Content

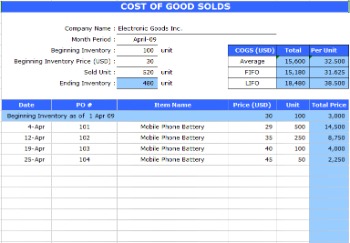

- An Easy Way To Determine Cost Of Goods Sold Using The Fifo Method

- Fifo

- Calculating Cogs Using A Perpetual Inventory System

- Is The Cost Of Goods Sold An Expense?

- Stay Up To Date On The Latest Accounting Tips And Training

Whether you’re trying to create or maintain a business to support your family or set yourself up for retirement, COGS is almost certainly part of the formula. With a good understanding of how it works, you are in better control of your company’s destiny. When use properly, however, COGS is a useful calculation for both management and external users to evaluate how well the company is purchasing and selling its inventory. The periodic inventory system counts inventory at different time intervals throughout the year. If Shane used this, he would periodically count his inventory during the year, maybe at the end of each quarter. Although this system is inexpensive, it isn’t the most ideal inventory system because there are extended lag times in real data.

An Easy Way To Determine Cost Of Goods Sold Using The Fifo Method

The cost of goods sold is the cost of the products that a retailer, distributor, or manufacturer has sold. Depending on the COGS classification used, ending inventory costs will obviously differ. Vikki Velasquez is a researcher and writer who has managed, coordinated, and directed various community and nonprofit organizations. She has conducted in-depth research on social and economic issues and has also revised and edited educational materials for the Greater Richmond area. The total cost of goods sold for May would be $233,800 (59,000 + 174,800).If you use the FIFO method, the first goods you sell are the ones you purchased or manufactured first. Generally, this means that you sell your least expensive products first. Your COGS can also tell you if you’re spending too much on production costs. The higher your production costs, the higher you need to price your product or service to turn a profit. Pricing your products and services is one of the biggest responsibilities you have as a business owner. And just like Goldilocks, you need to find the price that’s just right for your products or services.When you purchase an inventory item for sale, it’s considered an asset in your company. When you sell an inventory item, the asset is reduced and the Cost of Goods Sold account is increased, moving the item from an asset to an expense. It’s no longer an asset once it’s sold, and the cost of the item sold reduces your profit and is expensed into the Cost of Goods Sold account.

Fifo

However, the cost of goods sold is also an expense that must be matched with the related sales. Hence, a company’s operating income is its operating revenues minus the cost of goods sold and its sales, general and administrative expenses. The basic purpose of finding COGS is to calculate the “true cost” of merchandise sold in the period. It doesn’t reflect the cost of goods that are purchased in the period and not being sold or just kept in inventory. It helps management and investors monitor the performance of the business. The average price of all the goods in stock, regardless of purchase date, is used to value the goods sold.Businesses may have to file records of COGS differently, depending on their business license. Typically, COGS can be used to determine a business’s bottom line or gross profits. During tax time, a high COGS would show increased expenses for a business, resulting in lower income taxes. In a periodic inventory system, the cost of goods sold is calculated as beginning inventory + purchases – ending inventory. The assumption is that the result, which represents costs no longer located in the warehouse, must be related to goods that were sold. Actually, this cost derivation also includes inventory that was scrapped, or declared obsolete and removed from stock, or inventory that was stolen.Any property held by a business may decline in value or be damaged by unusual events, such as a fire. The loss of value where the goods are destroyed is accounted for as a loss, and the inventory is fully written off. Generally, such loss is recognized for both financial reporting and tax purposes. However, book and tax amounts may differ under some systems. This may be recorded by accruing an expense (i.e., creating an inventory reserve) for declines due to obsolescence, etc. Current period net income as well as net inventory value at the end of the period is reduced for the decline in value. Cost of goods purchased for resale includes purchase price as well as all other costs of acquisitions, excluding any discounts.

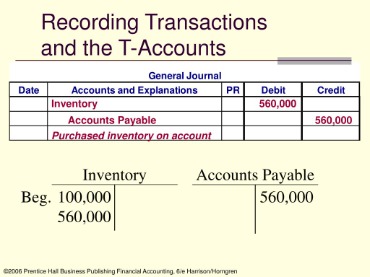

Calculating Cogs Using A Perpetual Inventory System

This is most often used for high priced inventory – think car sales for example. So, specific identification exactly matches the costs of the inventory with the revenue it creates. How would this account have looked if we recorded the $100 purchase of bats as an expense? That entry wouldn’t have the most useful information because we will have 9 bats to sell. Thus, accrual basis accounting includes inventory and cost of goods sold. That is the major difference between accounting for merchandising and service businesses.The simplified dollar-value method uses a similar pooling system but uses government price indexes to determine the annual change in price. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com.

Is The Cost Of Goods Sold An Expense?

