Content

- Generate A Trial Balance Report

- Statement Of Comprehensive Income

- Finalize The Income Statement

- Accountingtools

- Comprehensive Income

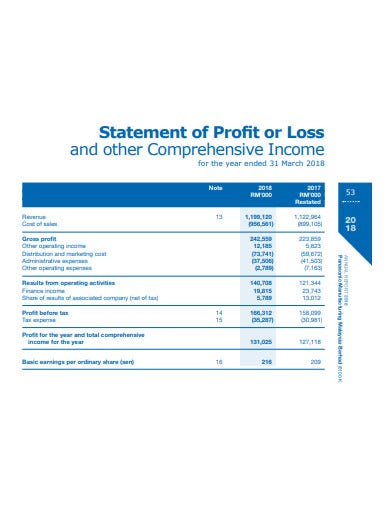

Using net profit alone might deflate earnings per share, so it’s important to include all income in this calculation. Guidelines for statements of comprehensive income and income statements of business entities are formulated by the International Accounting Standards Board and numerous country-specific organizations, for example the FASB in the U.S.. It indicates how the revenues (also known as the “top line”) are transformed into the net income or net profit .It will have a different total at the bottom because this statement will take into account the company’s investments and their current values. When Richard examines the statement, he can see immediately his company’s revenue and expenses, and net income. What he can’t see on the income statement is any information about the company’s purchase of the 5,000 shares and how that investment is working out for the company. A quarterly income statement shows the profits or losses generated by your business over a three month period.Depreciation / Amortization – the charge with respect to fixed assets / intangible assets that have been capitalised on the balance sheet for a specific period. It is a systematic and rational allocation of cost rather than the recognition of market value decrement. Items included in net income are displayed in various classifications, including income from continuing operations, discontinued operations, extraordinary items and cumulative effects of changes in accounting principle. Statement no. 130 does not alter those classifications or other requirements for reporting results from operations. You can see in the above example how generating a comprehensive income statement can give its management a more accurate picture of the company’s true income. A statement of comprehensive income provides details about a company’s equity that the income statement does not provide. Though this statement has some predictive value, it makes no indication of the timing for when revenue and expense items will be realized in the future.

Generate A Trial Balance Report

Items that are required by accounting standards to be reported as direct adjustments to paid-in capital, retained earnings or other nonincome equity accounts are not to be included as components of comprehensive income. In business, comprehensive income includes unrealized gains and losses on available-for-sale investments.

Statement Of Comprehensive Income

It is also known as the profit and loss statement (P&L), statement of operations, or statement of earnings. The income statement, or profit and loss statement (P&L), reports a company’s revenue, expenses, and net income over a period of time. Whenever CI is listed on the balance sheet, the statement of comprehensive income must be included in the general purpose financial statements to give external users details about how CI is computed. Cumulative effect of changes in accounting policies is the difference between the book value of the affected assets under the old policy and what the book value would have been if the new principle had been applied in the prior periods. For example, valuation of inventories using LIFO instead of weighted average method. The changes should be applied retrospectively and shown as adjustments to the beginning balance of affected components in Equity.This could include items such as restructurings, discontinued operations, and disposals of investments or of property, plant and equipment. Irregular items are reported separately so that users can better predict future cash flows.

Finalize The Income Statement

The net income is transferred down to the CI statement and adjusted for the non-owner transactions we listed above to compute the total CI for the period. This number is then transferred to the balance sheet as accumulated other comprehensive income. Since 1973, the Financial Accounting Standards Board has been the designated organization in the private sector for establishing standards of financial accounting and reporting. Those standards govern the preparation of financial reports and are officially recognized as authoritative by the Securities and Exchange Commission and the American Institute of Certified Public Accountants. Such standards are essential to the efficient functioning of the economy because investors, creditors, auditors, and others rely on credible, transparent, and comparable financial information. Stakeholders need to know how and where a company is generating revenue, and which costs are incurred along the way. Net income alone doesn’t give the full picture, but by including a statement of comprehensive income businesses can illuminate the smaller details.Present the components either net of related tax effects or before related tax effects with one amount shown for the aggregate income tax expense or benefit. State the amount of income tax expense or benefit allocated to each component, including reclassification adjustments, in the statement of comprehensive income or in a note. Another decision companies face is whether to show the components of other comprehensive income on a beforetax or aftertax basis.

- The income statement reflects a company’s performance over a period of time.

- Businesses typically choose to report their income statement on an annual, quarterly or monthly basis.

- Items that create temporary differences due to the recording requirements of GAAP include rent or other revenue collected in advance, estimated expenses, and deferred tax liabilities and assets.

- This will give you a future understanding of income statement definition that will be of great benefit to you and your business practice.

It can also be referred to as a profit or loss account, and is a crucial financial statement that shows the businesses income and expenditures, detailing your net income or net profits. Trial balance reports are internal documents that list the end balance of each account in the general ledger for a specific reporting period.

