Content

- What Is Revenue Recognition?

- How Can We Help You With Your Tax Planning?

- Tax Alert

- What Financial Statements Demonstrate Cost Recovery?

- Accounting

- Declining Balance Depreciation Explained

- Expense Report Template: Using Spreadsheets To Manage Your Money

- Free Accounting Courses

Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle.

What Is Revenue Recognition?

Company A chooses a payment method that lets him use recurring payments, paying $20,000 immediately, and $20,000 per annum over the next four years. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. Net profit is not recognized until the cash collected exceeds the cost of the item and/or service sold.Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. It is very useful when the revenue collection is uncertain as it shows the correct position of collection of revenue, and investors cannot get deceived. When there is a long period, i.e. more than 1 year, it is involved in the collection of the revenue. When the organization wants to follow the conservative basis of accounting. GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services. Create an online video course, reach students across the globe, and earn money.Check out Accounting Basics for a comprehensive tutorial on financial accounting. The cost recovery method of recognizing gross profit can help your business put off paying taxes for sales where you may not get paid. Under cost recovery method revenue is recognized only to the extent of receipts. So in Q1 revenue recognized is $3 million which is matched with cost of $3 million resulting in zero gross profit. In Q2 revenue recognized is $6 million matched with $6 million cost resulting in zero gross profit. In Q3 revenue recognized is $4 million matched with the remaining cost of $1 million ($10 million – $3 million – $6 million) resulting in a gross profit of $3 million.On September 1, 2016, it sold some goods on credit to one of its customers, Mr. Y, for $ 250,000. The sales were made on credit, and Shiny Clothes Ltd. does not know the recovery rate of their sales to customers. The company decides to use the cost recovery method to recognize revenue. You’ve got payroll accounting, operations account, inventory accounting and cost accounting . Well, some of these branches are pretty straightforward and others are, well, less understandable. In this article we’ll focus on accounts receivable because that is where we uncover the details of revenue recognition.

How Can We Help You With Your Tax Planning?

It has extensive reporting functions, multi-user plans and an intuitive interface. You don’t know if they’ll even be able to make the payments, but maybe against your better judgement, you approve the transaction. Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Case Studies & Interviews Learn how real businesses are staying relevant and profitable in a world that faces new challenges every day. It gives an accurate view of the financial position, i.e. actual collection and actual cost recovered.

- For revenue recognition, the company follows the cost recovery method as there is uncertainty concerning the recovery rate of the money from many of the customers of the business.

- Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses.

- Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

- In this scenario since total revenue is not determined it is more prudent to record revenue equal to the receipts and match costs.

Since 1992 Matt McGew has provided content for on and offline businesses and publications. Previous work has appeared in the “Los Angeles Times,” Travelocity and “GQ Magazine.” McGew specializes in search engine optimization and has a Master of Arts in journalism from New York University. CFDs and other derivatives are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how an investment works and whether you can afford to take the high risk of losing your money.

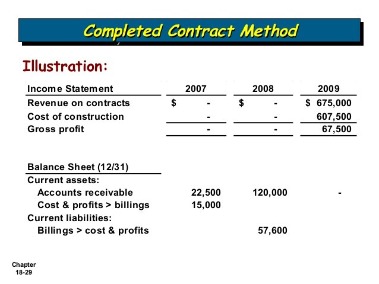

Tax Alert

Then the company will not recognize revenue until the end of 2009 when the total cash paid is $400,000 or the cost to Steel Co. The last payment in 2010 is like any normal sale assuming that it occurs because the full cost was recovered in 2009. As an example, assume that you sold $100,000 worth of a products to a company that agreed to pay the debt off in four annual installments of $25,000, with annual interest payments that totaled an additional $10,000. If the products you sold cost you $80,000 to begin with, you would not realize gross profit until you recovered the full $80,000. With no down payment, the company in this example paid $35,000 each of the first two years, totaling $70,000 in payments. During the third year, gross profit would be realized, because the third payment would take you over the $80,000 recovery mark.

Is 200 db the same as MACRS?

