Content

- Where To Mail Or Fax Form 2553

- Part Ii: Selection Of Fiscal Tax Year

- Who Needs A Form Irs 2553?

- Additional Forms

- Form 2553 Due Date

- Taxes & More

- Late Election Of S

If you need help with payroll, we recommend Gusto Payroll. And to manage your accounting, we recommend Xero or QuickBooks.

Where To Mail Or Fax Form 2553

The IRS provides certain exceptions for filing a late Form 2553. It’s possible to file form 2553 after the deadline, however you won’t be granted S corp status until the following tax year. So if your deadline for S corp election in 2022 is March 15 and you file form 2553 on March 16, 2022, you will not be granted S corp status until 2023. The name of this section can be daunting, but it’s only relevant for trusts applying for S corporation status. If you’re a trust applying for S corp status, list the income beneficiary’s name, address, and social security number, and the trust’s name, address, and employer identification number.

Do I have to file both 8832 and 2553?

As discussed earlier, it is not necessary to file both Form 8832 for a newly formed entity to elect to be treated as an association taxed as a corporation and Form 2553 to elect S corporation status. Instead, a single election can be made on Form 2553.5) I heard somewhere there might even be a way to avoid the payroll service provider costs by setting a fixed payment amount in lieu of a salary up front. Not sure if you know anything about that but would seem to apply nicely in this case. However, the S-Corporation still needs to file what’s known as an “informational return”. That includes filing Form 1120S as well as issue K-1s to each of the S-Corp shareholders. In column L, you’re going to list the percentage of ownership and the date which the ownership was acquired.In these tax classifications, you pay self-employment tax on all of your net income and there is no option to split your income and save money on self-employment tax. However, an LLC can also elect to be taxed as an S-Corporation with the IRS, and is a very common tax classification made by LLCs whose net income begins approaching $75,000 to $100,000 per year. Again, unlike an LLC or a Corporation, which is a business entity created at the state-level, an S-Corporation is a tax entity selection made with the IRS. If you aren’t 100% sure if the 2553 election is what you want, you have the opportunity to speak with an accountant who can provide you with helpful information so you can make the best decision for you. This s corp form is filed with the IRS to elect S Corporation status.

Part Ii: Selection Of Fiscal Tax Year

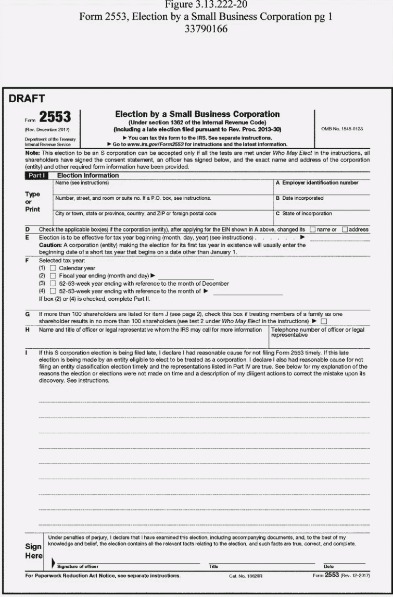

The corporation files a properly completed Form 2533 on March 2, 1993. The corporation is not eligible to be a subchapter S corporation for the 1993 taxable year because during the period of the taxable year prior to the election it had an ineligible shareholder. However, under paragraph of this section, the election is treated as made for the corporation’s 1994 taxable year. One significant benefit of electing to become an S corporation is that an S corp’s net taxable income, in general, is taxed to the shareholders of the corporation, not the corporation itself. The income is shown on the shareholders’ personal returns and is taxed at their personal tax rates. S corporations can also write off start-up losses. An LLC electing S corporation status must also provide each shareholder with Schedule K-1, which reports each individual shareholder’s distribution of LLC income.An officer of the company, such as the company president, must sign at the end of Part I. IRS Form 2553 is used to make an election with the Internal Revenue Service to have your business entity treated as an S corporation for tax purposes. The IRS will assume that it’s a C corporation if you don’t take this step, and your business would then be obligated to pay a corporate income tax on its net taxable income for the year. Instead of paying a corporate tax rate of up to 35 percent, Form 2553 turns your company into a “pass-through entity” for tax purposes. This means the earnings from your company pass through directly to you and any other shareholders, and you only have to pay taxes on the income at your own individual income tax rates. If your business is a C Corporation but you have decided that you would rather file taxes as an S Corporation, you need to notify the IRS in advance by filing the appropriate paperwork. IRS Form 2553, “Election By a Small Business Corporation,” is required to be filed with the IRS to switch a C Corporation to S Corporation status for purposes of federal taxation.

Who Needs A Form Irs 2553?

