Content

- Your Guide To Invoicing

- Accounting For Retail Business

- Managing Inventory Costs With Retail Accounting

- What Is Retail Accounting?

- Retail Inventory Method Vs Specific Identification Method

- How To Organize Inventory Sheets

- Inventory Valuation Methods:

- Inventory Valuation Methods & Accounting Best Practices

Speaking of the advantages, the main one that stands out is that in the retail method, calculations are pretty much easy. All that you’ll need is a few numbers to calculate the inventory cost when it comes to the retail method. Also, you won’t have to take a physical inventory count in order to understand your inventory value. This inventory costing method comes into play when there’s the question of difficulty in distinguishing one inventory unit from the other. It’s also considered when the stock won’t be rotated to ensure that the oldest inventory gets sold first. On the income statement, you track revenue, or all of the money your business is earning.

Your Guide To Invoicing

Now since we have understood that there are disadvantages as there are advantages to this method of accounting, let’s take a quick glimpse at each one of the disadvantages and advantages. From struggling to move goods across disrupted supply chains to having to shut physical stores for long periods, retailers face a business climate like no other in living memory. Accounting can be a long and arduous process, especially if you don’t have experience. You can outsource accounting, hire an in-house accountant or try to do the accounting yourself. If you want to do the accounting yourself, it may be worth looking into accounting software. A balance sheet is an important resource for keeping track of assets, liability and equity.Big, medium, or small…businesses of every size and flavor have a stake in the retail sector. And retail accounting takes the lion’s share when it comes to the problems faced by retail businesses. The cost-to-retail ratio is the percentage of your inventory’s value that’s actually cost, as opposed to markup. It’s calculated by dividing the retail value of goods available into the cost of goods available. Multiply the end-of-period retail value by this percentage to arrive at your end-of-period inventory cost.

Accounting For Retail Business

The Internal Revenue Service allows businesses to use either the direct cost method or the retail inventory method for tax-reporting purposes. The previous four inventory costing methods value inventory based on the cost to acquire the inventory. The retail method is different — it values inventory based on the retail price of the inventory, reduced by the markup percentage. This allows the retailer to quickly arrive at an approximate value of inventory, without having to take a physical count or match cost to items still on hand. Last but not least in inventory costing methods for the retail business, this one is quite simple and extremely effective.

- Yet another method of retail accounting that cannot be overlooked by any retail business…small, medium, or big!

- Manufacturing companies typically use the original cost of materials to value inventory, as they do not sell directly to end customers and do not set the retail price of goods.

- To help illustrate the above retail accounting approaches, let’s look at an example.

- With these advances in transaction processing, most retailers now use the cost method of accounting.

- This disadvantage becomes noteworthy since many retailers are known to mark different items at different prices.

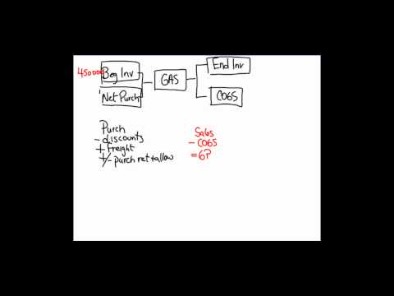

If you operate multiple storefronts, this convenience becomes especially important, as you won’t have to spend as much time conducting physical inventories. Specific identification inventory costing attaches cost to specific items in inventory. This is done using serial numbers or some other unique identifier. The specific identification method of inventory costing applies primarily to high-ticket items, like automobiles.These assumptions make for quicker calculations that eliminate the need for physical inventory counts while at least somewhat accurately suggesting the cash tied up in your company’s inventory. The retail method accounting system for inventory operates by using the current retail price to calculate inventory value. While deciding on an inventory valuation method may seem daunting, the truth is that many inventory systems will do the heavy lifting for business owners. In many cases, all they’ll need to do is download a report at the end of the month and pass that along to their accountants to have an accurate understanding of their costs. With retail accounting, your physical inventory matters less than your knowledge of all your items’ retail prices.For inventory valuation, the item WAC is multiplied by the quantity on-hand. The retail method of accounting groups like items into categories to establish a mark-up percent that is then used to determine the cost of goods sold and the value of inventory. This method prevailed when item level costs were difficult to capture and manage; however, with advances in merchandising systems, the retail method is now used for specific business models. The retail inventory method is an accounting method used to estimate the value of a store’s merchandise. The retail method provides the ending inventory balance for a store by measuring the cost of inventory relative to the price of the merchandise. Along with sales and inventory for a period, the retail inventory method uses the cost-to-retail ratio.On one side of the balance sheet, you list your assets, such as equipment. On the other side, you list your liabilities, such as business credit cards.