Reports will show the depreciation method allowed under MACRS (200DB, 150DB, S/L) that is being used to calculate the current depreciation for an asset, rather than displaying MACRS. This is the same as how the method is reported, per IRS instructions, on Form 4562.With the installment method, the gross profit is realized in increments of $666 in each of the three years. Using the cost recovery method, the full amount of profit is realized in year three. The cost collection method does not predict the future revenue hence the most reliable accounting method. $ 50,000 were received instantly, $ 50,000 were received in the year 2017, $ 100,000 in the year 2018, and the balance of $ 50,000 in the year 2019. Cost recovery, or the cost recovery method, refers to the means of recouping the cost of any expense. Cost recovery recognizes that recovering costs doesn’t happen instantly, or even within the same year, and the cost recovery method makes allowances for this when it comes to balancing the books. After the entire cost of goods sold has been recovered, recognize all remaining cash receipts as profit.With the implication of the cost recovery method, there is no recognition of bad debts or default due to non-collection from the customers as the recognition in the accounts is done on collection from customers. In which the sales is made rather the same will be recognized as income in the period in which payment is received after recovering the cost of goods sold. Or the income generated against the goods that are sold to the customer until the total cost element related to the respective sale has been received fully by the company from the customer. After the whole cost amount has been received, the remaining amount will be recorded as an income. When a business purchases an asset above a certain price , generally accepted accounting principles hold that the full purchase cannot be deducted on the income statement in the first year. Let’s work through an example of how a transaction paid in installments would be recognized with both the installment method and recovery accounting.

What Financial Statements Demonstrate Cost Recovery?

Sam’s would then have to write off the accounts receivable, showing a loss after it became clear that payments would never be made. Because the owner of the business is unsure whether Gilbert will make the incremental payments on time — or at all — the cost recovery method is a more conservative way of bookkeeping for the transaction.

Accounting

For example, assume the company that bought the machine paid $7,500 in January upon delivery of the machine, $2,500 in February, $2,500 in March and $2,500 in April. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management.

What are the uses of recover?

[intransitive] to get well again after being ill, hurt, etc. recover from something He’s still recovering from his operation. She spent many weeks in hospital recovering from her injuries. He has fully recovered from the shoulder surgery.The installment method of revenue recognition is another form of recovery accounting. In other words, businesses don’t receive the entire payment of a good all at once. Instead, they receive a portion as a down-payment and then collect installment payments over the course of a long period of time. This is typically used for large purchases such as real estate, appliances or motor vehicles.

Declining Balance Depreciation Explained

Recording the total sales value as revenue would overstate gross profit. Also known as the collection method, cost recovery method accounting is a way of recognizing revenue under the revenue principle. The method is commonly used in conjunction with companies who do not believe that they will receive a future payment of cash or it is highly unlikely that they will. For revenue recognition, the company follows the cost recovery method as there is uncertainty concerning the recovery rate of the money from many of the customers of the business.When each installment of whatever percent of the total sale has been received, that percent of deferred gross profit is recognized. Total revenue recognized and total gross profit earned under cost recovery method would equal all other methods but its distribution among various periods would be different. Cost recovery method is used to account for revenue in situations when the recoverability of revenue is not certain or the value of the sale cannot be determined accurately. IAS 18 Revenue requires companies to recognize revenue only when the consideration is measurable. In this scenario since total revenue is not determined it is more prudent to record revenue equal to the receipts and match costs.Under the cost recovery method, income on sale is not to be recognized till the recovery of the cost. This method of revenue recognition is used by the company where there is uncertainty regarding the collection of revenue and also to follow the principle of conservatism. Under this method, Profit is to be recognized when the revenue is collected in cash till it exceeds the cost of goods sold.Until the real collection of cost in cash the income is not to be recorded in the accounts. Though the revenue is to be recognized when the sales are made, the profit or income is deferred until the collection. This method can give an accurate financial view of the organization, which is not misleading in nature. It’s obvious that this method of revenue recognition directly affects financial reporting and thus directly affects how a business is taxed.

Free Accounting Courses

The cost of recovery method is how to account for revenue that does not recognize any profit until the cost of the merchandise is recovered. Under this accounting method, once the cost is recovered, any remaining payments are accounted for as gross profits. The cost of recovery method is generally not recognized as an accepted accounting practice.