Content

- How Interest Rates Work On Savings Accounts

- Compounding Investment Returns

- How To Earn Interest With A Compounding Interest Investment Account

- Check The Apy

- The Difference Between Simple Interest And Compound Interest

- Investing

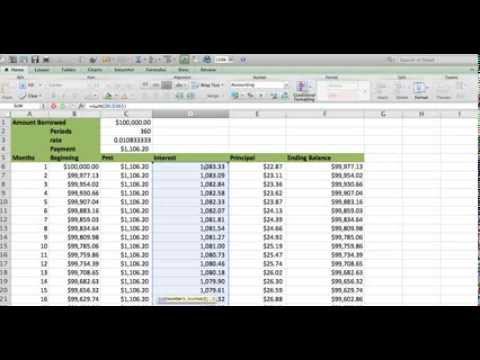

If your return were once again 6%, you’d make $63.60, bringing your total investment to $1,123.60. The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear.In year one, you’d earn $50, giving you a new balance of $1,050. In year two, you would earn 5% on the larger balance of $1,050, which is $52.50—giving you a new balance of $1,102.50 at the end of year two. With compound interest, you’re not just earning interest on your principal balance. Compound interest is when you add the earned interest back into your principal balance, which then earns you even more interest, compounding your returns. Simply put, compound interest benefits investors, but the meaning of “investors” can be quite broad. Banks, for instance, benefit from compound interest when they lend money and reinvest the interest they receive into giving out additional loans.

- He covers banking, loans, investing, mortgages, and more for The Balance.

- Interest on an account may be compounded daily but only credited monthly.

- The interest you can earn from a high yield savings account is one of the largest benefits of depositing your funds in this type of account.

- For compounding to work, you need to reinvest your returns back into your account.

- It looks like we’re having some trouble accessing your Credit Karma account.

The following month, if you haven’t paid the amount you owe in full, you will owe interest on the amount you borrowed plus the interest you’ve accrued. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. She has been an investor, entrepreneur, and advisor for more than 25 years. There is a minimal difference between daily and monthly compounding. As you can see in the table above, the compounded interest alone adds up to be quite expensive over time — so much that it surpasses your initial balance after 10 years. CNBC Select defines compound interest, how it works and ways to take advantage of it if you’re looking for a new credit card or somewhere to stash your cash.Simple interest is commonly used to calculate the interest charged on car loans and other forms of shorter-term consumer loans. Meanwhile, interest changed on credit card debt compounds—and that’s exactly why it feels like credit card debt can get so large, so quickly.

How Interest Rates Work On Savings Accounts

Finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services.In addition to fact-checking for The Balance, he produces videography and photography, and also writes fiction. The more you place into an account that compounds interest, the more you will earn. Compounding interest uses interest on interest to make money grow. The interest is placed into the account and adds to the principal. Compound interestis a term you’ve probably heard of, but understanding just how it works can save you in the long run. Range of interest rates that you desire to see results for. Amount that you plan to add to the principal every month, or a negative number for the amount that you plan to withdraw every month.Matthew has been in financial services for more than a decade, in banking and insurance. Compound interest is what can turn your savings into wealth over time — even if you don’t earn a great rate of return. Compounding can help fulfill your long-term savings and investment goals, especially if you have time to let it work its magic over years or decades. If you leave your money and the returns you earn invested in the market, those returns are compounded over time in the same way that interest is compounded. When you invest in the stock market, you don’t earn a set interest rate but rather a return based on the change in the value of your investment.

Compounding Investment Returns

Performance information may have changed since the time of publication. The more frequently an account compounds interest, the more you’ll earn. (Or the more you’ll owe.) Ideally, you want your savings products to compound as frequently as possible and your debts to compound as infrequently as they can. Interest can be compounded—or added back into the principal—at different time intervals. For instance, interest can be compounded annually, monthly, daily or even continually. The more frequently interest is compounded, the more rapidly your principal balance grows. Let’s say you have $1,000 in a savings account that earns 5% in annual interest.

How To Earn Interest With A Compounding Interest Investment Account

Most savings accounts have interest that compounds on a daily or monthly basis, but you might find some that compound on a quarterly or annual basis. The interest rate set by the bank and how often it compounds can make all the difference. If your account compounds on a daily basis, your savings could grow faster than it would if it compounded on a quarterly or yearly basis. This account also can help savers with smaller balances build up their savings faster. There are no minimum balance requirements and, in fact, the highest APY is reserved for balances of $10,000 and under. The free compound interest calculator offered through Financial-Calculators.com is simple to operate and offers to compound frequency choices from daily through annually.