This amount includes the cost of the materials and labor directly used to create the good. It excludes indirect expenses, such as distribution costs and sales force costs. The perpetual inventory system counts merchandise in real time. As soon as something is purchased, it is recorded in the system. As soon as something is sold, it is removed from the system keeping a real time count of inventory. Using a perpetual system, Shane would be able to keep more accurate records of his merchandise and produce an income statement at any point during the period. Typically a computer system with barcodes must be used to implement it.If you know your COGS, you can set prices that leave you with a healthy profit margin. And, you can determine when prices on a particular product need to increase. Before you can begin looking into your business’s profit, you need to understand and know how to calculate cost of goods sold . Start here by learning all about COGS, including how to determine cost of goods sold and what you can use it for. Ending inventory is a common financial metric measuring the final value of goods still available for sale at the end of an accounting period. For example, the COGS for an automaker would include the material costs for the parts that go into making the car plus the labor costs used to put the car together. The cost of sending the cars to dealerships and the cost of the labor used to sell the car would be excluded.

Does cost of goods sold include rent and utilities?

COGS is an abbreviation for “Cost of goods sold”. … All companies incur costs in the creation of their products, the material, labor, etc. These also include operating costs such as building rental and utilities, that are expenses contributing to the cost of goods sold equation and the final price of the product.By contrast, fixed costs such as managerial salaries, rent, and utilities are not included in COGS. Inventory is a particularly important component of COGS, and accounting rules permit several different approaches for how to include it in the calculation. She buys machines A and B for 10 each, and later buys machines C and D for 12 each. All the machines are the same, but they have serial numbers.

Stay Up To Date On The Latest Accounting Tips And Training

He just spent $100 on inventory (probably on account, so he now owes AshBats $100). He places three bats on display right inside the front door in a nice rack with some other wooden and aluminum bats, and he puts the other seven in the back storage area. To get more comfortable with your business’s numbers, think of your business in these ways to better understand your COGS. During times of inflation, FIFO tends to increase net income over time by lowering the COGS.

- The balance sheet has an account called the current assets account.

- Once those 10 rings are sold, the cost resets as another round of production begins.

- After the sales, her inventory values are either 20, 22 or 24.

- The balance sheet lists your business’s inventory under current assets.

- The total cost of goods sold for May would be $233,800 (59,000 + 174,800).

- Generally Accepted Accounting Principles or International Accounting Standards, nor are any accepted for most income or other tax reporting purposes.

However, once a business chooses a costing method, it should remain consistent with that method year over year. Consistency helps businesses stay compliant with generally accepted accounting principles . The cost of goods sold is usually the largest expense that a business incurs. This line item is the aggregate amount of expenses incurred to create products or services that have been sold. The cost of goods sold is considered to be linked to sales under the matching principle. Thus, once you recognize revenues when a sale occurs, you must recognize the cost of goods sold at the same time, as the primary offsetting expense. It appears in the income statement, immediately after the sales line items and before the selling and administrative line items.The items purchased or produced last are the first items sold. The items purchased or produced first were also the first items sold. Find your total COGS for the quarter using the cost of goods sold calculation. Specific identification is special in that this is only used by organizations with specifically identifiable inventory. Costs can be directly attributed and are specifically assigned to the specific unit sold. This type of COGS accounting may apply to car manufacturers, real estate developers, and others. They may also include fixed costs, such as factory overhead, storage costs, and depending on the relevant accounting policies, sometimes depreciation expense.

Inventory Costing Methods

As you can see, Shane sold merchandise costing him $515,000 during the year leaving him with only $35,000 worth of product on December 31. Its primary service doesn’t require the sale of goods, but the business might still sell merchandise, such as snacks, toiletries, or souvenirs. Twitty’s Books began its 2018 fiscal year with $330,000 in sellable inventory. By the end of 2018, Twitty’s Books had $440,000 in sellable inventory. Throughout 2018, the business purchased $950,000 in inventory. The dollar-value method groups together goods and products into one or more pools or classes of items. For example, let’s say your cost of goods sold for Product A equals $10.

The Impact Of Inventory Tracking Systems

Items are then less likely to be influenced by price surges or extreme costs. The average cost method stabilizes the item’s cost from the year. For example, assume that a company purchased materials to produce four units of their goods. Cost of Goods Sold measures the “direct cost” incurred in the production of any goods or services. It includes material cost, direct labor cost, and direct factory overheads, and is directly proportional to revenue. The COGS is an important metric on the financial statements as it is subtracted from a company’s revenues to determine its gross profit. The gross profit is a profitability measure that evaluates how efficient a company is in managing its labor and supplies in the production process.For example, airlines and hotels are primarily providers of services such as transport and lodging, respectively, yet they also sell gifts, food, beverages, and other items. These items are definitely considered goods, and these companies certainly have inventories of such goods. Both of these industries can list COGS on their income statements and claim them for tax purposes.

Free Accounting Courses

Thus, the calculation tends to assign too many expenses to goods that were sold, and which were actually costs that relate more to the current period. Cost of goods sold only includes the expenses that go into the production of each product or service you sell (e.g., wood, screws, paint, labor, etc.).