Content

- Freshbooks Is The Best Alternative

- The Best Online Accounting Services For Freelancers

- Alternatives To Freshbooks

- Create Professional Contracts With Bonsai

- Step 3: File Your Taxes With Confidence

- How To Use Freshbooks In Preparation For Tax Filing Season

FreshBooks also has a mobile app for iOS and Android with access to the software’s basic features and the ability to track mileage and time. But if you’re really nervous about doing your own bookkeeping and want the certainty of knowing that a professional is there to help the moment you need it, ZipBooks is the tool for you. Some business owners aim for the lowest-priced services — but this can leave them short on necessary features. Some business owners sign up for the most expensive plans, seduced by the myriad of extra features — but they end up overpaying for things they never use. Most modern businesses need to adjust generic contracts, project proposals, invoices, and other CRM documents to their specific parameters, with personal touches.

Freshbooks Is The Best Alternative

If your accountant uses Xero, you can share your financial data with them directly. And if you need more tools over time, you can add a wide variety of integrations and extra features to extend your accounting app as your work grows. Xero integrates with more than 700 apps—like Shopify, PayPal, Stripe, and Gusto—through its app marketplace.You shouldn’t view this as extra money for a rainy day or emergency funds—this account should only be used to save money for taxes. You’ll have to do some research to determine what your tax bracket is and how much you have to put aside, but an average estimate is 25-30% of your income.

- If you want to double-check your calculations, you can use a calculator like the Estimated Payments Calculator offered by the Center on Budget and Policy Priorities.

- All financial products, shopping products and services are presented without warranty.

- For example, under the cash method, you’ll record income from an invoice when it gets paid.

- They’re all kept in one place and you can easily view a history of the invoices you sent last year.

- You can integrate your bank account with Xero, so income and expenses will already be reconciled once tax time hits.

It’s software that makes billing, accounting, and client service easy for business owners. Get automated invoicing and payments to save you 550+ hours/year, reports that tell you how things are going, and access to time-saving tools for your whole team. We’ve got a website with all the details, a Twitter account that’s pretty sweet, and a Youtube account packed with awesome videos. Freelancers, small business owners, and solopreneurs generally use this accounting software to separate their business expenses from their personal expenses. At the end of each month, you transfer $1,667 to your savings account, where it will sit until it’s time to pay your quarterly estimated tax payment. Set a reminder on your calendar to do this at the end of each month or automate the transfer through your bank.

The Best Online Accounting Services For Freelancers

Its invoice creation and management tools are good, too, though the invoices could stand to be more flexible. On your main dashboard, you can see charts that summarize your invoices, profit and loss, revenue streams and spending.

How do I set up quarterly taxes?

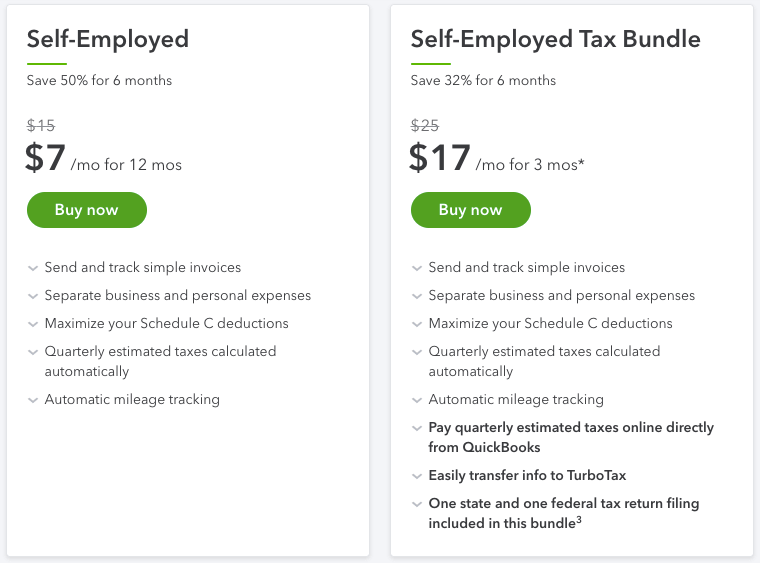

Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS).One of the top features of QuickBooks Self-Employed is the OCR technology they use to automatically scan your receipts and input the data. This eliminates the need to manually input number sin an Excel spreadsheet. The software also has some bookkeeping capabilities, which can be beneficial to self-employed people. While estimating your tax liability can be complicated, the IRS allows you to use a “safe harbor” method. Use one of these methods, and the IRS will not impose an estimated tax penalty, even if you’re underpaid at year-end. Is more expensive than FreshBooks, but it also has more robust reporting capabilities than FreshBooks, add-ons like QuickBooks Payroll and the ability to scale with your business. As the industry standard for small-business accounting, it’s widely used by accountants.

Alternatives To Freshbooks

Open an account with Hurdlr and it will automatically create an account for your business using your FreshBooks account info. Yearli would make it easy to use data from FreshBooks to file your 1099-MISC forms. Bench gives you a professional bookkeeper for an affordable price and it’s a powerful financial reporting software with zero learning curve. You can also invite your accountant or bookkeeper to your FreshBooks account.

Does FreshBooks do quarterly taxes?

The software also has some bookkeeping capabilities, which can be beneficial to self-employed people. The tax reporting features allow users to pay estimated quarterly taxes and file federal and state income tax returns (if applicable) directly from the app.It also has useful mobile apps and helps you estimate your quarterly taxes based on your income and expenses. As I mentioned earlier, it can also track your mileage, using your phone’s location services. Wave is a free service, though there are charges for payment processing and payroll if you use those features. The site no longer displays ads; revenues come from embedded financial services like credit card processing and advisory services. Yet Wave is the most comprehensive small business accounting application reviewed in this group and can accommodate sole proprietors as well as companies with up to 10 employees.

Create Professional Contracts With Bonsai

The needs of freelancers, contractors, and sole proprietors vary as widely as the types of businesses they represent. Others need the ability to send invoices and receive and record payments. Some need an integrated payroll service, while others are one-person shops.

Step 3: File Your Taxes With Confidence

If you’re working with an accountant, that may be important to you. FreshBooks’ suite of invoicing features on all plans also sets it apart from competitors.