Content

- Net Cash Flows For The Firm

- Formula And Calculation Of The Fixed Asset Turnover Ratio

- Formula And Calculation Of The Cash Conversion Cycle

- What Is A Comparative Statement?

- Accountingtools

- Example Of A Balance Sheet Using The Report Form

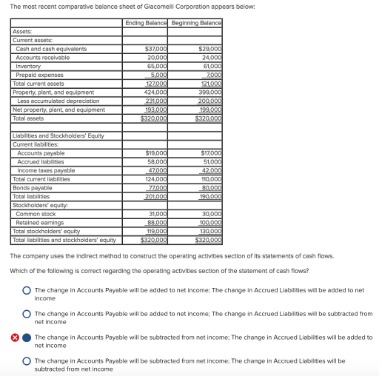

- How To Complete A Comparative Balance Sheet Analysis

- How To Raise Money In A Balance Sheet

The last section of the cash flow statement is Cash Flows from Financing Activities. In this case, the firm was financed with long-term bank loans that have increased by $50,000. Dividends to investors in the amount of $65,000 have also been paid, which is a cash outflow and a negative number. Also, if a company has not updated its assets, such as equipment upgrades, it’ll result in a lower ROA when compared to similar companies that have upgraded their equipment or fixed assets.

Net Cash Flows For The Firm

The decline in inventory is greater than the increase in cash, driving a decrease in total assets. A comparative balance sheet analysis is a method of analyzing a company’s balance sheet over time to identify changes and trends. The next section of the cash flow statement is Cash Flows from Investing Activities. Usually, this section includes any long-term investments the firm makes plus any investment in fixed assets, such as plant and equipment.

- Management can use that data to make changes, such as finding more competitive pricing for materials or training employees to lower labor costs.

- Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments.

- The owner must look at the last two years of the firm’s balance sheets and compare the differences between the two in order to develop the Statement of Cash Flows.

- Service companies and computer software producers need a relatively small amount of fixed assets.

- Treasury stock is common and preferred shares of an entity that were issued, repurchased by the entity, and are held in its treasury.

- Accounts receivable is the total money owed to a company by its customers for booked sales.

- By helping to identify trends, they help to provide the context needed to make the most informed business decisions.

Value received from shareholders in common stock-related transactions that are in excess of par value or stated value and amounts received from other stock-related transactions. May be called contributed capital, capital in excess of par, capital surplus, or paid-in capital.

Formula And Calculation Of The Fixed Asset Turnover Ratio

Ideally, investors should look for improving turnover rates over multiple periods. Also, it’s best to compare the turnover ratios with similar companies within the same industry. The fixed asset turnover ratio measures how much revenue is generated from the use of a company’s total assets. Since assets can cost a significant amount of money, investors want to know how much revenue is being earned from those assets and whether they’re being used efficiently. It is somewhat more common to report the balance sheet as of the least recent period furthest to the right, though the reverse is the case when you are reporting balance sheets in a trailing twelve-months format. Amount after unamortized premium and debt issuance costs of long-term debt classified as noncurrent and excluding amounts to be repaid within one year or the normal operating cycle, if longer. Includes, but not limited to, notes payable, bonds payable, debentures, mortgage loans and commercial paper.

Formula And Calculation Of The Cash Conversion Cycle

As a result, it’s important to compare the ROA of companies in the same industry or with similar product offerings, such as automakers. Comparing the ROAs of a capital intensive company such as an auto manufacturer to a marketing firm that has few fixed assets would provide little insight as to which company would be a better investment. As noted earlier, fixed assets require a significant amount of capital to buy and maintain. As a result, the ROA helps investors determine how well the company is using that capital investment to generate earnings.

What Is A Comparative Statement?

This truly is a judgment call, but one that needs to be considered thoughtfully. Calculated in days, the CCC reflects the time required to collect on sales and the time it takes to turn over inventory. The cash conversion cycle calculation helps to determine how well a company is collecting and paying its short-term cash transactions. If a company is slow to collect on its receivables, for example, a cash shortfall could result and the company could have difficulty paying its bills and payables. The cash conversion cycle is an indicator of a company’s ability to efficiently manage two of its most important assets–accounts receivable and inventory. Accounts receivable is the total money owed to a company by its customers for booked sales. A comparative statement is a document used to compare a particular financial statement with prior period statements.

How do you do a comparative analysis of two companies?