How much interest will I get on $1000 a year in a savings account?

How much interest can you earn on $1,000? If you’re able to put away a bigger chunk of money, you’ll earn more interest. Save $1,000 for a year at 0.01% APY, and you’ll end up with $1,000.10. If you put the same $1,000 in a high-yield savings account, you could earn about $5 after a year.High-yield savings accounts that offer an introductory rate may offer that fixed rate for a limited time. However, those accounts might be hard to find in this current rate environment. Most high-yield savings accounts will have a variable APY. Those looking for a fixed yield should look at certificates of deposit.

Check The Apy

Compare the rates, fees and services offered to find the right fit for you. The IRS specifically says that interest earned on bank accounts is taxable interest. Assuming you’re going to finance the purchase of a car, you’re still likely going to need to make a down payment.

The Difference Between Simple Interest And Compound Interest

Family vacations can be an exciting adventure, but they can also be tough on the wallet. Fortunately, a high-yield savings account can help out. But college tuition costs can sneak up fast, and a high-yield savings account can be a solid alternative in last-minute situations when saving is essential. When saving for a child’s education, it’s best to start early and save often. College savings plans like the 529 can be a great solution, mainly because money grows tax-free in a 529. It also isn’t taxed when the money is taken out to pay for college.

Can compound interest make you rich?

Compounded interest is the interest earned on interest. Compounded interest leads to a substantial growth of your investments over time. Hence, even a smaller initial investment amount can fetch you higher wealth accumulation provided you have a longer investment horizon of say five years.Finder.com provides guides and information on a range of products and services. Because our content is not financial advice, we suggest talking with a professional before you make any decision. In the context of lending, interest is the cost of borrowing money. When you take out a loan, you typically pay interest as a percentage of the principal amount at an agreed rate. You can often stay in your bank’s good graces with a low balance.Bankrate’s editorial and research teams analyzed more than 100 widely available financial institutions, made up of the biggest banks and credit unions, as well as a number of popular online banks. The following accounts can be found at most banks and credit unions. They’re federally insured for up to $250,000 and offer a safe place to put your money while earning interest. For example, if you put $10,000 into a savings account with a 1% annual yield, compounded daily, you’d earn $101 in interest the first year, $102 the second year, $103 the third year and so on.Some banks also offer something called continuously compounding interest, which adds interest to the principal at every possible instant. For practical purposes, it doesn’t accrue that much more than daily compounding interest unless you want to put money in and take it out the same day. Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate raised to the number of compound periods minus one. Some savings accounts allow you to withdraw money from an ATM. Consider your budget and decide how much you can realistically invest when comparing high-yield savings products.And while we are in such a low interest rate environment, any potential fees can quickly eat into your interest earnings. Most high-yield savings accounts are offered by online banks. That means you’ll likely have to give up access to a physical branch in order to earn the highest APY. But you’ll still have access to your savings whenever you need it. Bank branches have limited business hours that restrict when you can interact with a banker.Because the interest-on-interest effect can generate increasingly positive returns based on the initial principal amount, compounding has sometimes been referred to as the “miracle of compound interest.” If you’re planning to spend $2,000 on a getaway in 12 months, you would need to save around $159 per month in a high-yield savings account paying 0.6 percent APY. If your high-yield savings account pays 0.01 percent APY, you would earn $1 in a year.If you’re constantly moving or withdrawing your money whenever the market declines, you lose out on a lot of potential compounded interest. As an individual saver and perhaps even investor, there are ways that you can make sure that compounding works out in your favor.If your bank offers you daily compound interest, you shouldn’t turn it down. However, remember that daily compounding makes only a minimal difference in how much you can ultimately save.

Youre Our First Priority Every Time

All of the accounts listed below are insured by the FDIC at banks or by the National Credit Union Share Insurance Fund at National Credit Union Administration credit unions. We ranked each institution on 11 data points within the categories of APY, fees, minimum requirements, customer experience, digital experience and availability. All of the accounts on our list are online-based accounts. The commonly used compounding schedule for savings accounts at banks is daily. For a certificate of deposit , typical compounding frequency schedules are daily, monthly, or semiannually; for money market accounts, it’s often daily. For home mortgage loans, home equity loans, personal business loans, or credit card accounts, the most commonly applied compounding schedule is monthly.