Content

- Cash From Investing Activities

- Importance Of A Cash Flow Statement

- Preparation Methods

- Format Of A Cash Flow Statement

- The Indirect Method Of Calculating Cash Flow

- How To Prepare A Cash Flow Statement

The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting.Cash and cash equivalents include currency, petty cash, bank accounts, and other highly liquid, short-term investments. Examples of cash equivalents include commercial paper, Treasury bills, and short-term government bonds with a maturity of three months or less. The direct method shows cash inflows and cash outflows for each of the operating activities. The indirect method, on the other hand, makes a series of adjustments to the company’s net income in order to account for the affects of noncash transactions recorded using accrual accounting. Always prepare investing activities and financing activities the same way. Therefore, preparing the operating activities section of the cash flow statement either way yields the same results. Furthermore, the indirect method is required by industry regulations, so companies always report cash flows using the indirect method.

- Cash Flow From Operating Activities indicates the amount of cash a company generates from its ongoing, regular business activities.

- In financial modeling, the cash flow statement is always produced via the indirect method.

- Increase in Inventory is recorded as a $30,000 growth in inventory on the balance sheet.

- The Cash Conversion Ratio is a financial management tool used to determine the ratio between the cash flows of a company to its net profit.

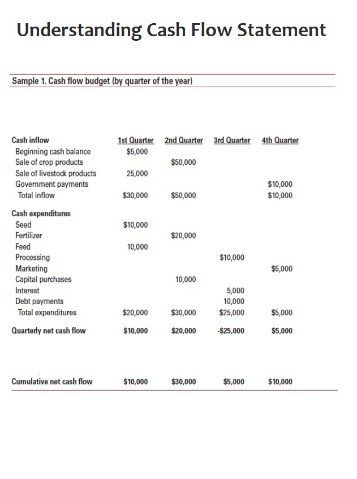

- Following is an example of what a cash flow statement looks like.

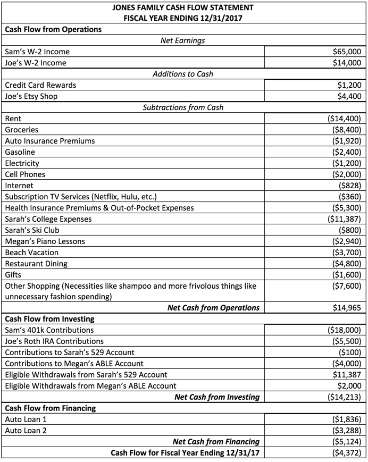

US GAAP requires that interest paid be included in operating activities. IAS 7 permits bank borrowings in certain countries to be included in cash equivalents rather than being considered a part of financing activities. Notes payable is recorded as a $7,500 liability on the balance sheet. Since we received proceeds from the loan, we record it as a $7,500 increase to cash on hand. These three activities sections of the statement of cash flows designate the different ways cash can enter and leave your business. You’ll also notice that the statement of cash flows is broken down into three sections—Cash Flow from Operating Activities, Cash Flow from Investing Activities, and Cash Flow from Financing Activities. When you have a positive number at the bottom of your statement, you’ve got positive cash flow for the month.

Cash From Investing Activities

For example, early stage businesses need to track their burn rate as they try to become profitable. The first section of the cash flow statement is cash flow from operations, which includes transactions from all operational business activities.

Importance Of A Cash Flow Statement

Under U.S. GAAP, interest paid and received are always treated as operating cash flows. The indirect method uses net-income as a starting point, makes adjustments for all transactions for non-cash items, then adjusts from all cash-based transactions.

Preparation Methods

Spend less time wondering how your business is doing, and more time making decisions based on crystal-clear financial insights. Get started with a free month of bookkeeping with financial statements. You can use cash flow statements to create cash flow projections, so you can plan for how much liquidity your business will have in the future. A cash flow statement provides data regarding all cash inflows a company receives from its ongoing operations and external investment sources. The operating activities on the CFS include any sources and uses of cash from business activities. In other words, it reflects how much cash is generated from a company’s products or services. Indirect method – The indirect method presents operating cash flows as a reconciliation from profit to cash flow.Learn financial modeling and valuation in Excel the easy way, with step-by-step training. There are several types of Cash Flow, so it’s important to have a solid understanding of what each of them is. When someone refers to CF, they could mean any of the types listed below, so be sure to clarify which cash flow term is being used. Cash Flow for Month Ending July 31, 2019 is $500, once we crunch all the numbers. After accounting for all of the additions and subtractions to cash, he has $6,000 at the end of the period. If we only looked at our net income, we might believe we had $60,000 cash on hand.

