Content

- Property Plant & Equipment

- Asset Accounts

- Chart Of Accounts: A Simple Guide With Examples

- Types Of Accounts

- Number Of Accounts Needed

- Deferred Taxes

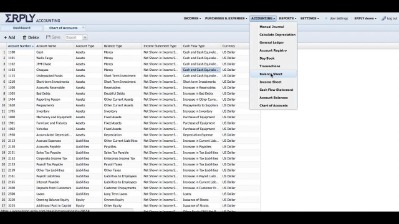

With online accounting software, you can organize and track your balance sheet accounts. No matter if you’re an entrepreneur starting a business or an owner looking to streamline your practices, accounting software can help you get the job done. It may make sense to create separate line items in your chart of accounts for different types of income. Within the categories of operating revenues and operating expenses, accounts might be further organized by business function and/or by company divisions, product lines, etc. In that case, you’d credit the cash asset account, since cash is leaving your business, and debit your expense account for rent.This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. The Spanish generally accepted accounting principles chart of accounts layout is used in Spain. The French generally accepted accounting principles chart of accounts layout is used in France, Belgium, Spain and many francophone countries. The use of the French GAAP chart of accounts layout is stated in French law.Within the COA, accounts will be typically listed in order of their appearance in the financial statements. Typically, Balance sheet accounts are listed first followed by the income statement accounts. That’s why a chart of accounts can be a beneficial addition to your financial analytics tools. Explore the definition of a chart of accounts and find out why a chart of accounts is important with our comprehensive guide. You can think of this like a rolodex of accounts that the bookkeeper and the accounting software can use to record transactions, make reports, and prepare financial statements throughout the year. Each of the accounts in the chart of accounts corresponds to the two main financial statements, i.e., the balance sheet and income statement.Balance sheet accounts usually appear first, and then the income statement accounts. The main components of the income statement accounts include the revenue accounts and expense accounts. The chart of accounts provides the name of each account listed, a brief description, and identification codes that are specific to each account. The balance sheet accounts are listed first, followed by the accounts in the income statement. Some may also display equity accounts on their company’s chart. An equity account is a representation of anything that remains after accounting for all operating expenses and revenue accounts.

Property Plant & Equipment

The sub-accounts are then categorized in the five main accounts (e.g., asset account). A chart of accounts is a bookkeeping tool that lists all the accounts you record transactions in.

- The more liabilities you incur, the more your equity decreases.

- Short-term, or current, liabilities are debts that you expect to pay within one year, like accounts payable.

- You click the plus-sign icon in the upper right corner and select Bank Deposit.

- The rules for making tweaks to your chart of accounts are simple.

- The chart of accounts for a major airline will have a lot more references to “aircraft parts” than your local cat cafe.

These are also the accounts included in your general ledger. By providing an easy-to-read overview of all your business accounts, the chart of accounts shows where money is going, which can help with forecasting and cutting expenses. There is a trade-off between simplicity and the ability to make historical comparisons. Initially keeping the number of accounts to a minimum has the advantage of making the accounting system simple. Starting with a small number of accounts, as certain accounts acquired significant balances they would be split into smaller, more specific accounts. However, following this strategy makes it more difficult to generate consistent historical comparisons.

Asset Accounts

Think of it as the filing cabinet for your small business’s accounting system. This helps keep track of money coming in and out of the company, especially when it’s time to file taxes.

Chart Of Accounts: A Simple Guide With Examples

Back when we did everything on paper, you used to have to pick and organize these numbers yourself. But because most accounting software these days will generate these for you automatically, you don’t have to worry about selecting reference numbers. Expense accounts are all of the money and resources you spend in the process of generating revenues, i.e. utilities, wages and rent. A liability is a debt or obligation owed by a business to some individual or entity , which is to be paid in cash, goods, or services. They are the costs a business must incur in order to gain revenue.

What is journal in accounts?

A journal is a detailed account that records all the financial transactions of a business, to be used for the future reconciling of accounts and the transfer of information to other official accounting records, such as the general ledger.Staying on top of your business’s accounting records can take up your time. Patriot’s accounting software lets you create invoices, record payments, and so much more. Regardless of your chart of accounts numbering, make sure it makes sense to you.