Shareholders must include their share of the corporation’s income on their tax returns. No matter your specific deadline, filing IRS Form 2553 on time is important if you want to take advantage of S-corp tax treatment for a specific tax year. If you file too late, you might have to wait one more year for the election to take effect. To elect S-corp tax treatment, businesses must fill out and submit Form 2553 to the Internal Revenue Service . Below, get step-by-step instructions on how to fill out this tax form, deadlines, and important things you should know prior to filing Form 2553. IRS Form 2553 is an election to have your business entity recognized as an S corporation for tax purposes. Sometimes the single-member limited liability company doesn’t elect to be treated as a corporation and doesn’t elect to be treated as an S corporation within the prescribed time frames.

When can an LLC make an S election?

For a New Business A corporation or LLC must file an S-Corp election within two months and 15 days (~75 days total) of the date of formation for the election to take effect in the first tax year. Example: Your articles of formation was filed on August 21st.We are in 2021 now, so please share your wisdom. Hi Mike, yes, as 2%+ S-Corp owner, you should record the total health insurance premiums paid by the LLC for you on your W-2. If you have a payroll company in place, they should be able to add this to your W-2 before submitting the form.

Additional Forms

This multi-line section is only needed if you are making a late S-Corp election . If that’s the case, you need to include a reason, and often, the IRS is fairly flexible on accepting Form 2553 after the deadline. Most filers check off the first box for “Calendar year”. You’ll need an EIN in order to make the S-Corporation tax election. You’ll often see this rule written as “your S-Corporation can’t have more than 100 shareholders”.IRS Form 8832 in the instructions to IRS Form 2553. Form 8832 is for LLCs that want to be taxed as a C-corp and for other businesses that want to change their tax classification.

- If you are interested, we can put you in touch with an accountant prior to filing a Form 2553, and the accountant can help you make the decision that is right for you.

- A common example is a single-member limited liability company .

- The consent statement should be attached to the corporation’s election statement.

- This business is a bunch of hurry up and wait.

- The income of an S corporation generally is taxed to the shareholders of the corporation rather than to the corporation itself.

- IRS Form 2553 is used for gaining recognition under Subcahpter S of the federal tax code.

An eligible domestic corporation can avoid double taxation from the Federal Government by electing to be treated as an “S corporation.” The income of an S corporation generally is taxed to the shareholders of the corporation rather than to the corporation itself. However, an S corporation may still owe tax on certain income. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362 to be an S corporation. Since I won’t be paying myself a salary, will the administrative paperwork still be existent? Since my revenue is quite limited at the time, I’m trying to save time and money on complex filings and administrative matters. If you’re a single member LLC, you can use Form 8832 to be taxed as a C-corp.

Form 2553 Due Date

If you need help, Incfile will prepare Form 2553 with all S Corporation incorporation order submissions. This prepared form will be delivered with instructions for receiving the S Corp tax election status approval upon the completion of your state filing. On January 1, 1993, two individuals and a partnership own all of the stock of a calendar year subchapter C corporation. On January 31, 1993, the partnership dissolved and distributed its shares in the corporation to its five partners, all individuals. On February 28, 1993, the seven shareholders of the corporation consented to the corporation’s election of subchapter S status.An S-Corporation is a “pass through” tax entity, so it is not subject to double taxation like a C-Corporation. Any income, losses, credits, and deductions flow through to the owners of an S-Corporation and will be reported and paid for on their personal tax return. An LLC is not a recognized entity for federal tax purposes and must instead elect an alternate tax classification, such as an S corporation, a C corporation, a sole proprietorship, or a disregarded entity. The deadline to file IRS Form 2553 is two months and 15 days after the start of the tax year in which you want the election to take effect. Established businesses can also file any time during the preceding tax year. This means no later than March 15 for most businesses, but deadlines can differ for new companies and companies that follow a non-calendar tax year.Apologies I couldn’t provide more black and white answers. Overall, you have a great grasp of the situation, but taxes vary widely from person to persona and from business to business. You don’t have to open a new LLC to remedy this.

Late Election Of S

And be sure to send in your original form if you’re filing by mail. If you opt for fax, store the original copy of the form in a safe place. The form should be filed before the 16th day of the third month of the corporation’s tax year, or before the 15th day of the second month of a tax year if the tax year is 2½ months or less. ABC therefore has until October 16 to file Form 2553 for the S corporation election to be valid for the company’s first year of operation. You must first incorporate your business by drawing up articles of incorporation, by-laws, and the various required legal documents that are required to form and operate your business.Because the corporation had no taxable year immediately preceding the taxable year for which the election is to be effective, an election made earlier than January 7, 1993, will not be valid. The corporation only failed to qualify for an S corp election because Form 2553 was not filed on time and for no other reason. For more detailed information about the requirements to make an S corp election, you can check out the IRS Form 2553 instructions. A corporation or other entity eligible to choose to be treated as a corporation should file the form 2553 IRS to make an election to be an S corporation. An applicant who filed the 2553 form treated as S corporation does not need to file Form 8832, Entity Classification Election. There is no single deadline to submit form 2553.