Format Of A Cash Flow Statement

Since it’s simpler than the direct method, many small businesses prefer this approach. Also, when using the indirect method, you do not have to go back and reconcile your statements with the direct method. Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business. Changes in cash from financing are “cash-in” when capital is raised and “cash-out” when dividends are paid. Thus, if a company issues a bond to the public, the company receives cash financing. However, when interest is paid to bondholders, the company is reducing its cash.The cash flow statement definition is a financial statement that shows a company’s cash inflows and cash outflows over a period of time. The cash flow statement is one of the most important financial statements of a company. In conclusion, use the statement of cash flows to analyze the financial health of a company. Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. International Accounting Standard 7 is the International Accounting Standard that deals with cash flow statements. It is an important indicator of a company’s financial health, because a company can report a profit on its income statement, but at the same time have insufficient cash to operate.

The Indirect Method Of Calculating Cash Flow

The bulk of the positive cash flow stems from cash earned from operations, which is a good sign for investors. It means that core operations are generating business and that there is enough money to buy new inventory. Generally, changes made in cash, accounts receivable, depreciation, inventory, and accounts payable are reflected in cash from operations. It may help to look at a real-world cash flow statement example to see how they work in practice.Cash flows from financing is the last section of the cash flow statement. The section provides an overview of cash used in business financing. It measures cash flow between a company and its owners and its creditors, and its source is normally from debt or equity.

What is difference between cash flow statement and fund flow statement?

Cash Flow statement shows the changes in the cash position (Inflows and outflows) of a firm. … On the other hand, Fund Flow statement is a statement that shows the ups and downs of the financial position or the changes in working capital of the entity between the two financial years.Cash flow statements are most commonly prepared using the indirect method, which is not especially useful in projecting future cash flows. Of course, not all cash flow statements look as healthy as our example or exhibit a positive cash flow. However, negative cash flow should not automatically raise a red flag without further analysis. Poor cash flow is sometimes the result of a company’s decision to expand its business at a certain point in time, which would be a good thing for the future.

Negative Cash Flow Vs Positive Cash Flow

A cash flow statement documents in detail all company income and debt over a specific period of time. It reflects the short-term viability of a company by indicating whether it has enough cash on hand to pay its employees and debts. If it does, then the company is considered to have a “positive” cash flow. While understanding profit and loss is important, it doesn’t tell you the whole story. After all, a significant amount of business takes place without any money changing hands, and the actual exchange of cash may happen after the profit/loss is recorded.Companies are able to generate sufficient positive cash flow for operational growth. If there is not enough generated, they may need to secure financing for external growth in order to expand. Investors and analysts should use good judgment when evaluating changes to working capital, as some companies may try to boost up their cash flow before reporting periods. The purchasing of new equipment shows that the company has the cash to invest in itself. Finally, the amount of cash available to the company should ease investors’ minds regarding the notes payable, as cash is plentiful to cover that future loan expense. If AR increases from one accounting period to the next, then the amount of the increase must be deducted from net earnings because, although the amounts represented in AR are in revenue, they are not cash. In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included because it is a business activity.However, if they so choose, they can also report cash flows using the direct method. Net working capital might be cash or might be the difference between current assets and current liabilities. From the late 1970 to the mid-1980s, the FASB discussed the usefulness of predicting future cash flows.

Creating A Cash Flow Statement From Your Income Statement And Balance Sheet

Overview of what is financial modeling, how & why to build a model. Or as inflows, the receipt of payments on such financing vehicles. Transactions that show a decrease in liabilities result in a decrease in cash flow.Here you can see that the business paid more in expenses than the amount of income it brought in. Sometimes a company may experience negative cash flow due to heavy investment expenditure, but this is not always an indicator of poor performance, because it may be leading to high capital growth.