Types Of Accounts

The following is an example of some of the accounts that might be included in a chart of accounts. To find out more about how Procurify integrates into your accounting system to streamline your chart of accounts, visit our website today.It includes a list of all the accounts used to capture the money spent in generating revenues for the business. The expenses can be tied back to specific products or revenue-generating activities of the business. To better understand the balance sheet and other relevant financial statements, you need to first understand the components that make up a chart of accounts. Knowing how to keep your company’s chart organized can make it easier for you to access financial information.Then, split the payment into an amount subtracted from what you owe, and an amount of interest paid, which will go into an expense account. You receive a $15,000 small-business loan and you’re using QuickBooks Online. You click the plus-sign icon in the upper right corner and select Bank Deposit. The money your business brings in from the sale of its goods or services. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.An international corporation with several divisions may need thousands of accounts, whereas a small local retailer may need as few as one hundred accounts. If you acquire another company, a key task is shifting the acquiree’s chart of accounts into the parent company’s chart of accounts, so that you can present consolidated financial results. This process is known as mappingthe acquiree’s information into the parent’s chart of accounts. NerdWallet strives to keep its information accurate and up to date.Accounts are usually grouped into categories, such as assets, liabilities, equity, revenue and expenses. Each account on the chart of accounts contains an identification code, description, and name.Below, we’ll go over what the accounting chart of accounts is, what it looks like, and why it’s so important for your business. Every time you record a business transaction—a new bank loan, an invoice from one of your clients, a laptop for the office—you have to record it in the right account. On the other hand, large businesses typically use four-digit numbers (e.g., 1000).

Number Of Accounts Needed

Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. Regulation S-X, Regulation S-K and Proxy statement In the U.S. the Securities and Exchange Commission prescribes and requires numerous quarterly and annual financial statement disclosures. A large portion of the required disclosures are numeric and must be supported by the Chart of accounts. She would then make an adjusting entry to move all of the plaster expenses she already had recorded in the “Lab Supplies” expenses account into the new “Plaster” expenses account. To do this, she would first add the new account—“Plaster”—to the chart of accounts.The cloud data vendor’s winter release updates its data platform with new capabilities to enable organizations to query and … The latest database release from Cockroach Labs focuses on providing optimized capabilities for large deployments that can handle… Oracle Autonomous Database can automate routine administrative and operational tasks for DBAs and improve productivity, but … This handbook looks at what Oracle Autonomous Database offers to Oracle users and issues that organizations should consider … The basic elements of a COA are the account names, account description, and account number. The account numbers do not run consecutively, which allows new numbers to be inserted in the gaps. If you want to take your company and yourself to the next level, thenclick here to learn more about the premier financial leadership development platform.

Stay Up To Date On The Latest Accounting Tips And Training

An account in bookkeeping is a record of financial transactions of a certain type (e.g., credit sales to the ABC Corp). The Chart of Accounts organizes the General Ledger accounts in a logical way that provides easy reference. But since the accounts collect information on one type of transaction, the COA can become a tool of analysis. The GL and, by extension, the COA should really show the financial transactions the business wants to monitor and measure. Consequently, the COA should have a logical link to the Key Performance Indicators of the business. When you’re producing a chart of accounts in Australia, consistency is key. Try to make a chart of accounts that won’t change for several years so that you can more easily compare results.

Deferred Taxes

Bench assumes no liability for actions taken in reliance upon the information contained herein. As employees continue to work remotely full- or part-time, scheduling software could help smooth the transition to a hybrid … OpenText intends to acquire Zix email security technology to broaden its portfolio, adds developer tools and connects OneDrive … SQL Server databases can be moved to the Azure cloud in several different ways. Good database design is a must to meet processing needs in SQL Server systems. With the addition of Data Workspace, the analytics vendor aims to enable power users within organizations to develop and deploy … SAP launched a series of developer products at SAP TechEd, including free tier access for the SAP Business Technology Platform …The costs of such detailed analysis in a manual system would have outweighed the benefits. There are a few things that you should keep in mind when you are building a chart of accounts for your business.Your checking account is automatically updated and $15,000 is added to the balance. In this case, you credited $15,000 to your loan account , and QuickBooks Online debited $15,000 to your checking account to balance it out. Liability accounts are a record of all the debts your company owes. Liability accounts usually have the word “payable” in their name—accounts payable, wages payable, invoices payable.