Content

- Monthly Payments In 2021

- Returning An Advance Payment

- Children After Divorce: Who Pays For What? Who Gets The Deductions And Credits?

- Do I Qualify For The Child Tax Credit?

- We Are Checking Your Browser Wwwcbpporg

- How To File Your Child’s First Income Tax Return

When you file your 2021 tax return on eFile.com, we will calculate this for you and determine the credit that is most beneficial to you based on your tax information. Although the advance monthly payments can’t be offset, the same rules don’t apply to a tax refund applicable to the child tax credit taken when you file your return next year. For example, if your actual 2021 child credits exceed the monthly payments you received, the difference may be refundable but can also be offset by back taxes, past-due child support, etc. There are other reasons people may decide to opt out of the advance payments besides wanting to take the fully refundable child credit in one lump sum on their 2021 tax returns. For example, opting out is recommended for families who claimed the child credit on their 2020 return, but know they will not be able to do so for 2021 because their modified AGI will be too high. A divorced parent who claimed a child as a dependent in 2020, and whose ex-spouse is eligible to claim the child in 2021, should also look into opting out of advance child credit payments.

- Education tax credits are available for taxpayers who pay qualified higher education expenses for eligible students, to offset certain education expenses.

- This could make your 2022 refund look smaller than what you typically receive.

- 2) Relationship test – The child must be your own child, a stepchild, or a foster child placed with you by a court or authorized agency.

- If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

- When both state and local taxes are considered, you’ll pay more sales tax when shopping in these states.

- For example, if a married couple has one child who is four years old, files a joint return, and has a modified AGI of $160,000 for 2021, they won’t get the full $3,600 enhanced credit.

The total payment in these instances is spread over less than six months, making each payment larger. For example, the maximum monthly payment for a family that received its first advance payment in September is $450-per-child for kids under age 6 and $375-per-child for kids ages 6 through 17. Above these income amounts, the credit is reduced by $50 for each $1,000 over these limits. The IRS will use your most recent tax return to determine how old your dependents are and how much of an advance to send you each month. Remember, the advance is only equal to half of the total credit and is coming in six monthly payments that started in July and will go through December. You can claim the balance of the credit on your 2021 tax return.

Monthly Payments In 2021

Unless extended by future legislation, the child tax credit will revert to its 2020 amounts and rules in 2022. Only one taxpayer may claim any one child for the purposes of the Child Tax Credit and the Additional Child Tax Credit.

Can I claim my dog as a dependent?

Unfortunately, the IRS does not think along the same lines. In most cases, pet-related costs are considered personal expenses, and you cannot claim pets as dependents. … But there are some tax deductions that you can claim for your dog or other pet and associated expenses.If you haven’t filed your 2020 tax returns yet, time is ticking. Taxes are due May 17, 2021, so consider filing your taxes with one of the best online tax filing programs. For example, a married couple with a seven-year-old son who file a joint return and have modified AGI of $415,000 for 2021 won’t get the full $3,000 enhanced credit.

Returning An Advance Payment

The American Rescue Plan Act of March 2021 is designed to assist in the United States’ recovery from the economic impact of the COVID-19 pandemic. The child tax credit has grown to up to $3,600, with the next advance payment scheduled for Dec. 15. Here’s what you need to know about who qualifies, when to expect payments and how to opt out.

Children After Divorce: Who Pays For What? Who Gets The Deductions And Credits?

Before this year, the refundable portion was limited to $1,400 per child and there were other requirements regarding earned income to obtain the refundable portion. Right now, no — but many people are rallying behind its expansion. In fact, President Biden’s American Families Plan supports extending the advance payment structure and the expanded credit until at least 2025. Whether legislation gains any traction, however, remains to be seen.

Do I Qualify For The Child Tax Credit?

If you qualify for a $3,000 child tax credit, you could get six $250 payments between July and December (for a total of $1,500) and then claim the remaining $1,500 on your tax return. Alternatively, you could opt out of the advance monthly payment plan and then claim the full $3,000 credit when you file your return. Everyone will receive the full Child Tax Credit benefits they are owed. If you sign up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign-up in time for monthly payments in 2021, you will receive the full benefit when you file your tax return in 2022.If one parent had primary custody of the child, that parent usually receives the tax credit. In cases of joint custody, the parents must reach an agreement about when each will claim the credit—in alternate years or according to some other formula. If you have children or other dependents under the age of 18, you likely qualify for the Child Tax Credit. There are also a number of income limits you should know about when planning how much you’ll receive. Since planning your family’s finances goes beyond just taxes, considerworking with a local financial advisorto optimize your plans. If you didn’t make enough to be required to file taxes in 2020 or 2019, you can still get benefits. Families with low-incomes and children are eligible for this crucial tax relief – including those who have not made enough money to be required to file taxes.

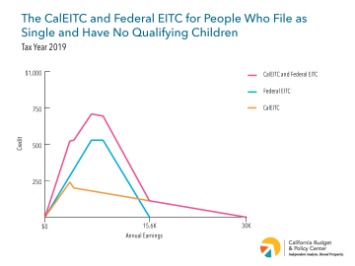

We Are Checking Your Browser Wwwcbpporg

Received $1,800 in 6 monthly installments of $300 between July and December. Receives $2,000 in 6 monthly installments of $333 between July and December. Receives $3,600 in 6 monthly installments of $600 between July and December. Receives $4,500 in 6 monthly installments of $750 between July and December. You and your child must both be US citizens, unlike mixed-status households. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

Who qualifies for the additional child tax credit?

To be eligible for the child tax credit, the child or dependent must: Be 16 years or younger by the end of the tax year. Be a U.S. citizen, national, or resident alien. Have lived with the taxpayer for more than half of the tax year.It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6. Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit. The child you’re claiming must live with you for at least six months out of the year. Be the first to know when the JofA publishes breaking news about tax, financial reporting, auditing, or other topics. Select to receive all alerts or just ones for the topic that interest you most. Maximizing this credit’s use and benefits will require an effective public educational and promotional program. It is estimated that the new rules will reduce by 45% the number of American children living in poverty.So, if your tax bill is $3,000 but you’re eligible for $1,000 in tax credits, your bill is now $2,000. This differs from a tax deduction, which reduces how much of your income is subject to income tax.

How To File Your Child’s First Income Tax Return

Later this year, you will also be able to go online and update your marital status and the number of qualifying children. If your income changed in 2021, and you believe that change could affect the amount of your child credit for 2021, go onto that portal and update it for the correct information. Child tax credit payments will be automatic for those who filed their 2020 tax returns or claimed all their dependents on their 2019 tax return.With taxes due May 17, you may wonder if this affects your 2020 tax return. This year, Americans were only required to file taxes if they earned $24,800 as a married couple, $18,650 as a Head of Household, or $12,400 as a single filer. If you had total income in 2020 below those levels, you can sign up to receive monthly Child Tax Credit payments usingsimple tool for non-filersdeveloped by the non-profit Code for America. People who receive payments by direct deposit got their first payment on July 15, 2021. After that, payments continue to go out on the 15th of every month. The expansion of the child tax credit for 2021 has important policy and economic implications. When the child tax credit was first enacted, it was intended to benefit low- and moderate-income families.