Managing Inventory Costs With Retail Accounting

This costing method is most often used when inventory is perishable and is a favorite for food retailers. But in order to do this, you have to know the cost of your inventory. This brings us back to inventory valuation methods, including retail accounting.Pros of Retail AccountingCons of Retail AccountingIt’s quick and easy to calculate. Need to do a quick calculation on the fly to get a sense of costs?In this situation, you may want to use the weighted-average costing method by dividing the total cost of the dice by the total number of dice you purchased. More on this in a bit, but first it’s important to understand the importance of accounting for the cost of inventory in your retail business. The right retail accounting software will help you keep your finger on the pulse of your business and meet your customers’ ever-changing needs. The best retail accounting software can generate useful reports to help you understand how your business is running. To date, he has entrusted the responsibility of inventory valuation, or the monetary value of his inventory, to another employee.

What Is Retail Accounting?

Inventory is actually considered an asset — something your business owns, which is recorded on your business’s balance sheet — until you sell it or account for it as shrinkage from theft or damage. At that point, the expense for the purchase of the inventory is recorded as cost of sales or cost of goods sold on your profit and loss statement. The retail inventory method is only an estimate and should always be supported by period physical inventory counts. Troy needs to decide what type of inventory valuation system makes the most sense for his business.Let’s see how this one differs from the rest of the inventory costing methods. As more retailers take advantage of modern computer-based accounting systems, the cost method of accounting has become more popular. It’s a more accurate system because it tracks the cost of your inventory at the stock-keeping unit level, rather than averaging values across an entire department. In addition, because the cost method records inventory at actual cost instead of retail price, markdowns don’t affect the value of your inventory — or your company.

Retail Inventory Method Vs Specific Identification Method

As any retailer knows, success involves more than just exchanging goods for money. You need to understand product merchandising, advertising and marketing, stock control, customer service, market research, supplier negotiation and more.You’ll then assume that the next 20 you sold were from the second order, meaning those dice cost you 7 cents each. The example below shows how the item WAC is re-calculated with there are changes in cost. For the example the change is due to the receipt of items from the vendor. Scalable means it will grow as your company does, letting you add new users when you need to. Extensible means you can add new features to the software just buy purchasing new add-on business apps. The days sales of inventory gives investors an idea of how long it takes a company to turn its inventory into sales.This includes sales records, loan statements, bank information and tax data. You’ll need it all for your tax returns, and also if your business is ever audited.The more accurately you’ve calculated your costs, the more you know how your business is really doing. Finally, everything boils down to the point that it’s most important to set up a system for inventory management and control since it’s the most important asset for your business. Christopher Williams has owned and operated his own small business since 2002, and has a wide range of professional experience in retail, sales and insurance industries. Jill Bowers is a technical writer by day and a fantasy author by night.This inventory-tracking method requires you to manually count and track inventory periodically, such as weekly or monthly. A major drawback of this method is that, because you don’t have a POS system tracking your sales, you don’t have a way to determine what items were sold, stolen or broken. Let’s assume you took a physical inventory count at the beginning of the quarter, and you know the actual cost of your inventory as of that date was $80,000. Reviewing the reports from your point of sale system you see that, as of the end of the quarter, your sales totaled $30,000. Finally, throughout the quarter, you purchased new yarn and accessories, which cost a total of $10,000. All of this means that you can’t run a successful retail business without keeping detailed records.