Accountingtools

When combined with income from operations, this yields income before taxes. This contrasts with the balance sheet, which represents a single moment in time.

Comprehensive Income

When analyzing income statements to determine the true cash flow of a business, these items should be added back in because they do not contribute to inflow or outflow of cash like other gains and expenses. A business reports comprehensive income to reflect all changes in its equity that result from recognized transactions and other economic events of the period-other than transactions with owners in their capacity as owners. Historically, companies displayed some of these changes in a statement that reported the results of operations, while other changes were included directly in balances within a separate component of equity in a statement of financial position. The statement does not address the recognition or measurement of comprehensive income but, rather, establishes a framework that can be refined later. Comprehensive income is important because the amounts help to reflect a company’s true income during a specific time period. This is valuable information for businesses with a large amount of investments. If the company is not doing well, but the investments are, then the realization of some assets may help keep the company afloat during periods of less profit.The Single Step income statement totals revenues, then subtracts all expenses to find the bottom line. While a company might look great on paper according to the income statement, it can’t tell investors anything about the future potential. There might be lucrative projects in the pipeline, but their earnings won’t yet be realized. Gains and losses of foreign currency transactions are subject to change and fall under comprehensive income. All non-owner changes in equity (i.e., comprehensive income) shall be presented either in the statement of comprehensive income or in a separate income statement and a statement of comprehensive income.

What comes first income statement or balance sheet?

Financial statements are prepared in the following order: Income Statement. Statement of Retained Earnings – also called Statement of Owners’ Equity. The Balance Sheet.While it is relatively easy for an auditor to detect error, part of the difficulty in determining whether an error was intentional or accidental lies in the accepted recognition that calculations are estimates. It is therefore possible for legitimate business practices to develop into unacceptable financial reporting. Income statements have several limitations stemming from estimation difficulties, reporting error, and fraud. In essence, if an activity is not a part of making or selling the products or services, but still affects the income of the business, it is a non-operating revenue or expense. Gains and losses of these benefits don’t fall under regular earned income but still need to be recorded. Shifting business location, stopping production temporarily, or changes due to technological improvement do not qualify as discontinued operations.The first step in preparing an income statement is to choose the reporting period your report will cover. Businesses typically choose to report their income statement on an annual, quarterly or monthly basis. Publicly traded companies are required to prepare financial statements on a quarterly and annual basis, but small businesses aren’t as heavily regulated in their reporting. Creating monthly income statements can help you identify trends in your profits and expenditures over time.The purpose of the income statement is to show managers and investors whether the company made money or lost money during the period being reported. Income statements show how much profit a business generated during a specific reporting period and the amount of expenses incurred while earning revenue. By adding this statement to the financial statement package, investors have a more detailed view of revenue and expense items that will be realized in the future.This gives investors and creditors a good idea of what the company’s assets and net assets are truly worth. Keep in mind, that we are not only adjusting the assets of the company,available for sale securities, we are also adjusting the net assets of the company, stockholder’s equity.Items included in comprehensive income, but not net income are reported under the accumulated other comprehensive income section of shareholder’s equity. Exhibit 5 uses a statement of changes in equity approach, where net income, other comprehensive income and comprehensive income are displayed. The FASB discourages companies from using this method because it tends to hide comprehensive income in the middle of the statement. Statement no. 130 provides three different approaches to displaying comprehensive income. Exhibits 3 and 4, pages 49 and 50, illustrate the one-statement and two-statement approaches, respectively, to reporting comprehensive income. Exhibit 5, page 52, illustrates how a company can display comprehensive income in the statement of changes in equity.This extra information can provide some clues as to the financial results that a business will report at a later date, though only a portion of it. Although the income statement is a go-to document for assessing the financial health of a company, it falls short in a few aspects. The income statement encompasses both the current revenues resulting from sales and the accounts receivables, which the firm is yet to be paid. The four basic principles of GAAP can affect items on the income statement. These principles include the historical cost principle, revenue recognition principle, matching principle, and full disclosure principle. Creditors can see how much skin investors have in the company and investors can see the potential of the company assets and future earnings and profits if these assets were actually sold and the gains were realized. As you can see, the net income is carried down and adjusted for the events that haven’t occurred yet.The income statement reflects a company’s performance over a period of time. This is in contrast to the balance sheet, which represents a single moment in time. For the first three quarters, the total unrealized gain on stock A was $400; this amount was reflected in other comprehensive income. The company sold stock A on October 1, 199X, for $1,400, resulting in a realized gain that ABC included in its net income computation.

What Is Comprehensive Income?

During the year, ABC Co. engaged in numerous transactions involving foreign currency, resulting in unrealized gains of $3,200 before tax. In addition, the company at yearend held securities classified as available-for-sale, which have unrealized gains of $2,400 before tax.