. Employers must also withhold an additional 0.9% (2.35% total) of Medicare tax on earned income of more than $200,000 in a tax year.

How To Figure Out The Percentage Of Taxes Taken Out Of Paychecks

Ways on how to save on taxes both during the tax year and when you prepare your income tax return. You will see your per paycheck tax withholding amount. Plus, you will find instructions on how to increase or decrease that tax withholding amount. When done, create the W-4 and the result of that W-4 will be based on your paycheck calculation results. Yes, it might seem so, but since the W-4 is created this way, that is all we have to work with. Contact a Taxpert® if you have questions.

Withholding Calculator

Use this calculator to help you determine the impact of changing your payroll deductions. You can enter your current payroll information and deductions, and then compare them to your proposed deductions. Try changing your withholdings, filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. The calculator also works for pension income withholding. The Withholding Calculator helps you determine whether you need to give your employer a newForm A-4, Arizona Withholding Percentage Election.If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. It’s a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. FICA is often referred to as payroll tax because typically employers deduct FICA tax from employee paychecks and remit the money to the IRS on behalf of the employee. A withholding is the portion of an employee’s wages that is not included in their paycheck because it is sent to federal, state, and local tax authorities.