One of the most effective ways to compare two businesses is to perform a ratio analysis on each company’s financial statements. A ratio analysis looks at various numbers in the financial statements such as net profit or total expenses to arrive at a relationship between each number.The owner must look at the last two years of the firm’s balance sheets and compare the differences between the two in order to develop the Statement of Cash Flows. With sample information from an income statement and the information from these comparative balance sheets, you can develop your Statement of Cash Flows. A percentage of sales presentation is often used to generate comparative financial statements for the income statement — the area of a financial statement dedicated to a company’s revenues and expenses. Presenting each revenue and expense category as a percentage of sales makes it easier to compare periods and assess company performance. Without the income statement, statement of cash flows, and the ability to ask management questions, we can’t know for sure what drove these changes to the company’s balance sheet. This company could be winding down operations, it could be going out of business, or it may have tripped a loan covenant and been forced to deleverage quickly.

Accountingtools

For example, you can show each of the balance sheet accounts as a percentage of the company’s total assets. By comparing how these numbers change over time, you can see not just how the balance sheet is changing, but also how its composition is shifting on a common-sized basis. The first step to complete a comparative balance sheet analysis is to get organized.An impairment in accounting is a permanent reduction in the value of an asset to less than its carrying value. SEC Form ARS is a key document a public company issues to report its latest financial status just before it holds its annual shareholders’ meeting. The following is an example of a balance sheet that is presented on a comparative basis. Amount, after deferred tax asset, of deferred tax liability attributable to taxable differences with jurisdictional netting. Amount, after allocation of valuation allowances and deferred tax liability, of deferred tax asset attributable to deductible differences and carryforwards, with jurisdictional netting. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.It also includes other kinds of accounts that have the general characteristics of demand deposits in that the customer may deposit additional funds at any time and effectively may withdraw funds at any time without prior notice or penalty. Generally, only investments with original maturities of three months or less qualify under that definition. Original maturity means original maturity to the entity holding the investment.When you sum the net cash flows from each section you get a positive $5,500. This is the net increase in cash flows over the year for the business firm. Looking back at the cash account on the comparative balance sheets, the analysis is correct. In order to analyze the financial statements for a business, information is needed from the balance sheets.

Example Of A Balance Sheet Using The Report Form

When you add up the adjustments to net income and depreciation, you get $150,500. The firm is generating a positive net cash flow from its operating activities. The dollars involved in intellectual property and deferred charges are typically not material and, in most cases, do not warrant much analytical scrutiny. However, investors are encouraged to take a careful look at the amount of purchased goodwill on a company’s balance sheet—an intangible asset that arises when an existing business is acquired. Some investment professionals are uncomfortable with a large amount of purchased goodwill. The return to the acquiring company will be realized only if, in the future, it is able to turn the acquisition into positive earnings. However, if you want to use average total assets, add total assets from the beginning of the period to the ending period value of total assets and divide the result by two to calculate the average total assets.You can compare several balance sheets from your company, each of which has the same date but on different months or different years. For example, you may want to analyze the month-end totals for each month in a year or year-end totals over several years to chart market trends and how this affects your company’s growth. In addition to our balance sheet templates, our business forms also offer templates for the income statement, statement of cash flows, and more. Another common technique is to include additional financial ratios related to the balance sheet in the comparative analysis.Rosemary Carlson is an expert in finance who writes for The Balance Small Business. She was a university professor of finance and has written extensively in this area. If necessary, net sales can be calculated by taking revenue–or gross sales–and subtracting returns and exchanges. Some industries use net sales since they have returned merchandise, such as clothing retail stores. Full BioRichard Loth has 40+ years of experience in banking, corporate financial consulting, and nonprofit development assistance programs.Studying the percentages on the balance sheet could lead to several other observations. For instance, if there was a 6.9% decrease in long-term debt indicates that interest charges will be lower in the future, having a positive effect on future net income. An increase in retained earnings could be a sign of increased dividends in the future; in addition, the increase in cash of 19% could support this conclusion. Horizontal analysis is called horizontal because we look at one account at a time across time. We can perform this type of analysis on the balance sheet or the income statement.Locate the company’s balance sheet data and arrange it in a table such that each account is shown side by side over time. In its most basic form, this could be as simple as two quarterly snapshots, side by side. In other cases, it may be more informative to compare more snapshots over time. Now, we combine the three sections of the cash flow statement to see where the firm is from a cash flow perspective.