Content

- Net Investment Income Tax Medicare Tax

- Offset Gains With Losses

- Tax Deductions Guide And 20 Popular Breaks In 2021

- Financial Services

- Get More With These Free Tax Calculators And Money

- Capital Gains Tax Calculator

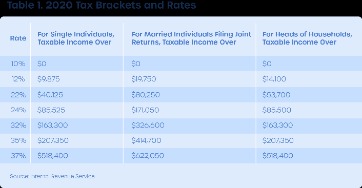

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We are an independent, advertising-supported comparison service.Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns. H&R Block prices are ultimately determined at the time of print or e-file. Investing for the long term has many advantages.MethodologyOur study aims to find the places in the country with the savviest investors. We wanted to find where people are not only seeing good returns on their investments but where they are doing so without taking too much risk. Stepped-up basis is somewhat controversial and might not be around forever. As always, the more valuable your family’s estate, the more it pays to consult a professional tax adviser who can work with you on minimizing taxes if that’s your goal. A financial advisor can help you manage your investment portfolio. To find a financial advisor near you, try our free online matching tool. Unfortunately, we are currently unable to find savings account that fit your criteria.That’s because it might cause part of your overall income to jump into a higher marginal tax bracket. When you sell a capital asset for more than its original purchase price, the result is a capital gain. Capital assets include stocks, bonds, precious metals, jewelry, and real estate. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you.The federal income tax rate that applies to gains from the sale of stocks, mutual funds or other capital assets depends on how long you held the asset and your taxable income. Gains from the sale of capital assets that you held for at least one year, which are considered long-term capital gains, are taxed at either a 0%, 15% or 20% rate. Capital gains taxes are the taxes you pay on profits from most investments, including stocks, bonds, or mutual funds. When you sell an investment for more than you paid for it, you’ll have to pay taxes on your gains at either the short-term capital gains rate or the long-term capital gains tax rate. Long-term capital gains are taxed at lower rates than ordinary income, and how much you owe depends on your annual taxable income.

Net Investment Income Tax Medicare Tax

Most states tax capital gains according to the same tax rates they use for regular income. So, if you’re lucky enough to live somewhere with no state income tax, you won’t have to worry about capital gains taxes at the state level. Some people are devotees of the tax-loss harvesting strategy. Others say that it costs you more in the long run because you’re selling assets that could appreciate in the future for a short-term tax break. You’re basing your investing strategy not on long-term considerations and diversification but on a short-term tax cut. And if you re-purchase the stock, you’re essentially deferring your capital gains taxation to a later year. Critics of tax-loss harvesting also say that, since there’s no way of knowing what changes Congress will make to the tax code, you run the risk of paying high taxes when you sell your assets later.

How long can I rent my house before paying capital gains?

The capital gains tax property 6-year rule allows you to use your property investment, as if it was your principal place of residence, for a period of up to six years, whilst you rent it out.We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money.

Offset Gains With Losses

Colorado and New Mexico do not tax capital gains. Montana has a credit to offset part of any capital gains tax.

What is exempt from CGT?

A gain on an asset that is transferred between spouses or civil partners is usually exempt from CGT. This exemption includes divorced spouses, and separated or former civil partners. The exemption does not apply where you transfer: trading stock of a business carried on by you, to your spouse or civil partner.The low capital gains rates are one of the major perks of earning income through investing. And regardless of the outcome of the 2020 election, these tax rates will remain in effect at least through the end of this year and likely for 2021.

Tax Deductions Guide And 20 Popular Breaks In 2021

Use low-cost index funds and go on enjoying your life. There is no benefit to checking your investment account 50 times a day.This allows you to stay invested in the market while still taking advantage of the tax deductions from your losses. Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. That’s why some very rich Americans don’t pay as much in taxes as you might expect. So, while retirement accounts offer tax deferral, they do not benefit from lower long-term capital gains rates.

- This exemption originally allowed the taxpayer to exclude 50% of any gain from the sale of the qualified small business stock.

- If you owned the investment for one year or less, you would incur short-term capital gains.

- The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate.

- These states include Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont and Wisconsin.

- You should know that we do not endorse or guarantee any products or services you may view on other sites.

- Both cardholders will have equal access to and ownership of all funds added to the card account.

The “basis” is what you paid for the asset, plus commissions and the cost of improvements, minus depreciation. There is no capital gain until you sell an asset, but once you’ve sold an asset for a gain, you’re required to claim it on your income taxes. Capital gains are not adjusted for inflation. These include 401 plans, individual retirement accounts and 529 college savings accounts, in which the investments grow tax-free or tax-deferred.

Financial Services

When you sell your primary residence, $250,000 of capital gains (or $500,000 for a couple) are exempted from capital gains taxation. This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale. The rules are slightly different for investment properties. You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation benefits you have received while you owned the property.

Get More With These Free Tax Calculators And Money

Of states that do levy an income tax, nine of them tax long-term capital gains less than ordinary income. These states include Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont and Wisconsin. However, this lower rate may take different forms, including deductions or credits that reduce the effective tax rate on capital gains. Capital gains taxes are a type of tax on the profits earned from the sale of assets such as stocks, real estate, businesses and other types of investments in non tax-advantaged accounts. When you acquire assets and sell them for a profit, the U.S. government looks at the gains as taxable income. Here is a quick example of how all of these long-term capital gains stuff works. Let’s say you and your spouse have a taxable income of $500,000 and purchased shares in a company in January 2017.